Find out how the self-employed £1,000 trading allowance works, how to claim the tax-free amount from HMRC and work out whether it’s right for you.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

What is the £1,000 Trading Allowance?

The trading income allowance lets UK individuals earn up to £1,000 tax-free every tax year** without letting HMRC know about their income – this extends to side hustlers or business owners. It simplifies the tax system for individuals because it means they:

- Don’t need to tell HMRC about this income;

- Avoid the need to register as self-employed with HMRC and fill out a tax return;

- Can earn it tax-free and in some cases, alongside their personal allowance.

** tax year runs from 6 April to 5 April each year

It is perfect for UK individuals who want to test an idea out before they set up a business, have a side hustle or just want to top up their main income with things like:

The income covered by this tax-free amount is your ‘trading income’. This means the money you get paid before deducting costs and expenses. This is without any tax deducted from it, but that would normally be considered taxable income.

All UK taxpayers are entitled to claim the tax-free allowance of £1,000 under the trading allowance rules but it can’t be claimed against:

- Money earned through a limited company or partnership;

- Employment or “PAYE” earnings on a payslip.

Was the £1000 Trading Allowance Scrapped?

Despite plans by HMRC several years ago, the trading allowance has not been scrapped. The allowance is there to help those earning small sums of money on the side, like a babysitter, not just business owners so it makes sense to keep it available. Although that could be subject to change.

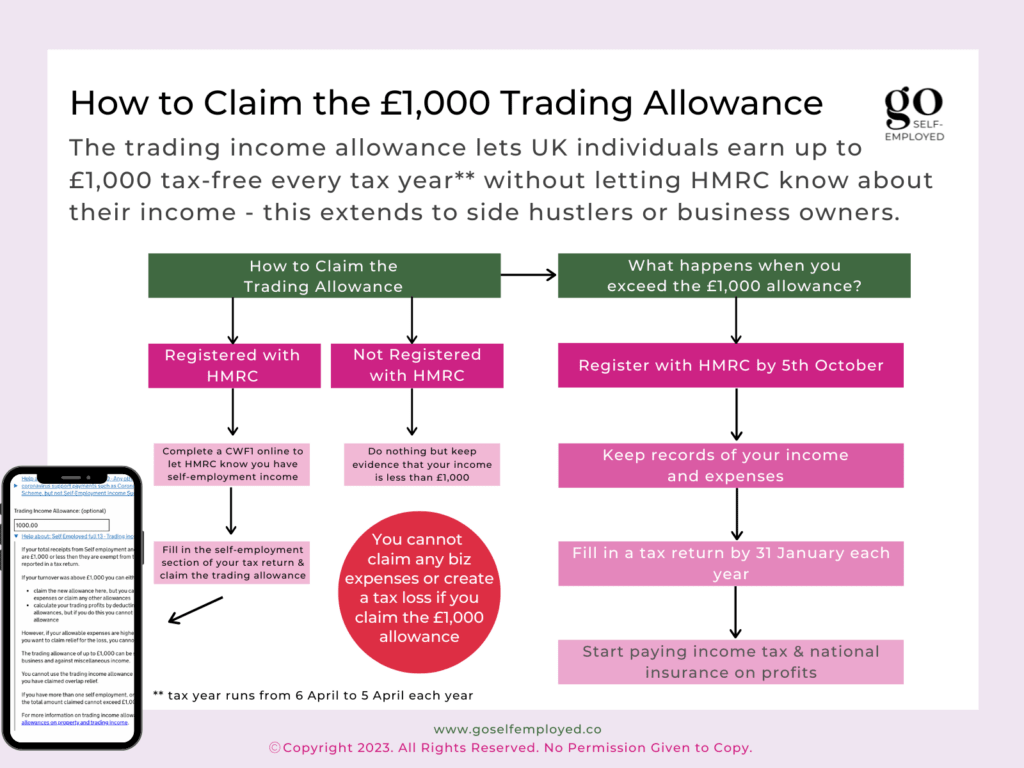

How to Claim the Trading Income Allowance

As with most self-employment rules, the way you claim the trading allowance depends on your circumstances.

If you do not fill out a self-assessment tax return at the moment then you do not need to let HMRC know what you have earned (as long as you keep evidence to demonstrate it is below £1,000). That said, it’s a good idea to consider setting up a simple spreadsheet and make sure you file all your business receipts so you can keep an eye on your income. Once your income goes above the trading allowance you will need to register as self-employed.

Alternatively, if you already have a UTR number then you’ll need to claim the trading income allowance when you come to complete your annual self-assessment. You’ll need to submit a CWF1 Form Online to let HMRC know you have self-employment income. Then, when tax-time comes, you can make your claim within the self-employment section of the tax return.

To claim the £1,000 trading allowance you’ll need to fill out two boxes:

- Enter income within the turnover section;

- Enter the trading allowance claim as an expense to reduce your income to zero or by £1,000.

Other Trading Allowance Rules You Need to Be Aware Of

Whilst the trading income allowance may sound generous and simple, there are some specific rules around it that you should be aware of before you claim it:

- HMRC only allows you to claim the trading allowance OR actual expenses, but not both. So, before you choose to use the allowance, check whether it is more beneficial to claim your actual expenses rather than the £1,000 allowance.

- You cannot claim the allowance if your income is from employment, a partnership or a limited company.

- You cannot use the self-employed £1,000 trading allowance to generate a tax loss.

- If you have two forms of income, for example from babysitting and some gardening, you cannot choose to use the trading allowance on your babysitting income and record actual expenses for your gardening work. You have to choose to claim the trading allowance OR use the actual expenses for both your babysitting and gardening income.

Trading Income Allowance Examples

Example 1

You are employed during the tax year 2022-23 and earned £500 as an Uber driver during the same tax year. As this is below the £1000 trading allowance, you do not need to register with HMRC or let them know about your earnings from Uber. However, you should keep records of all your Uber earnings to show that you earned less than the £1,000 tax-free amount.

Example 2

You are a newly self-employed hairdresser during the tax year 2018/2019. You haven’t had to spend any money on setting up your business but have earned £500 in income during the tax year. Because you’ve earned less than £1000 through self-employment, you can use the tax-free allowance against this income.

Example 3

You become self-employed during the tax year 2019-20 and have spent £2,000 on equipment to set up your new business and have earned £300 in income.

You are entitled to claim for the trading income allowance as your taxable income was less than £1,000. However, you may not want to claim the allowance because your expenses exceed your income. Consequently, if you register as self-employed and fill in a tax return you’ll be able to record a tax loss.

Tax losses can be set against any future profits you make in later tax years, and therefore reduce how much tax you’ll pay later on.

Example 4

You become self-employed in the tax year 2018/19 and your income is £1,500. As this exceeds the trading income allowance you will need to register as self-employed and declare your income on a tax return. You’ll be able to choose between:

- Either claim for the trading income allowance of £1,000 against your £1,500 income, leaving £500 profit which you may need to pay self-employment tax on, or;

- Claim for your actual expenses.

Generally, people choose the option that generates them showing the lowest taxable profit, which results in a smaller tax bill. But remember, you cannot claim for both the trading allowance and your expenses.

Example 5

You have been a self-employed dog walker for many years, fully registered as self-employed with HMRC, and filling out a tax return to declare your earnings annually. During the tax year 2022-23, you did some gardening work on the side.

Your earnings for 2020/2021 were:

- Dog Walking Income £20,000/Expenses £5,000

- Gardening £500/Expenses £0

When tax time comes, you cannot use the £1,000 trading allowance against your gardening income. You’ll need to fill out an additional self-employment section in your tax return for the gardening income and pay tax on the £500 accordingly. You must use the same method for all your forms of income.

Example 6

You earn dividend and pension income each year and have been submitting tax returns by 31 January each year. During the tax year 2020/2021 you earn £750 doing consultancy work.

This is within the trading income allowance of £1,000 so you do not need to pay tax on your extra income. Nevertheless, as you complete a tax return for other reasons, you’ll need to complete a CWF1 and complete a self-employment section in your tax return. Here you can declare your £750 income and make your claim for the trading income allowance.

Do You Need to Keep Records to Claim the Trading Income and Property Allowance?

Yes! You must keep records of any money that has been paid to you to demonstrate that your taxable income is below the £1,000 limit. You must keep these records for 6 years in case HMRC ever ask for them if they wanted to investigate you.

Can the Trading Allowance Create a Tax Loss?

In this instance, no, you cannot use the trading allowance to create a tax loss on your tax return. You must either choose to claim expenses in full to create your tax loss or use the trading allowance.

Can You Claim the Property Income Allowance and Trading Income Allowance?

Yes, you can claim for both the property income allowance and trading income allowance but depending on your circumstances, you may need to claim this on a tax return.

Can You Claim the Trading Income Allowance and Expenses?

No, you cannot claim for both the trading income allowance and expenses. Rather, you must choose which method you want to use. You can, however, change this between tax years to use the one that is the most tax-efficient for you.

What Happens Once You Exceed the Trading Allowance?

Once your trading income exceeds £1,000 you’ll need to:

- Register as self-employed by the deadline;

- Keep records of your income and expenses;

- Fill in a tax return by 31 January each year;

- Calculate how much self employment tax you owe, paying them over to HMRC along with a payment on account if necessary.

Do I Still Need To Make Student Loan Repayments if I use the Trading Income Allowance?

Any money you earn that falls within the trading income allowance will not be included when it comes to calculating your student loan repayments.

How Much Can I Earn Before Paying Tax?

You can earn £1,000 under the trading income allowance as well as the personal allowance every tax year before paying tax. This is the amount you can earn before paying tax and is currently £12,570 for 2022-23. That means some people, for example, those who are employed and self-employed, can earn £13,570 before they start paying income tax. After that, you’ll pay tax based on your taxable earnings according to which tax bands you fall into.

Does the Trading Income Allowance Affect the Benefits I’m Entitled to?

When you are self-employed, the way in which you claim for benefit and tax credits changes. You may also find yourself unable to claim certain allowances. You’ll need to fill in a tax return as evidence of your earnings if you want to claim for:

That means even if you earn below the £1,000 tax-free amount, you should register for self-assessment to declare your income. Don’t worry, you’ll have no tax to pay because you can still claim the trading income allowance. You’ll just need to fill out the necessary paperwork.

Often unexpectedly, if you are newly self-employed you may not realise that if you do not pay any Class 2 National Insurance contributions, you will be affecting your ability to claim things such as Maternity Allowance and the State Pension. Even if you earn below the threshold for paying Class 2 National Insurance and are entitled to the trading income allowance, by not paying into the system you affect your ability to claim from it. It means many self-employed individuals opt to pay voluntary class 2 National Insurance contributions.

So there you have it, the trading income allowance explained! Whether you’re running your own business or have just got a side-hustle going on, get the most out of the self-employed £1,000 allowance to make difference.

Related: