The VAT fuel scale charges simplify record-keeping and VAT returns when fuel, paid for by a business, is used both for business and personally. Read this guide to understand the fuel scale charge for VAT, see an example of how it is calculated and the rates set by HMRC beginning 1 May 2021.

Using the fuel scale charge is one way a business can claim back VAT on fuel. Find out about the other options available in this guide.

Table of contents

Updated 18 August 2021

1. What is the Fuel Scale Charge?

The VAT fuel scale charge is applied when a VAT registered business provides fuel to its employees, that is used both business and personally. The most common way fuel of this kind is provided is usually when fuel cards are issued. Under these circumstances, it is hard to separate out how much fuel relates to personal travel and business travel, so to make things easier the fuel scale charge can be applied. The fuel scale charge lets the business claim back all the VAT on fuel they have paid, just like any other eligible VAT expense, then make an adjustment on each VAT return submitted at the amount set by HMRC to reduce the input VAT claimed as a reflection of personal use.

2. How Much is the Fuel Scale Charge?

The fuel scale charge differs depending on which VAT scheme you have chosen and whether you file VAT returns monthly, quarterly or annually.

You can find the rates on the HMRC website where they are laid out by vehicle’s CO2 emissions figures, so you’ll need to know which car has been used when calculating the fuel scale charge for your business.

3. How is the Fuel Scale Charge Calculated?

The adjustment required on the VAT return to input VAT claimed on fuel, is set by HMRC according to the CO2 emissions of the vehicle. Here are the steps you need to take to calculate your adjustment:

How to Calculate the Fuel Scale Charge

- Establish Vehicle CO2 Emissions

If you are unsure, enter the vehicle registration number plate on the .GOV website, which will give you details of the vehicle, according to what is registered on their database against that plate.

- Work out the Fuel Scale Charge

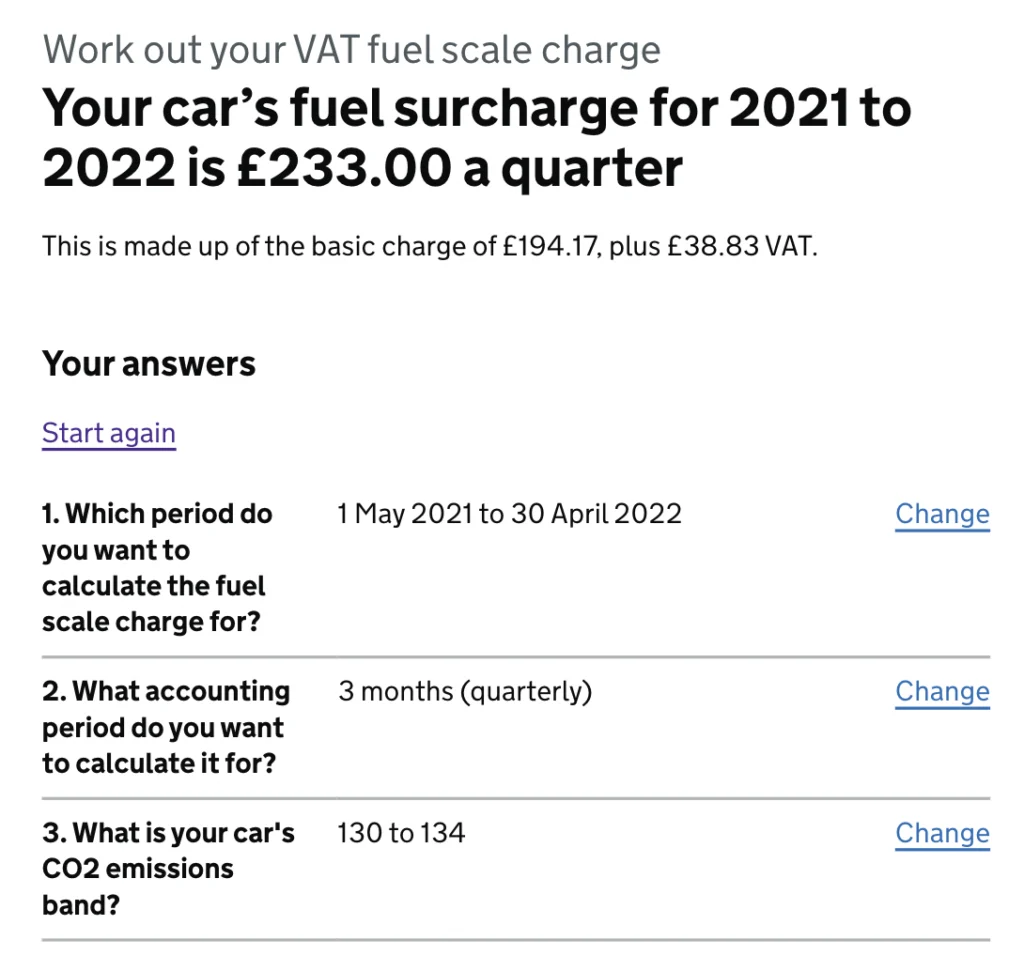

Head over to the HMRC website and use their fuel scale charge calculator. That will give your the gross, net and VAT amount you’ll need to put on your VAT return.

- Make the Adjustment on the VAT Return

Disclose the fuel scale adjustment on the VAT return by entering the VAT element into Box 1 and the net fuel into Box 6.

3.1 Example

A registered employer provides an employee with a free fuel card for both personal and business petrol, along with a company car that has CO2 emissions of 130g/km. Using the HMRC calculator the gross charge is £233 (£194.17 net plus VAT of £38.83). The employer would also need to file a P11d form on behalf of the employee since the company car is a benefit in kind.

Alternatively, you can look up the rates yourself by using the HMRC fuel scale charge tables, depending on whether you file your returns:

Finally, an adjustment for the fuel scale charge would need to be made on the VAT return as follows:

- Box 1 would include £38.83

- Box 6 would include £194.17

Depending on the accounting system you use, a manual entry for the fuel scale charge may be required to enter the fuel scale charge onto your VAT return. You can see how to record the fuel scale charge in Xero here.

5. Other Advice

The fuel scale charge is an easy area for the VAT-man to check and, with rates changing every year, inspectors know they may find errors in VAT returns they are inspecting. So always make sure you check the rate you are using before submitting your VAT return.

You must also use the same policy across the board for all company cars in the business. You can’t choose to use the fuel scale charge for one vehicle and not reclaim VAT on fuel for another vehicle. If this happened, all cars would become ineligible for claiming any VAT back.

Related: