Find out how to set up as a sole trader, how to complete the registration process with HMRC and your responsibilities including taxes and expenses.

This guide is for sole traders, there are other UK business structures which may be more suitable depending on your circumstances.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

Table of contents

- 1. What is a Sole Trader?

- 2. Should I Set Up as a Sole Trader or a Limited Company?

- 3. Is Self Employed and Sole Trader the Same?

- 4. How Do Sole Traders Pay Tax?

- 5. What is Self Assessment?

- 6. What is a Tax Return?

- 7. When to Register as a Sole Trader

- 8. How Much Tax Do Sole Traders Pay?

- 9. Tax Deductions for Sole Traders

- 10. How to Register as a Sole Trader

- 12. Your Responsibilities Once Set Up as a Sole Trader

- 11. FAQs

1. What is a Sole Trader?

A sole trader is a person who works for themselves as an incorporated business. Unlike a Limited Company, sole trader businesses are not legally separate entities from their owners.

Setting up as a sole trader is probably the easiest (and free) way to get started working for yourself but it does mean you are personally responsible for the debts of your business which could put your personal assets at risk. For that reason, some people decide it is worth setting up a limited company instead and because their earnings are at a level which means they can benefit from the tax savings incorporation can bring.

Despite this, becoming a sole trader still remain a really popular option in the UK because taxes are easier to calculate and the form filling is more straightforward meaning many DIY their own taxes.

2. Should I Set Up as a Sole Trader or a Limited Company?

The right business structure for you will depend on your circumstances. You’ll need to consider who you are working with, what your clients prefer and how much you are earning.

Generally, accountants don’t recommend setting up a Limited Company until you are making profits of £30,000 or more. Below this there is no significant tax savings to offset the fees of using an accountant to handle the additional reporting requirements and tax returns.

Read this guide about Sole Trader v Limited Company to help you decide which structure is right for you.

3. Is Self Employed and Sole Trader the Same?

When it comes to business setup and taxes, self-employed, sole trader and freelancer mean the same thing – there is no difference. It’s just that in different industries people tend to use one term over another but they are all the same when it comes to the HMRC side of things.

4. How Do Sole Traders Pay Tax?

If you have ever received a payslip you’ll notice that deductions for income tax and national insurance are made on your behalf before you get paid. However, when you’re a sole trader you are responsible for working out how much tax and national insurance you owe on the money you earn, paying them over to HMRC in accordance with the rules of self-assessment (there’s more on taxes later).

5. What is Self Assessment?

Self-assessment is the process created by HMRC that allows anyone who receives untaxed income to declare it to the government and pay any tax due.

As a sole trader, in most cases, the money you get paid has no tax deducted from it. The most common exception to this are contractors in the construction industry who have to follow special rules.

It’s your responsibility to tell HMRC about it, work out how much tax you owe and pay it over. The way you do this is by registering for self-assessment to fill in a tax return.

6. What is a Tax Return?

A tax return is a form issued by HMRC (also known as an SA100). It contains lots of different sections and boxes that you need to fill in to declare your income. Once completed, HMRC will then calculate how much tax you owe ready for you to pay them.

You need to fill in your tax return by the 31 January each year summarising all your earnings for the previous tax year. The tax year runs from 6 April to 5 April each year. So a tax return due by 31 January 2023 would contain your earnings between 6 April 2021 to 5 April 2022.

7. When to Register as a Sole Trader

You need to register as a sole trader by 5th October following the end of the tax year you started working for yourself. You can choose to claim the trading income allowance, which lets UK individuals earn up to £1,000 in income (not profit) during a tax year without letting HMRC know about your business and paying any tax.

Once your income exceeds £1,000 during the tax year you’ll need to set up as a sole trader and declare your income to HMRC, whether you make a profit or not under the rules of self assessment.

Example:

You start working for yourself on 1 January 2023, you’ll need to register by 5 October 2023.

There is an automatic penalty of £100 for failing to register, so it can be helpful to register sooner rather than later so you don’t forget.

8. How Much Tax Do Sole Traders Pay?

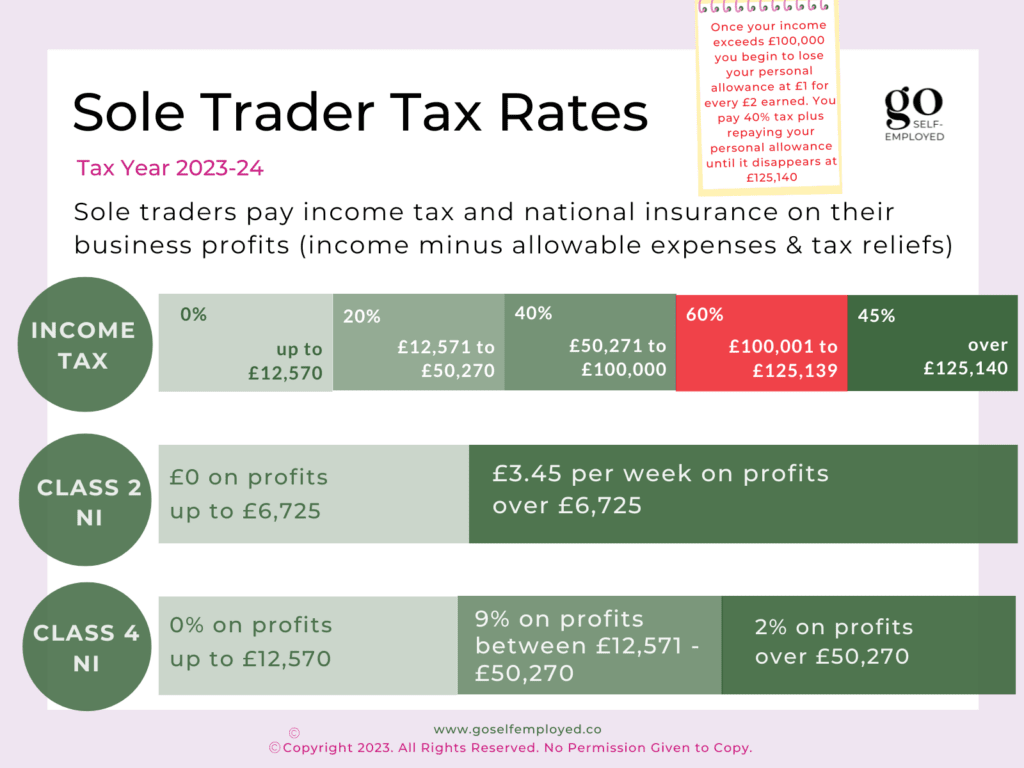

As a sole trader you’ll pay income tax, Class 2 and Class 4 national insurance on your business profits. Profit means all your income minus expenses you can claim as a tax deduction.

Income tax starts at 20% on all your income over £12,570 and 40% over £50,270. Class 2 National Insurance is paid as a set weekly amount of £3.45 when your income goes over £6,725 and Class 4 starts at 9% on your earnings over £12,570.

You can read more about sole trader tax here, see examples of how it’s calculated and when you pay it, including if you’re employed and self-employed.

9. Tax Deductions for Sole Traders

Claiming for allowable business expenses is the easiest way to reduce your tax bill when you’re self-employed. Typically, most of the things that you pay in your business will be tax-deductible. For example:

- Rent or home office

- Business mileage

- Advertising

- Freelancers

- Website hosting and email

- Business subscriptions

- Platform and payment charges

- Mobile phone & data

- Business Insurance

- Accountant’s fees

- Bank charges of a business bank account.

There may be some expenses you pay for that you use personally and for work, such as your mobile phone. In these cases, you can only claim a portion as a business expense where you can make a clear apportionment of your usage. So, say you use your mobile phone for 60% work and 40% personal, then can claim 60% of the total bills to put against your taxes.

While most things you pay for as part of working for yourself are tax write-offs, there are some things you may pay for that you cannot deduct against your taxes. This includes things like:

- Fines and penalties eg: parking fines

- HMRC interest and penalties

- Training and courses for new skills

- Food, except in certain circumstances

- Personal expenses

10. How to Register as a Sole Trader

The easiest way to register is to go online and fill out the HMRC application form.

If you’ve already completed a self-assessment tax return form, then you’ll need to fill out a CWF1 to let HMRC know that you have a new form of income. Don’t register again otherwise, HMRC will expect two tax returns from you! You’ll need to find your UTR number and enter it on the form so HMRC can match your sole trader application to your personal Gateway account.

If you have never registered with HMRC or filled out a tax return, then you’ll need to to set you up with an online account so you can then notify them that you are a sole trader. In summary, you’ll need to complete the following four steps:

- Visit the HMRC website and choose the option to “Register Online”;

- Set up your HMRC Government Gateway Account so you can manage your taxes online;

- Enrol for self-assessment online;

- Wait for your UTR number to be posted to you which can take up to 10 days or find it sooner in the HMRC app. Keep this safe, you’ll need it to manage your sole trader taxes.

Registering with HMRC will be easier if you have the information you need to hand. Here’s some of the information you’ll need to enter onto the form:

- Name

- Date of Birth

- UK Address

- National Insurance Number

- Telephone number

- Email address

- Business start date

- A brief description of what you do

12. Your Responsibilities Once Set Up as a Sole Trader

Once you’ve successfully registered with HMRC you’ll need to consider your responsibilities as a sole trader which include:

- Applying for relevant licences, legal contracts & trademarks

- Taking out business insurance

- Opening a business bank account

- Setting up a system to track your income and expenses, such as a bookkeeping spreadsheet

- Checking whether you need to register for VAT

11. FAQs

Sole traders are referred to as sole proprietors, self-employed or freelancers but not Directors. The term Director is only used by individuals who have been appointed to run a Limited Company.

There is no register of sole traders or list like the Land Registry, for example. In addition, sole traders are not required to register on Companies House, unless they trade through a Limited Company. The only evidence a sole trader has is a UTR number. But, this reference number is highly confidential and you shouldn’t share it unless absolutely necessary.

Unfortunately, there is no register of self-employed people. So, how you’ll prove you work for yourself will depend on who is asking. If you are applying for a mortgage, for example, you can provide a form called an SA302 which proves you’ve filed tax returns, how much you earned and the tax you’ve paid.

If a potential client is asking you to prove your employment status, then you could provide your UTR number. However this is a really confidential piece of information so you shouldn’t share it unless you are sure. Also, unless they have specialist software, there is no way for them to confirm what you have given is true. Often sole traders add a note on their invoices confirming that they are self-employed and responsible for their own taxes.

Related Articles: