Understand your P60 form – a UK tax form created by HMRC and completed by employers. Here, all is explained about the P60 form, what it looks like and why you should keep it safe.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

What is a P60 Form?

A P60 is a tax form filled out by employers and issued to their employees once the tax year ends on 5 April. It shows an individuals gross income (salary before tax) along with the total amount deducted for income tax and national insurance for the previous tax year**. It also contains any adjustments made for statutory items such as maternity pay and student loan repayments, along with the final tax code used.

**The tax year runs from 6 April to 5 April.

P60s are also called ‘end of year certificates’. That’s because one P60 covers one tax year. It’s issued once the tax year ends on 5 April summarising information on income and deductions for the previous tax year.

In many cases, if you’ve been with your employer for the full tax year, the figures on your P60 will be the totals of your payslip.

But, if you started your job part way through the tax year the figures from your previous employment will be included on this form, if you gave your new employer a P45.

Your P60 is highly confidential. The form contains not just your personal details but also it contains an annual tax summary about your gross income. For that reason keep it safe and only share it if you are totally sure that the information will not be shared.

When Do You Get a P60?

Employers must issue P60 forms to everyone working for them on the last day of the tax year, 5 April. It is a legal requirement as part of the PAYE process and they must be issued by the 31 May. So P60s for the tax year ended 5 April 2023 should be issued by 31 May 2023.

If you left your employment after the tax ended you will still receive a P60 from your old employer because you were on their payroll at 5 April and they have information on your pay for that tax year.

P60 v. P45

A P45 is a form given to an employee when they stop working for an employer, regardless of what date they leave in the tax year. A P60 is issued by employers to all employees who worked for them on the last day of the tax year, 5 April, even if they have left their employment subsequently.

Example P60 v. P45

Karan changed jobs in the tax year 2022-23. From 6 April 2022 to 30 November 2022, she worked for Company A but from 1 January 2023 she started work at Company B.

When Karan left Company A, she received a P45 with details about her income from 6 April 2022 to 30 November 2022

When Karan started her new job at Company B on 1 January 2023, she will have handed her new employer her P45.

Once the tax year ends on 5 April 2023, Karan will receive a P60 from her new employer only. This will summarise her income and deductions for the 2022-23 tax year from Company A and Company B.

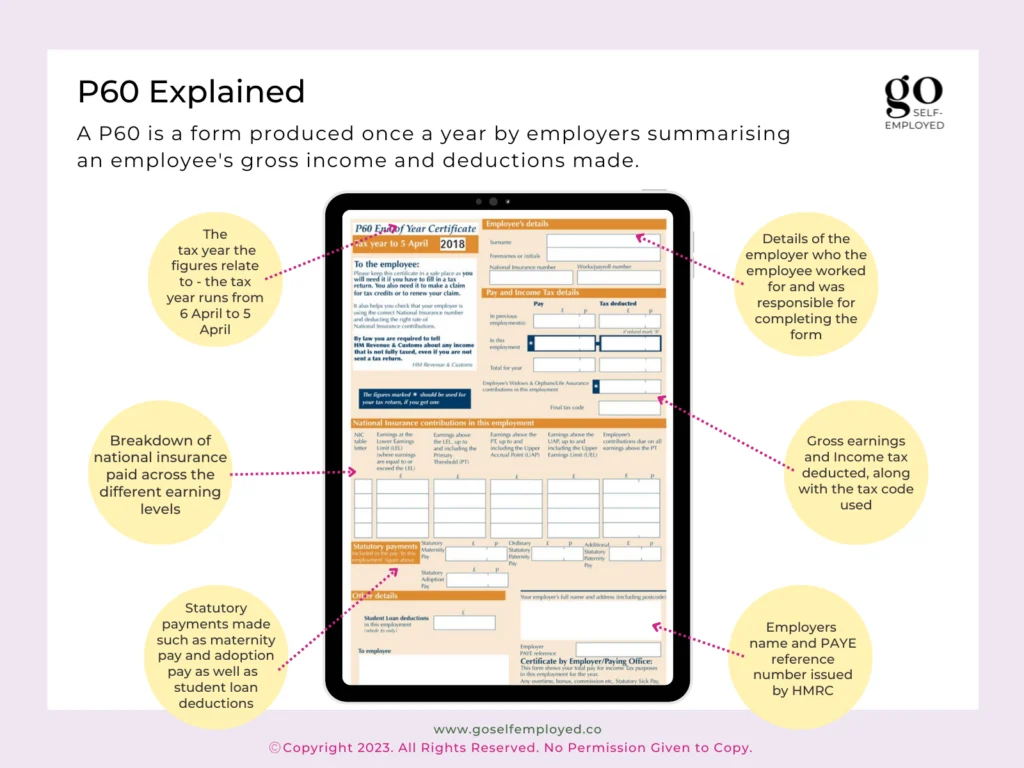

What Does a P60 Look Like?

The P60 form is created by HMRC but it is filled out by Employers since they have all the information on salaries and deductions. Even if there are differences in format, colours and orientation, the boxes are the same.

Example P60

P60 Figures Explained

The P60 form is made of different sections to help summarise important tax and salary information succinctly and in an easy to understand way. Here’s what each of the boxes on a P60 statement mean to help you read yours:

- Employee Details: personal information such as national insurance number and full name;

- Gross Income and Income Tax: total income tax deducted from gross pay;

- National Insurance Deductions: total NI deductions made broken down across different pay levels;

- Statutory Payments: adjustments made to pay statutory payments such as maternity, paternity and adoption pay;

- Other Details: any other information such as student loan deductions;

- Employer Details: the employers’ name and address who issued it.

What is a P60 Form Used For?

A P60 is evidence of your income for previous tax years and may be useful if you need to:

- Claim a tax refund;

- Prove gross income for a loan or mortgage;

- Apply for tax credits or state benefits

- Fill in your tax return if you are registered for self assessment.

P60 Marked R

A P60 marked R indicates that the individual has received a tax refund that has been passed on by the employer.

P60 and the Self-Employed

If you are employed and self-employed you will receive a P60 from your employer. The information on the form will only relate to the income in your job, not your self-employment income. When you fill in your tax return, you’ll need include details of your job in the Employment Section using the figures on your P60.

If you are full-time self-employed, you won’t receive a P60 because you don’t have an employer. You’ll declare your income on your tax return and this will be evidence of your earnings.

Does a P60 include Pension Contribution Deductions?

Pension deductions are not shown on a P60. It only shows taxable pay which means gross income minus pension contributions.

Do You Get a P60 for Your State Pension?

You do not get a P60 if you are receiving a state pension, it’s your responsibility to keep your own records of how much you have received.

Do You Get a P60 When You’re the Director of a Limited Company?

If you work for yourself and operate through a Limited Company, paying your salary through a payroll scheme then you’ll be registered as an employer. As an employer you are legally required to issue P60 forms, even if that is to yourself.

Should I Receive a P60 while Claiming Job Seekers Allowance?

Job Seekers Allowance is paid under a PAYE scheme – the Benefits Office is your ’employer’ and your JSA is your ‘salary’. That means the benefits office will issue you with a P60.

When you find a job, the benefits o

Relevant Reading: