I put together this tax guide for dog breeders because as a Chartered Accountant in my previous life, I know how confusing business registration and taxes can be when you go self-employed. In this guide, I’ll share some of my knowledge, not just about registering to become a dog breeder, but also VAT, tax deductions and returns. I’ll also point you to where you can find additional information and tax advice for dog breeders to read to help build your knowledge.

I only cover self-employment in this guide. If you have a Limited Company you’ll be affected by different taxes such as corporation tax and dividend tax.

Table of contents

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

Do Dog Breeders Get Taxed?

Since COVID struck, people in the UK have been forced to work from home. As a consequence, this has made the demand for a furry companion more than we’ve ever seen! Naturally, this has resulted in price increases as demand exceed to supply. However, what this does mean, is that dog breeding businesses are seeing increases in turnover from the sale of puppies and others are making more profit.

When it comes to paying tax, generally everyone who is in business needs to register with HMRC. They also have to declare their income and pay tax depending on their profit. This is unless they have a hobby business.

Who is a Hobby Dog Breeder?

A hobby business is something that is done for enjoyment and pleasure, like playing golf. For that reason, it doesn’t attract tax and HMRC don’t need to know about it (you can read about the Hobby Business Tax Rules in this guide).

In some circumstances, a hobby can become a business or for others, as much as they enjoy what they do, can still be considered a business.

When it comes to deciding whether you have a business or a hobby, you need to refer to HMRC for guidance because they won’t just take your word for it. In fact, back in May 2019, there was a high clamp down on illegal dog breeders in the UK. This resulted in more than £5m in tax being recovered.

HMRC sets out a series of 9 questions known as the badges of trade which need to be answered when deciding whether someone has a business or hobby. These include investigating whether the person:

- Is seeking to make a profit;

- Make repeated sales;

- Has similar businesses.

Not all the badges need applying to conclude that a person is in business and should pay tax. And the badges are always used to find a conclusive answer by HMRC. For example, they can decide to ignore their findings here and look at other evidence. However, it is a good place to start if you are trying to decide on your tax status as a dog breeder.

How to Register as a Dog Breeder with HMRC

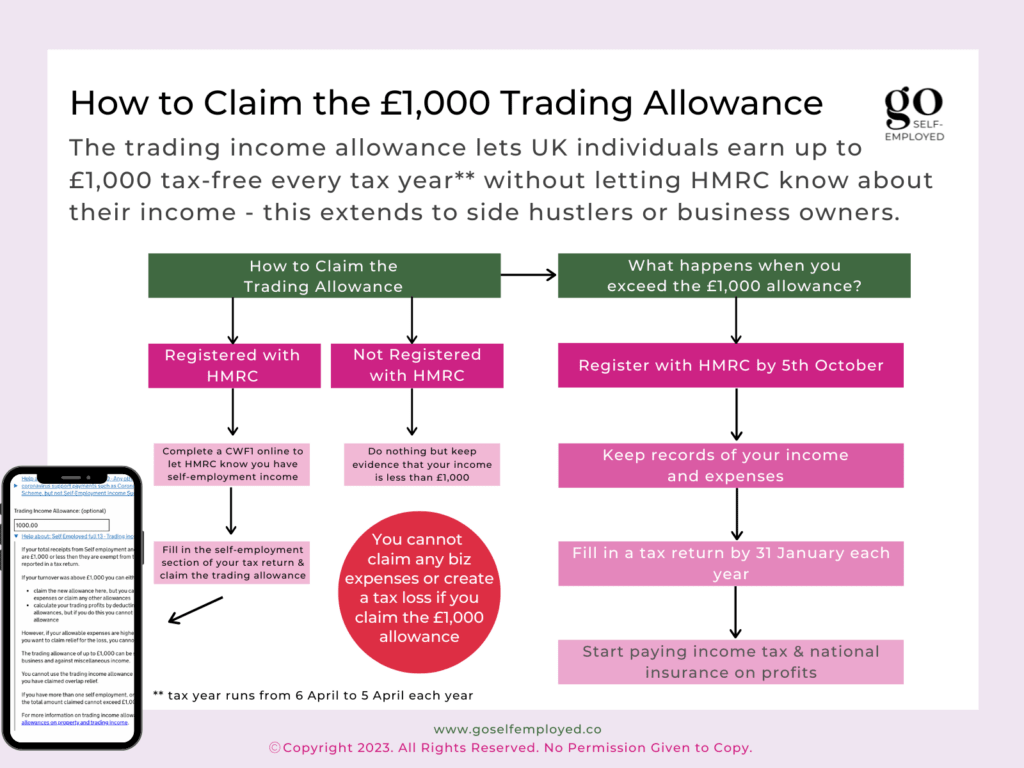

The quickest and easiest way to register to work for yourself with HMRC is to apply to be self-employed. You’ll need to do this once your income (not profit) goes over £1,000 during a tax year (6th April to 5th April). That means that even if you make a loss from breeding a litter of puppies, you’ll still have to let HMRC know about your income and expenses from your dog breeding business.

The £1,000 trading allowance relates to tax only, not the number of litters you have. You would also still need to check whether you need to be a licensed dog breeder separately.

You’ll need to make sure you’ve registered by the 5th October, following the end of the tax year you went over the £1,000 threshold.

Even if you are currently not making much money in profit, but have crossed the £1,000 income threshold, you must still register with HMRC and complete a tax return. Although this may feel onerous, completing a tax return means you can record all your expenses to create a tax loss. This can then be used against any money you make in the future and save you tax at this point.

How to Register as Self-Employed

There are other business structures out there including:

- Limited Company

- Partnerships

These may offer you better tax-savings depending on your earnings and protection from creditors. However, they often carry more reporting responsibilities meaning you need to engage an accountant.

For the rest of this guide I’ll assume that you are registered as self-employed.

Paying Tax on the Puppies You Sell

The amount of income tax and National Insurance you’ll pay will depend on how much money is left over after deducting allowance expenses, tax allowances and reliefs.

Income tax starts at 20% on all your income (not just from teaching) over £12,500 and 40% over £50,000. Class 2 National Insurance is paid as a set weekly amount when your earnings go over £6,475. Alternatively, Class 4 is worked out as 9% on your earnings over £9,501.

When you fill in your tax return online, HMRC will automatically calculate how much tax you owe. This will be based on the information you enter.

Self-Employment Taxes Explained

Allowable Expenses for Dog Breeders

Claiming for allowable business expenses is the easiest way to reduce your tax bill when you’re self-employed. Typically, most of the things that you pay for in your dog breeding business will be tax-deductible, for example:

- Puppy toys

- Puppy food

- Bedding

- Whelping boxes

- Stud fees

- Vets fees

- Vaccination fees

- Equipment like crates and pens

- Website design, build and hosting

- Laptop

- Mobile Phone

- Licences and subscriptions

- Training and courses

- Use of home

- Insurance

- Travel and mileage

- Legal fees

- Accountants fees

- Bank charges for a business bank account

There may be some expenses you pay for that you use personally and for business, like your mobile phone. In these cases, you can only claim a portion as a business expense. So, say you use your mobile phone for 60% work and 40% personal, then you can claim 60% of the total bills to put against your taxes.

Whilst most things you pay for as part of being registered as a dog breeder are tax write-offs, there are some things you may pay for that you cannot deduct against your taxes. This includes things like:

- Fines and penalties eg: parking fines

- HMRC interest and penalties

- Training and courses for new skills

- Food, except in certain circumstances

- Personal expenses and things you buy for your own pets

A Guide to Claiming Self Employed Expenses

Tax Returns for Self Employed Dog Breeders

When you become a dog breeder, you’ll need to follow the rules of HMRC self assessment. You’ll need to submit a tax return online (SA100 form) declaring your income and expenses once a year by 31 January. This is in addition to paying tax twice a year by 31 January and 31 July.

Keeping Tax Records

As a dog breeder, you’re legally required to keep records and paperwork that support all your income and expenses and hold onto them for 6 years. That way if HMRC ever asks how you arrived at the figures on your tax return, you’ll be able to show them evidence.

Your records include things like receipts from clients and receipts for any expenses you may wish to claim, along with bank statements.

The simplest ways to keep your records in order and speed up filling in your tax return is to:

- Open a separate bank account so all your payments are in one place and help you budget for your tax bill (take a look at Starling);

- Store your records and paperwork using a secure cloud-based storage system like google drive or Dropbox;

- Set aside time on a regular basis to check all your finances are in order and do your bookkeeping.

VAT for Dog Breeders

Value Added Tax (known as ‘VAT’) is a tax added to the price most goods and services consumers buy. Only businesses with a turnover (not profit) of £85,000 or more are required to register for VAT. Once VAT registered, a business must charge VAT to its customers at the right rate and pay this over to HMRC after claiming back any VAT they have paid to their suppliers as well as submitting VAT returns, usually quarterly.

As VAT relates to turnover, not profit, dog breeders can find themselves needing to register for VAT. This is especially so given the prices puppies are selling at now. Although this represents a milestone for any business, for dog breeders who sell to consumers it can pose a problem. Only registered business can claim back VAT so when you’re VAT registered you’ll need to add the standard rate of VAT 20% to the price of each puppy you sell. (Some breeders do this but it can make you uncompetitive). Alternatively, you’ll have to pay a portion of the price you charge over to HMRC (which comes straight out of your profit).

Here’s an example:

Penny became a dog breeder in 2020 and crossed the £85,000 threshold for VAT. Penny has a litter of 10 puppies to sell at £3,000 each so she must charge her customers an extra 20% for VAT, a total of £3,600 per puppy. Or she can charge £3,000 and take VAT out of the amount she gets paid for each puppy to pay to HMRC of £500 (£3,000 x 20/120).

There are VAT schemes available the UK which can help to improve cash flow and even reduce the amount of VAT paid. However, one breeder attempted to adopt the margin scheme for puppies which landed them in hot water with HMRC. Unfortunately, whilst we don’t like to think of puppies like commodities when it comes to business, they are subject to VAT just like any other inanimate object.