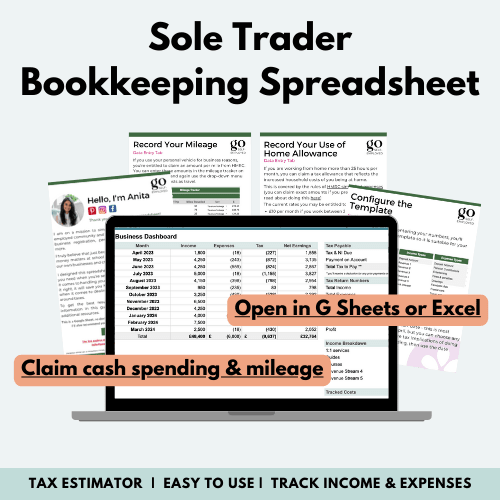

A simple sole trader bookkeeping spreadsheet that estimates your tax and generates the numbers you need for your self-assessment tax return.

Opening in Excel or G Sheets, the spreadsheet includes:

📊 5 simple but powerful tabs that track the numbers that matter to self-employed business owners

📝 A single data entry tab that automatically updates the ENTIRE spreadsheet

✍🏽 Customisable income and expense categories

💷 A dashboard with the numbers for your tax return

🧮 Tax estimator that works even if you’re employed & self-employed, so you’re ready to pay your tax bill and payment on account

🧾 Cash expenses, mileage & use of home claim forms

🙌🏽 A comprehensive set-up guide so you can start your bookkeeping immediately

What You’ll Receive:

A PDF document will be sent straight to your inbox with:

🔗 A link to the Excel & G Sheets version of the sole trader bookkeeping spreadsheet;

🔗 Instructions on configuring your spreadsheet and finding the numbers you’ll need.