Confused about how self employed tax works? Let me take you through it step-by-step and show you what you need to know about self employed tax, how it’s calculated as well as how (+when) you’ll pay your tax bill when you work for yourself.

This guide is for self-employed workers and side hustlers. Different tax rules apply if you have a Limited Company.

Table of Contents

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

How Does Self Employed Tax Work?

If you’ve ever worked for someone you’ve probably received a payslip with all your deductions for income tax, national insurance and pension taken care of for you, before you get paid. Your employer then pays your tax and national insurance over to HMRC on your behalf. It’s simple – all your tax is taken care of for you!

Read more => What Does HMRC Stand For + Affect the UK Self-Employed?

When you’re self-employed you are responsible for working out how much self employed tax you owe on the money you’re making and paying it to HMRC yourself following the rules of self-assessment.

What is Self-Assessment?

Self-assessment is the process created by HMRC that allows anyone who receives untaxed income to declare it to the government and pay any tax due.

As a self-employed individual, the money you get paid by your clients and customers has no tax deducted from it.

(In the UK most types of income are taxable, although there are some exceptions)

In a nutshell, self-assessment for the self-employed means:

- Registering as self-employed

- Being issued with a UTR number from HMRC

- Filling in a tax return once a year to declare your earnings

- Paying your tax twice a year

Read=> How to Register as Self-Employed with HMRC (2024)

Read=> When To Register as Self-Employed

Read=> A Beginners Guide to HMRC Self Assessment

What is a Tax Return?

A tax return is the form that people use to declare their untaxed income to HMRC. It contains different sections that need to be completed depending on the type of income you’ve received for example:

- Rental income

- Employment income

- Self employment income

You only need to complete the sections relevant to you. And once you’ve filled in your figures only, HMRC will automatically calculate how much self employed tax and national insurance you owe from the numbers you’ve entered. You’ll then need to pay what you owe.

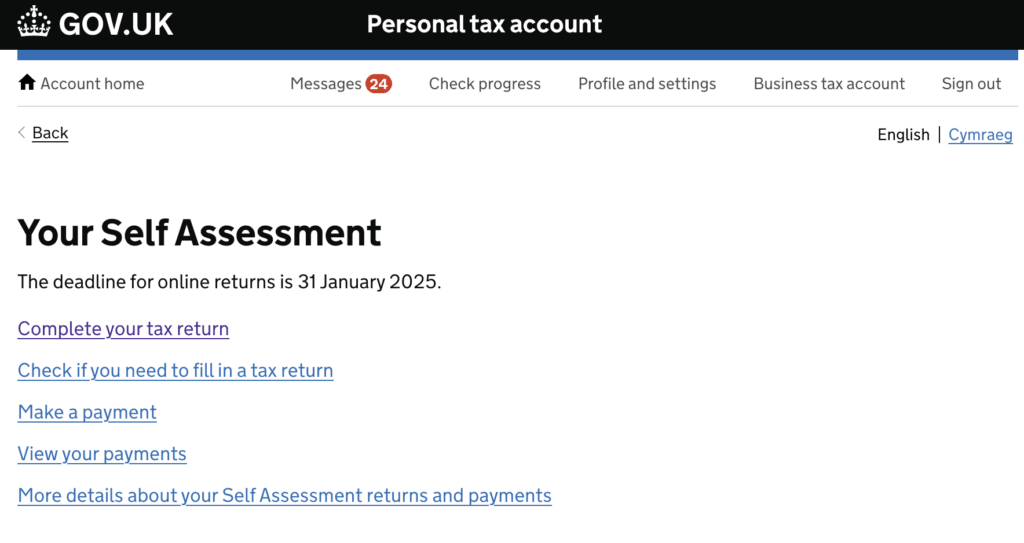

Tax returns are due for filing by 31 January each year. One tax return contains all your earnings for the previous tax year.

The tax year runs from 6 April to 5 April each year.

So a tax return due by 31 January 2025 would contain details of income from 6 April 2023 to 5 April 2024.

Once you’re registered for self-assessment, you must file your tax return by the 31 January deadline to avoid automatic penalties.

Read=> Beginners Guide to Completing Your Tax Return Online

What Tax and National Insurance Do You Pay When You’re Self-Employed?

From 6 April 2024, as a self-employed worker, you’ll pay income tax and class 4 national insurance on the profit* you make from your business.

*Profit means all your business income minus business expenses you can claim as a tax deduction.

Read=> Self Employed Expenses – What Can You Claim?

Until 6 April 2024, self-employed workers were also required to pay class 2 national insurance. However, this has been scrapped for many sole traders, unless they want to pay it voluntarily to top up their national insurance records to protect their entitlement to state benefits.

Read=> Should I Pay Class 2 NICs Voluntarily?

Self Employed Tax Rates 2024-25

Income tax and class 4 national insurance are paid at different rates and thresholds. But the amount of each you’ll pay is based on your business profits.

Read=> How to Calculate Your Business Profits

The income tax and national insurance rates change every tax year with any changes to tax rates usually taking effect at the start of each new tax year, on 6 April.

Income Tax

Income tax starts at 20% on all your income (not just from self-employment) over £12,570 in England and Wales. The rates differ in Scotland.

If you’re employed and self-employed the amount of income tax you’ll pay will be based on your combined earnings.

Here are the income tax rates for the 2024-25 tax year:

| England & Wales | Scotland |

|---|---|

| 0%: £0 to £12,570 (personal allowance) | 0%: £0 to £12,570 (personal allowance) |

| 20%: £12,571 to £50,270 (basic rate) | 19%: £12,571 to £14,876 (starter rate) |

| 40%: £50,271 to £100,000 (higher rate) | 20%: £14,877 to £26,561 (basic rate) |

| 60%: £100,001 to £125,139 (higher rate + personal allowance restriction) | 21%: £26,562 to £43,662 (intermediate rate) |

| 45%: Over £125,140 (additional rate) | 42%: £43,663 to £75,000 (higher rate) |

| 45%: £75,001 to £100,000 (advanced rate) | |

| 63%: £100,001 to £125,140 (higher rate + personal allowance restriction) | |

| 48%: Over £125,141 (top rate) |

Example:

You live in England and your taxable business profits are £40,000 for the tax year 2024-25. You have no other forms of income. You’ll pay income tax of £5,486.20 which is calculated as:

- 0% on the first £12,570

- 20% on the next £27,430

Income tax is paid on all your taxable earnings. So if you are employed and self-employed, the tax brackets you’ll fall into will be based on your combined taxable business profits and your gross salary.

Example:

You live in England, earning £40,000 gross salary from your job and £20,000 from your side hustle. The amount of income tax you pay is based on your combined income of £60,000 so you’ll pay income tax of £11,432.60 which is calculated as:

- 0% on the first £12,570

- 20% on the next £37,700

- 40% on the remaining £9,730

Your combined earnings mean that you are now paying the higher rate tax of 40%.

Read more => Tax When You’re Employed and Self-Employed

Class 4 National Insurance

As a self-employed worker, you’ll pay class 4 national insurance on your taxable business profits, in addition to income tax. The class 4 NI rates for 2024/25 are 8% on taxable profits between £12,570 to £50,270 and 2% thereafter.

If you are employed in a job, you’ll also be paying class 1 national insurance on your payslip income.

Example:

Your taxable business profits are £40,000 for the tax year 2024-25. You’ll pay class 4 national insurance of £2,194.40 which is calculated as:

- 0% on the first £12,570

- 8% on the remaining £27,430

Self Employed Tax Dates and Deadlines

It’s important to make a note of all the relevant tax year dates and deadlines to avoid penalties for missing them.

Here’s a summary of the tax dates and deadlines for the self employed:

- 31 January: tax return filing deadline, tax bill due for payment along with first payment on account*

- 5 April: tax year ends

- 31 July: second payment on account* due for payment

- 5 October: deadline to register as self-employed

- 30 December: tax return deadline to pay self employed tax through PAYE

* Payments On Account

Payments on account are two advance payments you make towards your next tax bill by 31 January and 31 July each year. The amount you’ll need to pay is 50% of your most recent tax bill if:

- The tax bill for your latest filed return is more than £1,000;

- You pay less than 80% of your total tax bill through your payslip if someone employs you.

Any advance payments you make are deducted from your actual tax bill which is calculated when you file your tax return.

Although the process is designed to help self-employed people stay on top of their tax bill, it means that if this is your first year of self-employment you could find yourself paying an extra 50% of your tax bill in January and then again in July.

Read=> Payments on Account Explained

Budgeting for Your Tax Bill

So you know you’re going to need to pay tax on your income, but how do you estimate it?

Budgeting for your tax bill is essential. Remember your tax return isn’t due until around 9 months after the end of the tax year – so there is money in your account that needs to be saved towards your tax bill.

The first step is to track your income and expenses:

How to Keep Track of Your Income and Expenses

Tracking your income and expenses is not only a legal requirement for self employed workers but it also helps you to estimate how much tax you owe because you’re able to keep an eye on your business profits.

Depending on how complicated your business is, the easiest way to get started tracking your numbers is with a bookkeeping spreadsheet. I’ve created one for self-employed workers and side hustlers that you can find here or you can follow this guide where I show you how to make your own, step-by-step.

Alternatively, you could opt for a software like Xero. Do you need it? It depends. If you’re VAT registered, then you’ll legally be required to use an accounting software to submit your VAT returns.

However if you’re not VAT registered and your accounts are quite simple then there is no need to use an accounting software.

It’s worth noting that if you choose to use an accountant they may be able to include the cost of a subscription to an accounting software as part of their fee and help get you get up and running with using it.

Read More=> How to Do Your Own Accounts When You’re Self-Employed

Can I Earn £1,000 tax-free?

UK taxpayers are allowed to earn £1,000 tax-free in income (not profit) from self-employment every tax year without letting HMRC know about their income, in addition to their personal allowance. This is known as the trading income allowance and avoids registering for self-employment, filling out a tax return and paying tax on it.

How Much You Earn as Self Employed Before Paying Tax?

Currently you can make £1,000 in income (not profit) each tax year before paying tax. Once you hit this threshold, you’ll need to register as self-employed. Once registered you will need to pay income tax and class 4 national insurance on your business profits. You begin to pay class 4 NICs once your profits go over £12,570. You’ll pay income tax once all your income (not just your self-employment profits) go over the personal allowance limit of £12,570.

Do Self Employed People Pay National Insurance?

Self-employed people pay Class 4 national insurance. Until 6 April 2024, self-employed workers were also required to pay class 2 national insurance. However, this has been scrapped for many sole traders, unless they want to pay it voluntarily to top up their national insurance records to protect their entitlement to state benefits.

Want to Read More About Self Employed Tax?

If you’ve enjoyed this post you may like to read more about self employed tax. Here are some of my most popular blog posts on this topic…

- Self Employed Tax: An Easy Guide for Beginners (2024)

- The UK 60% Tax Trap Explained (63% in Scotland)

- Claiming Self-Employed Expenses

Any Questions?

I’d love to help if you have any questions about this topic. Feel free to ask over in my group ‘The Self-Employed Club‘.

Don’t miss a thing!

Follow me on Instagram and TikTok. Or why not subscribe and get business tips straight to your inbox every week?