Discover the tax-free thresholds and rates for calculating Class 4 National Insurance for self-employed workers in the 2024-25 tax year.

Table of Contents

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

What is Class 4 National Insurance?

Class 4 National insurance is a type of UK tax that the UK self-employed pay as a percentage of their profits.

It’s one of three taxes self-employed individuals pay on their business profits – the other two are income tax and class 2 national insurance. Although recent changes that kicked in from 6 April 2024 means many self-employed individuals may no longer need to pay Class 2 NICs.

Read=> Should I Pay Class 2 NICs Voluntarily?

Read=> Self Employed Tax: An Easy Guide for Beginners (2024)

How is Class 4 NI calculated for self-employed?

Class 4 National Insurance for tax year 2024-25 is calculated as 8% on taxable profits between £12,570 to £50,270 and 2% thereafter.

Example:

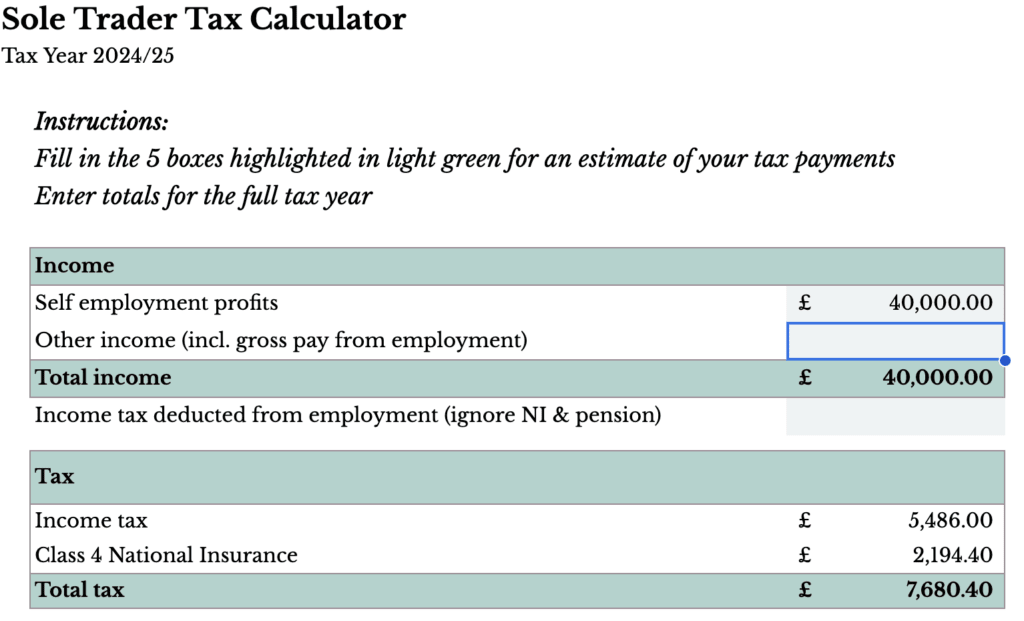

You are self-employed and your taxable business profits were £40,000 for the tax year 2024-25. You’ll pay class 4 national insurance of £2,194.48 which is calculated as:

- 0% on the first £12,570

- 8% on the remaining £27,430.

HMRC will calculate class 4 national insurance when you fill in your tax return online. It will also be taken into account when calculating your payment on account.

Read=> Beginners Guide to Completing Your Tax Return Online

Budgeting for Your Class 4 National Insurance Bill

Budgeting for your class 4 national insurance and income tax bill is essential. Remember your tax return isn’t due until around 9 months after the end of the tax year – so there is money in your bank account that needs to be saved towards your tax bill.

You’ll need to track your income and expenses.

Depending on how complicated your business is, the easiest way to get started tracking your numbers is with a bookkeeping spreadsheet. I’ve created one for self-employed workers and side hustlers that you can find here or you can follow this guide where I show you how to make your own, step-by-step.

Alternatively, you could opt for a software like Xero. Do you need it? It depends. If you’re VAT registered, then you’ll legally be required to use an accounting software to submit your VAT returns.

However if you’re not VAT registered and your accounts are quite simple then there is no need to use an accounting software.

Read More=> How to Do Your Own Accounts When You’re Self-Employed

Class 4 National Insurance Rates for Self Employed Workers

| 2024-25 | 2023-24 | 2022-23 | 2021-22 | 2020-21 | |

|---|---|---|---|---|---|

| Lower profits limit | £12,570 | £12,570 | £11,909 | £9,568 | £9,500 |

| Upper profits limit | £50,270 | £50,270 | £50,270 | £50,270 | £50,000 |

| Rate between lower and upper limit | 8% | 9% | 9.73% | 9% | 9% |

| Upper profit limit | £50,270 | £50,270 | £50,270 | £50,270 | £50,000 |

| Rate above upper profit limit | 2% | 2% | 2.73% | 2% | 2% |

FAQs

At what age do you stop paying Class 4 National Insurance?

You’ll stop paying class 4 national insurance at the end of the tax year in which you reach the state pension age, currently age 66.

What is the difference between Class 1, 2, 3 and 4 National Insurance?

Here’s a summary of the different types of national insurance in the UK:

Class 1: paid by employees automatically deducted through their payslips;

Class 1a: paid by employers on their employee’s gross salary and benefits in kind;

Class 2: paid by self-employed and counts towards person’s entitlement to state benefits such as basic state pension and maternity allowance

Class 3: voluntary contributions of £17.45 per week to fill gaps in national insurance records to claim the state pension;

Class 4: paid by self-employed individuals on their taxable business profits (this is in addition to class 2).

Does Class 4 National Insurance count towards pension?

Class 4 contributions paid by self-employed people with business profits of £12,570 or more do not count towards state benefits and instead is generally considered a type of tax.

Want to Read More About Self Employed Tax?

If you’ve enjoyed this post you may like to read more about self employed tax. Here are some of my most popular blog posts on this topic…

- Beginners Guide to Completing Your Tax Return Online

- The 40% Tax Bracket (+ 3 Ways to Avoid It)

- The UK 60% Tax Trap Explained (63% in Scotland)

- Claiming Self-Employed Expenses

Any Questions?

I’d love to help if you have any questions about this topic. Feel free to ask over in my group ‘The Self-Employed Club‘.

Don’t miss a thing!

Follow me on Instagram and TikTok. Or why not subscribe and get business tips straight to your inbox every week?