HMRC sets out different ways you can claim for working from home if you’re self-employed. In this guide, you’ll find out your options to claim for your home office, the work from home allowances for 2022/2023 as well as how to claim it on your self-assessment tax return.

This guide is for self-employed business owners, different rules may apply if you have a Limited Company.

Table of contents

1. How to Claim for Your Home Office Against Your Taxes If You’re Self-Employed

There are two ways HMRC lets you claim a use of home allowance against your taxes to reflect the increased cost of utilities and a portion of your rent/mortgage against your taxes:

- By claiming a flat rate amount based on the number of hours you work or;

- By claiming a portion of the actual costs of your household bills.

2. How to Claim the Flat Rate for Working from Home

If you are self-employed, your first option for claiming for home office allowance is to use a flat-rate amount based on the number of hours you spend working as an expense. This method is also known as simplified expenses, which helps make claiming for complicated expenses like your home office or business mileage more straight-forward.

2.1 Working from Home Allowance 2022/2023

The flat-rate amounts that you can claim for working from home for the 2022/2023 tax year are:

- £10 per month if you work between 25 and 50 hours per month;

- £18 per month if you work between 51 and 100 hours per month;

- £26 per month if you work 101 or more hours per month.

2.2 Pros and Cons of the Flat Rate Method Home Office Claim

The flat rate method means you don’t need to keep any receipts but the downside is that you:

- Can only claim the use of home as office allowance if you work at home for more than 25 hours per week;

- Still need to make a separate claim for business use of your telephone and internet (for which you must keep receipts);

- Should check whether claiming for actual costs is more beneficial to you.

3. How to Claim Actual Costs for Working from Home if You’re Self-Employed

If you’re self-employed and working from home, the flat rate method may not really cover the costs of your home office. As an alternative, HMRC permits you to claim a portion of your actual bills to reflect your true use of home as office.

When working out your tax deduction, you’ll want to consider the following household bills in your calculation:

- Heating

- Electricity

- Rent

- Mortgage interest

- Insurance

- Repairs

- Cleaning

- Council tax

3.1 How to Calculate Your Actual Use of Home Allowance

Once you have all your actual costs, you’ll need to work out the portion to claim against your taxes. Here are the steps you need to follow:

- Count up the number of rooms in your house or apartment;

- Divide the total costs of the bills by each room (either equally or by floor space);

- Estimate how much time you spend working in each room as a percentage;

- Multiply this percentage by the total cost for each room to work out your claim for business use.

Example:

Eddie is a sole trader and works from home. His apartment has a bedroom, bathroom, kitchen and living room. His electricity bill for the year is £850. Therefore, his claim for working from home as self-employed is:

- Total number of rooms = 4

- The total cost of electricity in each room is £850/4 = £212.50

- Eddie spends 70% of his time in his living room working and 10% of his time in his bedroom working.

- Eddie can, therefore, claim an allowable amount for electricity on his tax return as follows:

Living room 70% x 212.50 = £148.75

Bedroom 10% x £212.50 = £21.25

Total = £170

Claiming for use home using actual expenses can be more tax-efficient for some just make sure that you:

- Keep your utility bills to support your claim;

- Apportion the cost of bills according to the floor space of each room, rather than equally (as in step 2 in our example above) if it makes more sense;

- Don’t dedicate a room in your home to your office space. Dual-use is essential, otherwise, you may risk being charged capital gains tax when you sell your home or getting a bill for business rates;

- Check your mortgage, tenancy agreement or lease because there may be clauses preventing you from using your home as an office.

Whether you choose the flat-rate or actual cost method to claim for your home office, don’t forget you’ll need to claim for additional costs against your self-employed taxes such as:

- Broadband

- Mobile phone

- Desk

- Shelving and storage

- Stationery

4. Where to Claim the Working from Home Allowance on Your Tax Return

Whichever method you choose, you’ll need to claim your use of home as office allowance in the self-employment section of your tax return. If your business turnover is less than £85,000 for 2022/2023, you’ll have the option to fill in the simplified version of this part of the tax return so only need to enter your total expenses. You’ll need to include your home office claim alongside your other business expenses in the figure you enter.

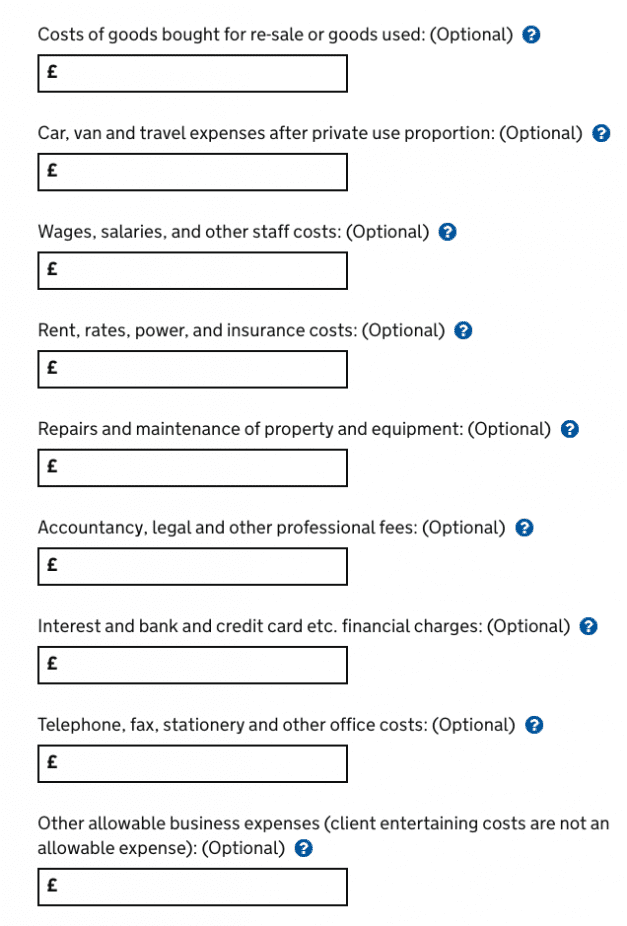

If your business turnover is more than £85,000, you’ll need to enter a breakdown of your expenses in the boxes set out by HMRC and you’ll need to include your working from home claim in Box 21: rent, rates, power and insurance costs.

Whatever your business turnover, you should note what you are claiming and how you worked it out as part of your business records. This is in case of an HMRC investigation and they ask for evidence of what you are claiming to check you’ve paid the right amount of self-employed tax.

When it comes to claiming expenses, always use your judgement when it comes to deciding what you deduct against your taxes. Incorrect claims can result in penalties. And, as always, if you aren’t sure, seek the advice of a professional.

Related: