Business turnover is one of the most important KPIs in a business. It’s often used as a yardstick to measure a business’ health, growth and success. You’ll also need to calculate it when you fill in your tax return. However, show too much and you’ll pay too much tax, show too little and you could face penalties. So, what is business turnover and how do you calculate it in business? Read on to find out how turnover is defined in business and how to calculate it. I’ll also explain what you need to include on your tax return if you are registered as self-employed.

Table of contents

- 1. What is Business Turnover

- 2. How to Calculate Turnover in Business

- 3. How is Business Turnover Calculated Using the Cash Basis v Traditional Accounting

- 4. Business Turnover v Business Profit

- 5. Does Turnover Include VAT?

- 6. How to Work Out Total Turnover for Your Self-Employed Tax Return

- 7. Where to Include Business Income on Your Self-Assessment Tax Return

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

1. What is Business Turnover

Business turnover is defined as the total sales (revenue) generated by a business before deducting expenses.

It’s all the sales you have generated in your business for work you have carried out or the product you have sold. Business turnover does not include money earned as interest or received in the form of business loans. These are dealt with in a different way in accounting and when you fill in your tax return.

2. How to Calculate Turnover in Business

Business turnover is calculated as all the sales made during a certain period of time. If you want to calculate your business turnover, you’ll need to look through your business records. You’ll also need to add up your sales (before any deductions) from things like:

- Sales invoices;

- Bank statements;

- Cash sales;

- Marketplace statements such as eBay, Etsy or Amazon.

You’ll need to calculate your business turnover when completing out your self-assessment tax return, totalling up everything you have earned in the tax year. The figures you use must be gross, which means before deductions. So, if you are a self-employed uber driver, for example, you’ll need to add up your income before any Uber deductions.

Don’t worry, you’ll be able to get tax relief on any fees deducted from your earnings when you enter your expenses into your tax return. You’ll find the figures you need by referring back to all the places you collected money like:

- Cash takings records;

- Invoices;

- Tips;

- Bank statements;

- Online accounts like eBay, Amazon, Shopify or payment processing solution for your own website.

The actual figures you need to add up depends on whether you use the cash basis or traditional accounting.

3. How is Business Turnover Calculated Using the Cash Basis v Traditional Accounting

The easiest way to work out your business turnover for your turnover (although it isn’t always beneficial for everyone) is to use the cash basis. That means that you need to add up everything you were paid during your accounting period.

So, if you have invoiced a customer but they have not paid you, then you don’t need to include it in your business turnover calculation. This method works great for self-employed business owners because it means they only pay tax on the money they have actually been paid.

If you don’t use the cash basis, you’ll need to include all the money you have earned during your accounting period. This is applicable whether it has been paid to you or not. Any money that is owed to you, or you owe suppliers at the end of the tax year, are known as trade debtors and trade creditors.

4. Business Turnover v Business Profit

Turnover and profit are often confused. Profit refers to the amount of money a business makes after deducting expenses. In contrast, turnover refers to sales made before expenses. Both turnover and profit are important but some say that profit is more important because without it a business simply can’t survive.

5. Does Turnover Include VAT?

If you are VAT registered, then turnover does not include VAT you have charged your customers on invoices. That’s because when you are VAT registered, you are simply collecting VAT on behalf of HMRC. Therefore, VAT is not part of your turnover. If you are not registered for VAT, then you need to include the VAT inclusive amounts for turnover and expenses on your self-employed tax return.

6. How to Work Out Total Turnover for Your Self-Employed Tax Return

If you are struggling to get started adding up your business turnover for self-assessment, here are some tips to get you going:

- Write down your accounting period;

- List out all your sources of income during your accounting period;

- Run through your paperwork and list out all income received during your accounting period;

- Find amounts you were paid that are net of charges, fees or other deductions;

- Find statements and documentation that relate to the amounts in #4;

- Note down all charges, fees or other deductions from the statements in #5;

- Add back all deductions and charges to the figures in #4 to show your gross business turnover (that means before any deductions);

- If you are using traditional accounting, adjust for any unpaid invoices (trade debtors) or money you are owed on the last day of your accounting period.

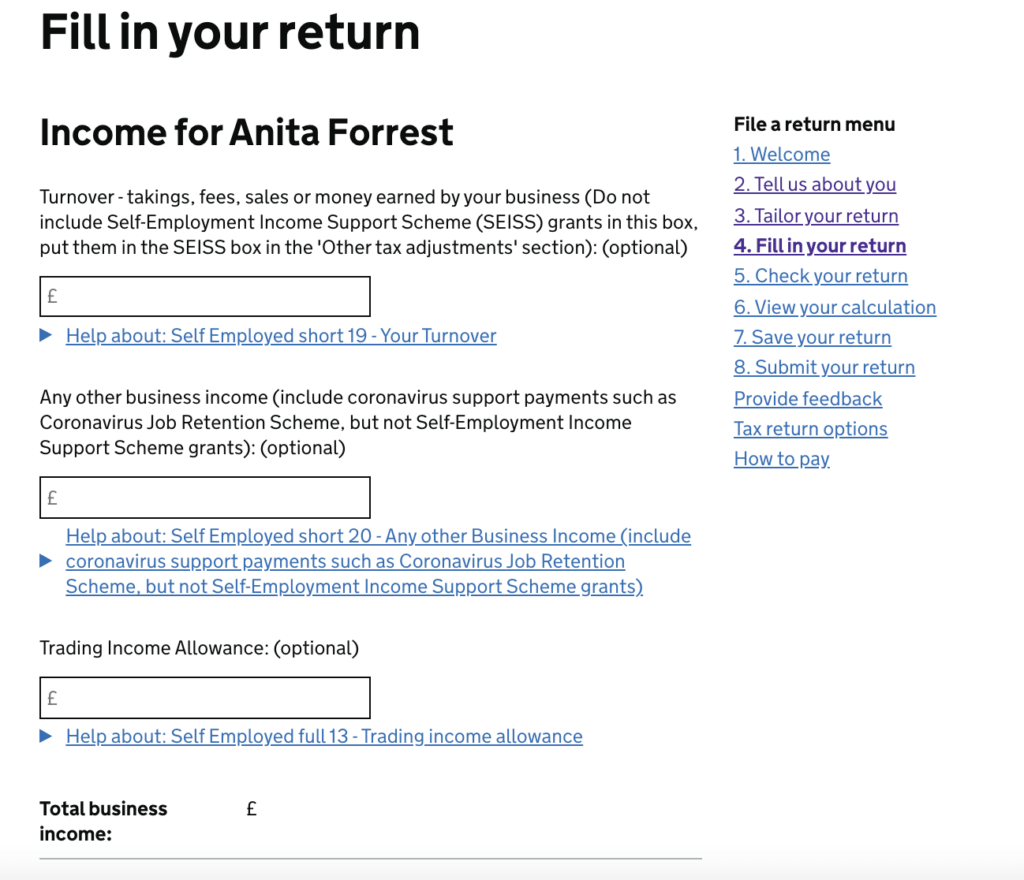

7. Where to Include Business Income on Your Self-Assessment Tax Return

You’ll need to declare your business income in the self-employment section of your tax return. Whether you are filing in the short-form tax return or full, you’ll only need to show your total income on your self-assessment in the box called ‘Turnover’:

Whatever your business turnover, you should keep a note of what you are declaring and how you worked it out as part of your business records. This is in case of an HMRC investigation and they ask for evidence of what you are showing to check you’ve paid the right amount of self-employed tax.

Related: