Getting ready to complete the self-employment section of your self-assessment tax return? Confused about where to find the numbers you need and the allowances you need to claim that will help you to pay less tax? Then this guide is for you! Here, you’ll find a step-by-step guide to completing the self-employment section and which numbers you need. I’ll also give you extra help with things like capital allowances, CIS and National Insurance. Plus, who can fill in the short-form tax return (SA200) – a real time saver!

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

Table of contents

- 1. Who Should Fill in a Self-Employed Tax Return?

- 2. Where is the Self-Employment Section?

- 3. Who Can Complete Short Form Tax Return (SA200)?

- 4. How to Complete The Self-Employment Section of Your Tax Return

- 5. How To Choose Your Accounting Date

- 6. What is the Cash Basis?

- 6. Declaring Self-Employment Income

- 7. Claiming Self-Employment Expenses

- 8. Claiming Capital Allowances

- 9. Making Tax Adjustments

- 10. Using Tax Losses

- 11. Entering CIS Tax Deductions

- 12. How to Claim a Class 4 National Insurance Exemption

- 13. Paying Class 2 National Insurance Contributions

1. Who Should Fill in a Self-Employed Tax Return?

If you work for yourself and receive untaxed income. In other words, if money is paid to you without tax deducted, then you’ll need to fill in the self-employed section of your tax return.

If your business turnover (not profit) was less than £1,000, you still have the option to go back to the tailor your return section. You can also choose to take advantage of the trading income allowance. This can avoid filling in the self-employment section on a tax return and declaring your income to HMRC.

2. Where is the Self-Employment Section?

You should have let HMRC know about your business in the ‘tailor your return section’ of your SA100 return when you sign into your .GOV account with your HMRC user ID. The self-employment section will then appear as one of the pages you need to complete as part of your self-assessment.

3. Who Can Complete Short Form Tax Return (SA200)?

HMRC issues the short-form tax return (SA200) to individuals who have simple tax affairs. This is because their business turnover is less than £85,000 during the tax year for the tax return you are completing.

If your business turnover is less than £85,000 for 2021/2022, you’ll have the option to fill in the simplified version of this part of the tax return. Therefore, you only need to enter your total self-employed expenses. If your business turnover is more than £85,000, you’ll need to enter a breakdown of your expenses in the boxes set out by HMRC.

4. How to Complete The Self-Employment Section of Your Tax Return

Firstly, you have to answer a number of questions. This is so HMRC can learn a little more about what you do in your business and the types of claims you’ll be making. Here’s some tips to help you answer them:

Q: I am a foster carer or adult placement carer

Tick the box if you were a qualified foster carer (this doesn’t apply if you have a private arrangement). There is more information in this guide to self-assessment for foster carers if this applies to you.

Q: I wish to make an adjustment to my profits chargeable to Class 4 NICs

There are some special circumstances that mean a self-employed individual can reduce the amount of Class 4 National Insurance they pay. This is usually because they are:

- Changing accounting period

- Making cash basis adjustments

- Relieving certain trading losses from earlier tax years

- Want to reduce how much tax they pay due to being employed and self-employed

- Claiming relief for interest paid for the purpose of your business, but not claimed in your return for this year or any earlier years.

Q: I am a farmer, market gardener or a creator of literary or artistic works and I wish to claim averaging adjustment

In certain industries, people can receive up-front sums of money. For example, a writer who receives an advance for a new book. These individuals can claim relief to spread this income out over one or two tax years. This will help even out their tax bill. And, it is called an “averaging adjustment” so tick this box if you wish to claim this.

Q: I am a practising barrister

Barristers must be careful when claiming certain expenses and the income they need to declare. So, only tick this box if it applies to you.

Q: I have changed my accounting date

If you filed a tax return last year, you can choose to declare your figures for a different time period in this return. But a change in an accounting date can mean you end up getting taxed twice for the same accounting period. We call this double tax, overlap profits. Although you can claim overlap relief, at a later date to get back your tax, you may not want to create a high tax bill that you have to pay now.

Q: The results of my accounts, made up to a date in the year to 5 April 2020, have been declared on a previous return

Select this box if you provided information about this year’s profits on last year’s return.

Q: My ‘basis period’ (the self-employed period for which I am taxable) is not the same as my accounting period

The basis period generally just means the tax year (6 April to 5 April). If you have filed a tax year before, then you should check what accounting period you used previously. You should check whether your accounting period matches the basis period.

If you are new to self-employment, then choosing an accounting period then ends either on 5 April or 31 March will make your self-assessment easier to handle. It will also avoid you getting double-taxed due to overlap profits in your first year.

Q: I provide my services under contracts for professional or other services and these contracts span my accounting date

If you have service contracts with your clients, then there are special rules you need to follow around how you calculate your turnover for your tax return. This is especially so if you are only partway through your contractual obligations.

Q: My business is abroad

If your business works overseas, then you may only have to pay income tax on certain income you have earned.

Q: I wish to claim ‘overlap relief’

You can claim overlap relief if you’ve sold/closed down your business or changed your accounting date this year resulting in a change of basis period, and that basis period is now more than 12 months long. You’ll only be able to claim this if you have already recorded overlap profits in a previous self-assessment return. So, if you are new to self-employment then this won’t affect you.

Q: My total turnover is £1,000 or less from all self-employments but I wish to voluntarily pay Class 2 NICs.

Paying voluntary Class 2 National Insurance helps to protect your ability to claim state benefits, like the new state pension or Maternity Allowance. Even if your turnover is less than £1,000, you can choose to claim the trading allowance, but still pay Class 2 National Insurance, so this is where you let HMRC know you want to do this.

Q: My total turnover is £1,000 or less from all self-employments but I wish to claim back tax deducted under the Construction Industry Scheme (CIS).

If you are a registered CIS subcontractor, but your turnover is no more than £1,000, you can choose to complete the self-employment section to claim back tax deducted under the Construction Industry Scheme (CIS).

Q: My total turnover is £1,000 or less and I have made a loss.

If you choose to claim the trading allowance because your business turnover was £1,000 or less, you can’t claim any business expenses. However, if you have paid for costs to set yourself up, then you can record a tax loss on your tax return to use against future profits by filling out the self-employment section of your tax return.

Q: I want to declare disguised remuneration income

Disguised remuneration is income earned under tax avoidance schemes. It uses things like loans to avoid paying income tax and National Insurance. If you have earned money in this way, then disclose this here.

5. How To Choose Your Accounting Date

Your accounting date will normally be 12 months long unless you are new or are stopping self-employment. HMRC want to know so they understand what period the figures you have entered for your self-assessment. If you are new to self-employment, then choose the date you wish to use as your accounting period this year and future ones. Choosing a period that matches the tax year is normally easier because if you choose something different or change your accounting period at a later date, you run the risk of overlap profits which means you could overpay on your tax bill.

6. What is the Cash Basis?

The cash basis means you can record your income and expenses according to what you received and pay during your accounting period. It can simplify reporting and speed up filling out your tax return but it isn’t always suitable. For more info, read this guide to the cash basis to help decide if it is right for you. If you used the cash basis for your tax return last year, then you can continue to use it this tax year, but you do have the option to change it.

6. Declaring Self-Employment Income

Your business turnover is made up of things like your:

- Invoices

- Credit notes

- Cash takings

- Transfers

- Statements from payment processing and marketplaces like stripe or Etsy

It also includes any money you get paid to cover expenses, even if they are a simple re-charge back to your client. You won’t be taxed on it because you’ll be able to claim back any re-charged expenses as an allowable expense. However, you’ll still need to record it separately as business income in the employment section of a tax return.

Other business income is money you have earned (or been paid if you use the cash basis) that is not part of your true business turnover. For example, if you choose to sub-let part of your office, this would not be how you actually make money in your business but it is additional income you need to declare. Be careful not to include any income that needs to be shown in another part of your tax return such as bank interest or dividends you received. This may need to be entered elsewhere in your tax return because it may get taxed differently.

You should also show your SEISS grant separately on your tax return. You can find out how to declare your SEISS grant in this guide.

7. Claiming Self-Employment Expenses

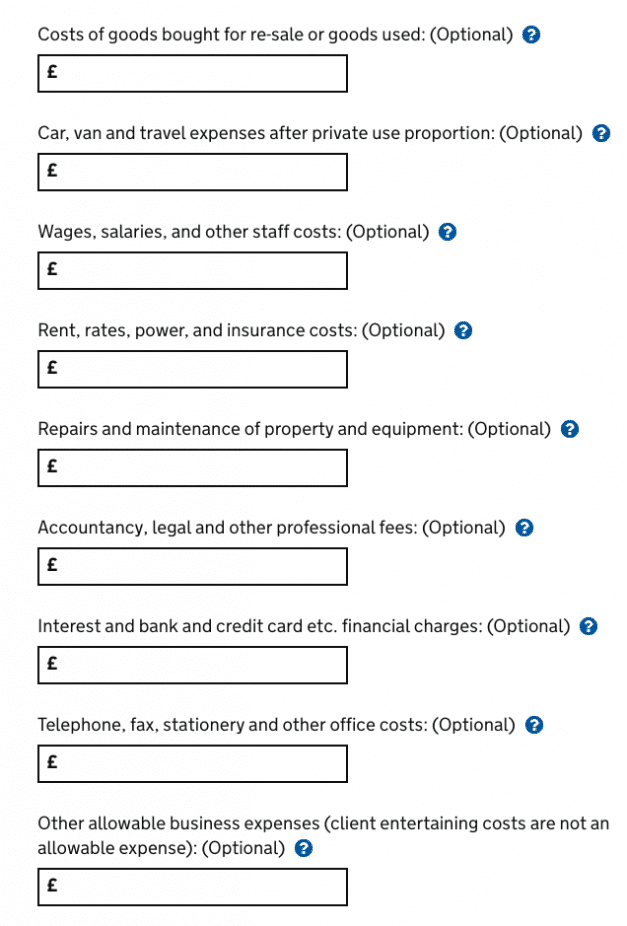

If you have claimed the Trading Income Allowance, then you cannot claim any expenses so leave this box blank. But, if you want to claim for self-employed expenses against your income, then you’ll either enter a single total value or a detailed breakdown. This depends on whether your business turnover was more or less than £85,000 for 2021/2022.

8. Claiming Capital Allowances

Capital Allowances and the Annual Investment Allowance are a type of tax relief you can claim on your self-assessment return for the cost of any equipment or cars you have purchased for your business. You cannot claim capital allowances if you use the cash basis, unless you have bought a car or if you have claimed the £1,000 Trading Income Allowance.

9. Making Tax Adjustments

Q: Goods or services for your own use

If you took any goods out of your business or have included any costs in your expenses that were for personal reasons, then enter this figure now. However, if you worked out your allowable business expenses and adjusted it for any personal use of goods or services, then you can leave this box blank.

Q: Loss brought forward from earlier years set-off against 2018-19 profits

If you have submitted a tax return before and showed a trading loss, then you can choose to set this off against any profits you have made in the current tax year here – it will go towards reducing your tax bill.

Q: Any other business income not already included

If you received income in your business, but it does not relate to what you actually sell, enter those amounts in this box. This can include declaring the new enterprise allowance.

10. Using Tax Losses

If your business has made a loss, then there are four main ways you can use it:

- Carry back your tax loss

- Claim a tax repayment if you are employed and self-employed

- Set your tax loss off against capital gains

- Carry forward your tax loss to use in the future

You can read more about using tax losses if you’re self-employed in this separate guide.

You cannot use options 1 and 2 if you use the cash basis for your short tax return.

11. Entering CIS Tax Deductions

This page is only for CIS registered subcontractors. If you are a CIS subcontractor, then add up all the deductions made from your payments by the contractors you worked for during the tax

year. The deductions will be included on your deduction statements that you must legally be provided with. If you make an entry here, don’t forget to include in your ‘turnover’ your gross receipts from all contractors.

Gross means the full amount of the payments you received for the tax year, if more than £1,000, before taking off the CIS deductions.

12. How to Claim a Class 4 National Insurance Exemption

Some people are exempt from paying Class 4 National Insurance if on 6 April 2020 they were:

- at or over State Pension age at the beginning of the year of assessment. This includes if you reach State Pension age on 6 April 2018;

- under 16;

- during the tax year 6 April 2020 to 5 April 2021 you were not resident in the UK for tax purposes;

- a qualifying trustee, a diver or diving instructor.

HMRC Annual Maximum for National Insurance Contributions.

13. Paying Class 2 National Insurance Contributions

You’ll need to pay Class 2 National Insurance if your business profits were about the annual limit – £6,515 for the 2021/2022 tax year. However, you can choose to pay it voluntarily to protect your ability to claim:

- State benefits, like the new state pension

- Maternity allowance

- Contribution-based employment and support allowance

Related: