Claiming for business travel as an expense on your tax return is a handy way to reduce your tax bill. However, the HMRC rules surrounding what you can and can’t claim are very strict. That’s because they want to keep things fair across everyone in the self-employed community.

In this guide, you’ll find out what travel expenses you can claim on your tax return along with examples to help you understand how the rules work.

Table of contents

- 1. What Counts as Business Travel When You’re Self-Employed

- 2. How to Claim Business Travel When You’re Self-Employed

- 3. Claiming for Overseas Business Travel

- 4. Claiming for Overnight Stays

- 5. How to Claim For Business Travel in Your Own Vehicle

- 6. Keeping a Record of Your Self-Employed Travel Expenses

- 7. How to Claim Travel Expenses On Your Tax Return

1. What Counts as Business Travel When You’re Self-Employed

You can claim for business travel outside of your normal business commute against your taxes, also known as irregular travel. That includes times like when you see a client, supplier & other one-off trips.

1.1 What is a Normal Business Commute?

A normal business commute means your usual travel between your home and your base of work. If you’re mainly based at home, then your home office will be your base of work so you’ll have no business commute. However, if you rent an office then that location will become your base of work. This means you cannot claim business travel between your home and work on your tax return.

For those that store tools or equipment at a location away from their home and travel to collect equipment on the way to work, then any travel between home and collecting tools is not a tax deductible expense.

2. How to Claim Business Travel When You’re Self-Employed

You can claim for business travel outside of your normal commute if you are self-employed. However, it’s only on the premise that it meets with HMRC guidelines.

For your business travel to be an allowable expense, each journey you undertake must be:

- An irregular journey, outside of your normal commute;

- Fully business related and not contain any element of personal travel (also known as a dual purpose trip);

- Not related to a regular contract/arrangement with a client.

2.1 What is an Irregular Journey?

In general, irregular business travel for the self-employed, means travel outside of your normal commute and is tax allowable. That’s times like when you travel to a one-off client meeting, sales meeting or to meet a supplier.

Example:

A self-employed bookkeeper travels from their office to meet with a potential new client at their premises. The cost of doing so would be tax deductible.

2.2 Dual Purpose Trips

A dual-purpose trip is one that has a personal element to it. For example, where you sight-see as part of your work trip, take your family along or even just stop to buy a pint of milk on the way home! Consequently, your entire trip could be rendered a disallowable expense.

2.3 Travel to a Permanent Place of Work

Travel to a permanent place of work is not a tax allowable expense and this could include travel to work at a clients workplace on an ongoing basis. Travel to a temporary workplace would be tax allowable.

3. Claiming for Overseas Business Travel

You could keep entirely separate receipts and expenses for the business side of your trip and book your family’s ticket separate from your own. That way if the HMRC does investigate your expense claim they wouldn’t be able to see that you took your family with you.

4. Claiming for Overnight Stays

If your business travel includes an overnight stay, then you can claim the cost of this as part of your travel. You can do this along with food and drink you have had to pay for as part of your irregular journey. You can claim for the following:

- The cost of your travel to the location;

- Accommodation for your overnight stay;

- A reasonable amount for an evening meal and breakfast;

Just like with business travel, the rules for what you can and can’t claim on your tax return when it comes to food are quite strict. Read this guide to claiming for food when you’re self-employed to help you decide what is an allowable business expense.

5. How to Claim For Business Travel in Your Own Vehicle

Whilst the amounts you spend on taxis, train fares and flights are easy to identify, if you use your own car for business purposes you’ll need to decide which is the most tax efficient way to claim for using your car for work reasons. This will most likely depend on how much business travel you do.

The main ways you can claim for using your car for reasons is to:

- Claim for business mileage at the set rate by HMRC;

- Buy a car through your business as a sole trader, with for cash or a lease;

6. Keeping a Record of Your Self-Employed Travel Expenses

Just like any other business expenses, you need to keep receipts and invoices to support any business travel you are claiming on your tax return. For things like hotels, Uber and flights this is straight-forward because you’ll probably be emailed any receipts for the things you buy.

If you are claiming for business mileage, then you’ll need to keep a record of the miles you have travelled, you also need the date and reason. You can find out how to download a business mileage expense claim form here.

7. How to Claim Travel Expenses On Your Tax Return

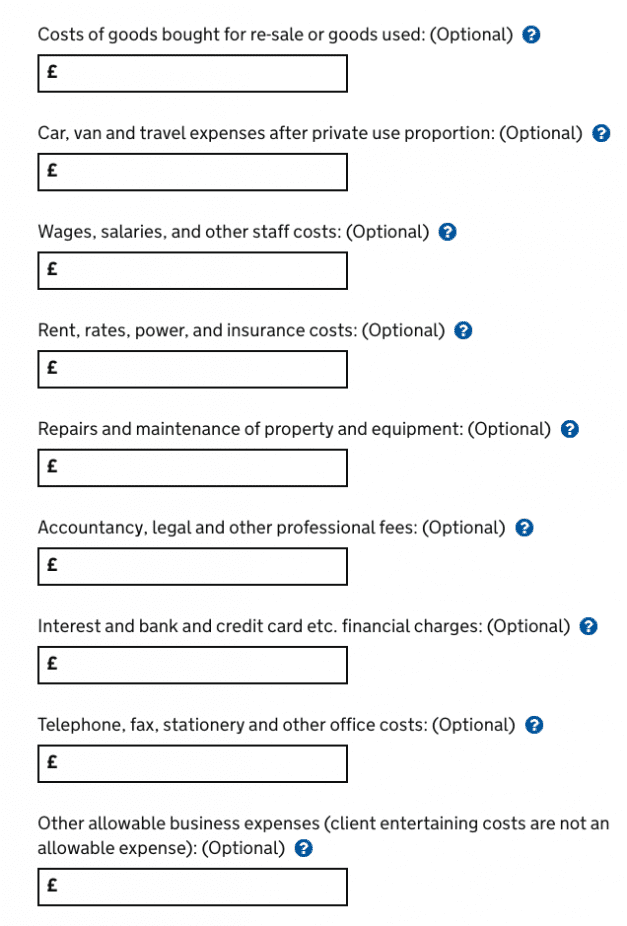

You need to claim the cost of tax-deductible business travel in the self-employment section of your tax return. If your business turnover is less than £85,000 for 2021/2022, you’ll have the option to fill in the simplified version of this part of the tax return. Therefore, you only need to enter your total expenses. You need to include your business travel claim in the figure you enter alongside your other allowable business expenses.

If your business turnover is more than £85,000, you need to enter a breakdown of your expenses in the boxes set out by HMRC. Here, you should include your business travel in car, van and travel expenses.

Whatever your business turnover, you should keep a note of what you are claiming for and how you worked it out as part of your business records. This is in case of an HMRC investigation and they ask for evidence of what you are claiming for to check you’ve paid the right amount of self-employed tax.

When it comes to claiming expenses, always use your judgement when it comes to deciding what you deduct against your taxes. Incorrect claims can result in penalties. And, as always, if you aren’t sure, seeks the advice of a professional.

Related: