Find out which types of bank interest your need to declare on your tax return, including how to handle ISA interest and the tax-free amount you may be entitled to under the savings interest allowance.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional.

Is Bank Interest Taxable?

Some savings are tax-free such as ISAs and NS&I, so you do not have to include this on your return. Other types of interest count as taxable income investments and need to be declared. That includes:

- bank and building society accounts (including business accounts and your portion of joint bank accounts)

- savings and credit union accounts

- unit trusts, investment trusts and open-ended investment companies

- peer-to-peer lending

- trust funds

- payment protection insurance (PPI)

- government or company bonds

- life annuity payments

- some life insurance contracts

Source: HRMC

How to Declare Bank Interest On Your Tax Return

You need to declare bank interest you’ve received on all your bank accounts in the main section of your tax return, which you’ll find when you signed into your .GOV account with your HMRC user ID.

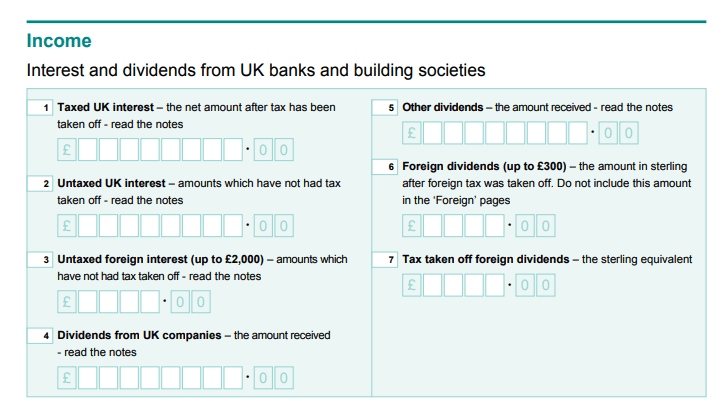

You’ll need to show it in the income section, separating the interest you’ve received between the ones which have been taxed and those that haven’t. You can check your interest certificates to check whether tax has been deducted, or, look for details on your bank statements for the tax year.

How Much Tax Do You Pay On Savings Interest?

You’ll pay income tax on taxable savings interest received, but the amount you will pay will depend on your total income for the tax year but also after deducting income tax allowances available to use against interest:

How to Claim The Savings Interest Allowances

The way you claim the allowances depends on whether you have taxable income of more than £17,570 and the rate of tax you pay. HMRC will automatically work out your allowance entitlement and any tax you have to pay based on the information you enter into your tax return.

In summary, here’s how the allowances work:

- Taxable income up to £12,570 – entitled to the starting rate for savings of £5,000 tax-free interest income;

- A taxable income from £12,571 to £17,570 – entitled to the starting rate for savings meaning £5,000 tapered for earnings up to £17,570 and £1,000 personal savings allowance;

- Taxable income from £17,571 to £50,270 – entitled to £1,000 personal savings allowance;

- A taxable income from £50,271 to £150,000 – entitled to £500 personal savings allowance;

- Taxable income over £150,000 – no entitlement to the starting rate for savings or personal savings allowance.

Read this guide to find out more about claiming the personal savings allowance and the tax-free starting rate for savings.

Related: