Claiming for coaching as a business expense on your tax return is a handy way to reduce your tax bill. However, the HMRC rules surrounding what types of coaching you can and can’t claim are very strict. That’s because they want to keep things fair across everyone in the self-employed community.

In this guide, you’ll find out what coaching expenses you can claim on your tax return. Although, this will depend on the type of coaching you have booked to help you understand how the rules work.

Table of contents

1. Can I Claim Life Coaching as a Business Expense?

When it comes to life coaching, then in most cases it is unlikely that you can claim it against your taxes. That’s because chances are, it isn’t directly related to your business. That said, if your life coach does advise on aspects of your business, then you may be able to claim a portion of their fees against your taxes.

2. Can I Claim Business Coaching as an Expense?

Business coaching, on the other hand, might be a tax-deductible expense. This is because you are working closely with someone who is helping your handle things in your business. For example, business planning, finances and business vision.

3. How to Claim for Coaching On Your Tax Return

You’ll need to claim the cost of allowable coaching in the self-employment section of your tax return. If your business turnover is less than £85,000 for 2021/2022, you’ll have the option to fill in the simplified version of this part of the tax return. Therefore, you only need to enter your total expenses. You’ll need to include your claim for coaching in the figure you enter alongside your other allowable business expenses.

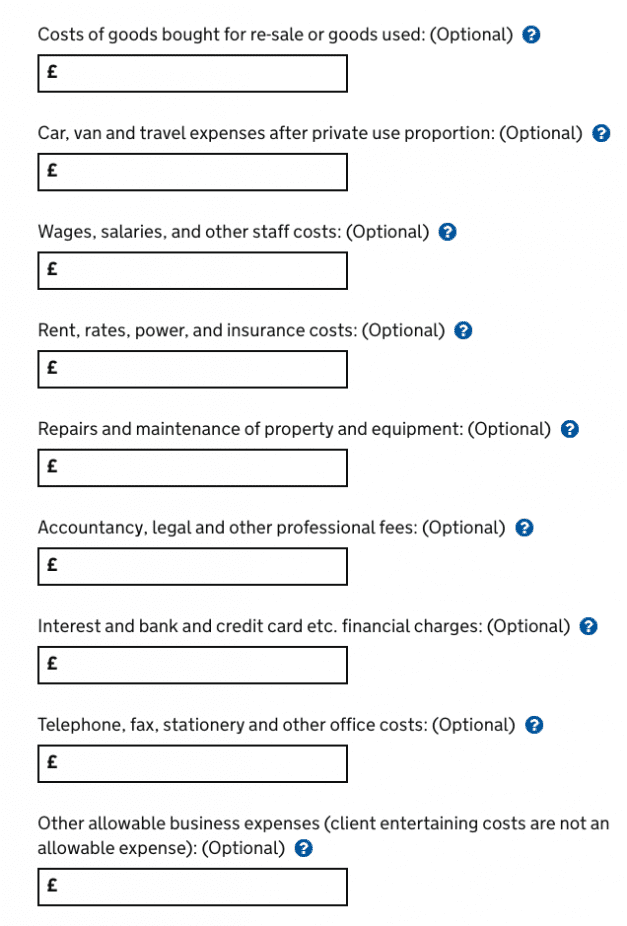

If your business turnover is more than £85,000 you’ll need to enter a breakdown of your expenses in the boxes set out by HMRC and you’ll need to include your business clothing. This should be done either ‘accountancy, legal and other professional fees’ or ‘other allowable business expenses’.

Whatever your business turnover, you should keep a note of what you are claiming for and how you worked it out as part of your business records. This is in case of an HMRC investigation and they ask for evidence of what you are claiming for to check you’ve paid the right amount of self-employed tax.

When it comes to claiming expenses, always use your judgement when it comes to deciding what you deduct against your taxes. Incorrect claims can result in penalties. And, as always, if you aren’t sure, seeks the advice of a professional.

Related: