Working Tax Credits are available to eligible individuals who earn below a certain threshold, including those who are self-employed.

In order to qualify for working tax credits when you are self-employed, you need to meet very strict criteria.

The Government keep the criteria really tight in order to avoid misuse of the Working Tax Credit System.

What Are Working Tax Credits

Working Tax Credits are available to individuals whose income is below a certain level. They have, in the most, been replaced by Universal Credits.

For those that meet the criteria for working tax credits, the basic amount is up to £1,960 per year but you can get more or less depending on your circumstances.

The Criteria for Working Tax Credits

You can get Working Tax Credits if:

- get the severe disability premium, or are entitled to it

- got or were entitled to the severe disability premium in the last month, and you’re still eligible for it aged from 16 to 24 and have a child or a qualifying disability

Additional Criteria for Working Tax Credits When You’re Self-Employed

If you are self-employed there are additional criteria you’ll need to meet to be eligible for working tax credits.

These are:

- Your work must aim to make a profit

- Your work must be commercial, regular and organised

- Keep business records and receipts

- Met all necessary regulations in place for your work eg: licenses, insurance, qualifications

If the average hourly profit you make from your self-employment work is less than the national minimum way, the tax office may ask for the below information in order to verify that you are truly self-employed:

- Business records and receipts;

- A business plan;

- Details of the day-to-day running of your business;

- Evidence that you’ve promoted your business – such as advertisements or flyers.

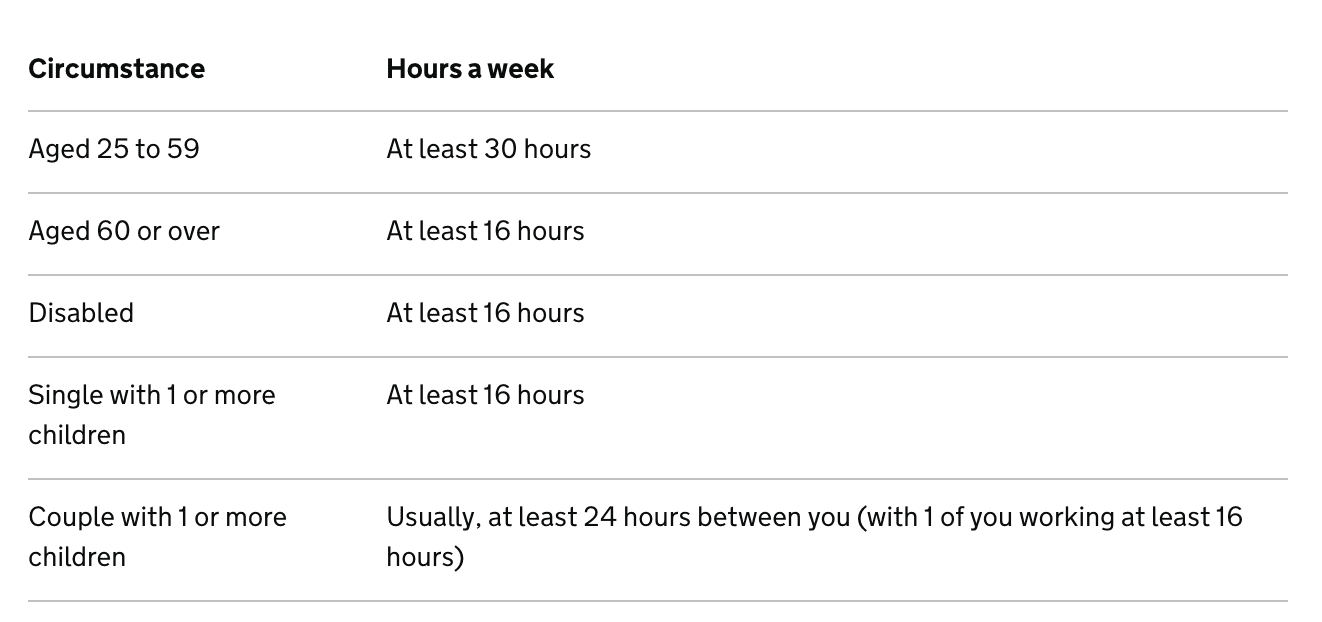

1. Number of Hours Worked Each Week

Depending on your age and status you must work a minimum number of hours each week to qualify for Working Tax Credits. These are:

2. What Counts as Income for Working Tax Credits

In order to calculate your income for working tax credit purposes, you’ll need to look at your earnings for the previous tax year (6 April to 5 April) and add up all of the following:

- your gross pay – your earnings before tax and National Insurance (check your P60, payslips if you’re employed or your Self Assessment tax return if you’re self-employed)

- benefits from your employer (check your P11D)

- certain state benefits

- money from a pension – including your State Pension

- interest on savings

- your partner’s income – if you make a joint claim

- UK company dividends

- profit from a property you own or rent out in the UK

- earnings from the Rent a Room Scheme above £7,500 (or £3,750 if you’re a joint owner)

How Much Working Tax Credit Will You Receive

Once you have worked out that you eligible for working tax credits when you are self-employed, then the amount you receive will again depend on your circumstances:

You’ll be paid the amount you are entitled to every week or once a month into a bank account of your choice.

How to Apply

You need to complete a form which the government will post to you (it can take two weeks to arrive and then a further 5 weeks to process once you return it).

In order to request the Working Tax Credit form you’ll need to either:

- Call in at your local tax office

- Complete an online questionnaire here.