Managing your money and estimating your tax bll when you’re self-employed is a challenge. Believe me, I know! Knowing how to budget for your tax bill is one of the most common questions I’m asked so this guide is here to help you.

It’s a constant juggling act of getting paid and paying yourself. Plus, making sure there is money for all those subscriptions that come out on different days of the month!

Then your dreaded tax bill arrives throwing your carefully balanced bank account totally out.

When you work for yourself, money management doesn’t just have to be about making ends meet, month after month. It’s can be about planning for your future payments. Just like you would if you were saving for a summer holiday or a new car.

Only, maybe not always quite as fun!

Your tax bill is likely to be the largest bill that you will be faced with. And whether you’re self-employed or take dividends from your Limited Company, you’ll need to make a tax payment every year by 31 January and 31 July.

Despite knowing these dates, there are many people out there that just don’t plan for these payments. They let themselves get hit twice a year with ‘unexpected’ tax bills. This is commonly, just after Christmas or right in the middle of their summer holiday.

For some, I know that they always seem to manage to pay their bill somehow and it just works out for them. But others unfortunately, just don’t have the money and are faced with HMRC penalties and being chased by the tax-man.

Failing to budget for taxes is one of the biggest money management mistakes I see self-employed people make.

It’s upsetting because left unpaid it can affect their credit scores and ability to borrow for things like a mortgage.

The reasons behind not planning for taxes vary.

Some have developed a fear of money and HMRC. So much so, that they opt to bury their heads in the sand for as long as they can.

Others see tax as a bill they shouldn’t have to pay and are determined to ignore it.

But the reality is we all have to pay tax.

For those that are employed their tax and National Insurance gets deducted before they get paid. As a result, it never builds up and they don’t really question how much they are paying.

But for those that are self-employed, every time they get paid that money includes tax. Therefore, if not separated out, it can get accidentally spent. Or give a false sense of security that the business account has more money that it actually does.

Budgeting for your tax bill can be tough, depending on how you get paid. But, I have some tried and tested ways to share with you to help you set money aside to ease the pressure of tax time.

How to Estimate Your Tax Bill

Your first step in budgeting for your tax bill is to find a way to estimate how much tax you are going to owe.

There are a couple of ways you can do this. However, as with making any estimation, you’ll need to rely on certain assumptions, so it will never be 100% accurate.

How you estimate your tax bill and the assumptions you’ll need will depend on your business structure and how you pay yourself.

Estimating your Tax if You’re Self-Employed

When you are registered as self-employed, you’ll pay tax on your business profits.

Tracking and deducting all the expenses you are entitled to is the easiest way you can reduce your tax bill. But this is is still cited as one of the most confusing areas of self-employment taxes, with many sole traders failing to track their business expenses or struggling to understand what they can and can’t expense.

Guide to Claiming Business Expenses (+ free Checklist)

Taxes for Self-Employed or Sole Traders

When you’re self-employed you’ll need to pay income tax as well as Class 2 and Class 4 National Insurance on your business profits.

The income tax rates for 2020/2021 are:

- 0% on profits up to £12,500

- 20% on profits between £12,501 to £50,000

- 40% on profits between £50,001 and £150,000

- 50% on profits over £150,000

You no longer get a personal allowance of £12,500 if you earn more than £122,000. It will get clawed back once you start earning more than £100,000 until it is completely taken back.

You’ll also need to make an estimate for your National Insurance.

Class 2 National Insurance for 2020/2021 is £3.05 per week on profits over £6,475 per year.

Class 4 National Insurance for 2020/2021 is:

- 9% on profits between £9,501 and £50,000;

- 2% on profits over £50,000.

To estimate your tax bill, you’ll need to keep your bookkeeping up to date so you know, ideally monthly, how much profit you have made.

From there, you can either budget your that your tax bill will be roughly 29% (20% income tax plus 9% class 4 National Insurance) or 49% if you pay higher rate income tax.

If this is your first year of being self-employed, you’ll need to make your first contribution towards your following years bill, worked out as 50% of your current years tax bill, so make sure you add that on too.

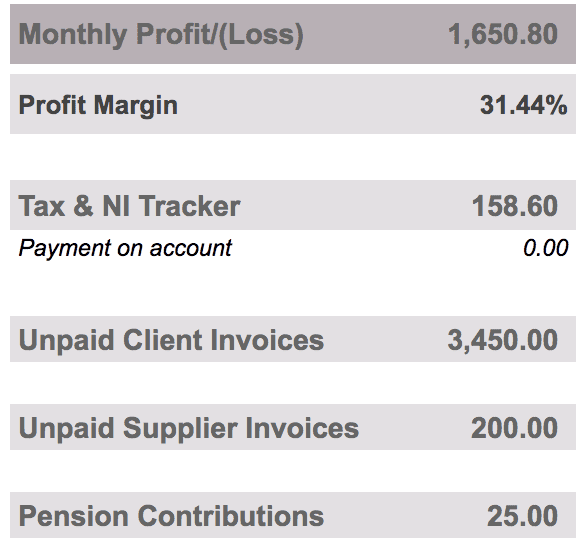

If you’re using my bookkeeping spreadsheet it will automatically estimate your tax bill so you know how much to put away each month.

Estimating your Tax if You’re Limited Company Owners

If you have a Limited Company, working out your taxes is a bit more complicated. However, many people make greater tax-savings by forming a Limited Company.

When it comes to estimating your taxes for your Limited Company, you’ll need to consider corporation tax (payable by the Company) and personal tax depending on how you pay yourself.

Corporation tax is worked out as 19% (tax year 2020/2021) on your business profits.

If you take a PAYE salary, then your tax will be deducted at source, so that gets handled for you.

If you take dividends, then you will have a personal tax liability on these to pay by 31 January and 31 July each year.

Dividend tax rates for 2020/2021

- 7.5% on dividends between £12,501 to £50,000;

- 32.5% on dividends between £50,001 to £150,000;

- 38.1% on dividends over £150,000.

If you own a Limited Company you’ll need to estimate your corporation tax, ideally monthly, based on the results of your business in the previous month.

The easiest way to estimate you dividend is to plan how much you think you’ll take for 12 months and apply the relevant dividend tax rate.

For example;

I plan to take £2,500 per month from my Limited Company as a dividend. If I multiply that by 12 months, I will take a total of £30,000 meaning I will need to pay tax at 7.5%. So, every time I pay myself I know I need to tuck away £187.50 (7.5% of £2,500).

It goes without saying that you’ll need to re-assess your calculation if you increase your dividend or pay yourself any extra amounts.

Tips to Help You Budget for Your Tax Bill

Once you have estimated your upcoming tax bills, the next step is managing the money in your bank account so you can set your tax aside before you get a chance to spend it.

Here are some easy ways to help you do that:

Keep Your Bookkeeping Up to Date

If you keep on top of your bookkeeping at least once a month, you’ll have the numbers you need to estimate your tax as accurately as possible.

Open a Deposit Account

Once you know roughly how much tax you owe, transfer it to an instant access deposit it. Let it sit there ready for tax-time.

Out of sight, out of mind.

Pay Yourself a Salary

By paying yourself a regular amount, especially if you are paying yourself a dividend, you’ll be able to budget for your taxes much easier.

It also has the added benefit of making it easier to manage your business and personal money because your salary simply becomes a fixed cost.

You’ll run your business better and have a regular pay-check that you can use to pay your personal bills on time.

Change Your Money Mindset

If you are afraid of taxes or feel it is unfair, change your mindset.

If you’re paying tax, it means your business is making money. And remember, if you are self-employed you are probably paying less tax than most because you can deduct expenses from your income, unlike someone who is employed. Or, if you are taking dividends, you’re getting to pay tax at 7.5% not 20%!

Wrapping Up on How to Budget for Your Tax Bill

Budgeting for your tax bill and changing your money mindset towards HMRC may take time.

But, if you consistently set your money aside on a regular basis, you’ll soon have a great money habit that helps you handle one of the biggest bills anyone who works for themselves has to pay.

Even if you have never budgeted for your tax bill, but want to change this moving forward, just get started! Once you have created a good money habit, you can look back retrospectively and decide how you will handle the tax you have not budgeted for.