Do you have unused subscriptions coming out of your bank account? Alternatively, are you forever splurging on Instagram ads without a real plan? If this sounds like you, creating a business budget could help you take control of what is happening in your business. In this step-by-step guide, I’ll show you how to create a budget, whether you want to get a handle on your business spending, have plans for growth or just want to plot out how your business will look over the coming months.

Table of contents

- 1. What is a Business Budget?

- 2. Why Your Business Needs a Budget

- 2. What Should a Business Budget Include?

- 3. How to Create a Business Budget

- Step 1: Forecast Your Income

- Step 2: List Your Fixed Costs

- Step 3: List Your Variable Costs

- Step 4: Estimate Your Tax

- Step 5: Add Your Business Reinvestment Funds

- Step 6: Add Your Emergency Fund

- Step 7: Check What’s Left

- Step 8: Set Your Goals

- Step 9: Amend Your Income & Expenses

- Step 10: Track Your Actual Income & Expenses Against Your Business Budget

- How to Make Business Budgeting Easier

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

1. What is a Business Budget?

A business budget is an estimate of your business income and expenses for a particular period of time. This is usually set 12 months in advance, but those who are self-employed may choose to do a shorter time frame due to the unpredictable nature of small businesses.

If you are familiar with personal budgeting, you’ll know that this type of budget shows income from your payslip, for example. In addition, it also creates a plan for how you spend that money on bills, savings and fun stuff. A business budget is a similar type of plan for the income that your clients pay you and, subsequently, how you’ll spend that money on expenses, business growth and paying yourself.

2. Why Your Business Needs a Budget

When you have a business budget, making financial decisions will become much easier because:

- You can see where your money is going;

- Plan how you’ll achieve your business goals;

- Understand how you can generate enough take home pay to clear your bills or pay for extras like holidays;

- Start spending money on the right things instead of wasting it;

- You have a blueprint for spending decisions and overcome that limiting feeling.

Instead of being reactive to where you spend your money or generate your income, you can think long term making decisions according to whether they are in line with your plan. In turn, this helps get rid of that clueless feeling about where all your money is going or spending hours of income generation that simply isn’t profitable.

2. What Should a Business Budget Include?

As a minimum, your business budget should include the following line items:

- Business income

- Fixed business expenses

- Variable business expenses

- Tax estimate

- Reinvestment fund

- Emergency fund

- Profit/loss figure

In this guide, I’ll show you how to put together a business budget with each of these line items.

3. How to Create a Business Budget

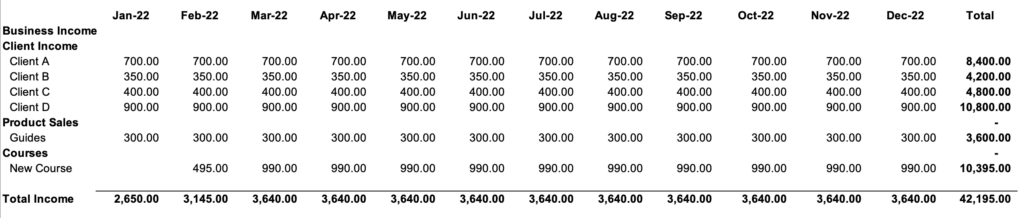

I’ll work through this guide using an example of a bookkeeping business to demonstrate how a business budget is made.

Step 1: Forecast Your Income

You’ll need to predict how much income you’ll generate over the next 12 months – this is known as a sales forecast.

A sales forecast is a monthly estimate of how much you think you’ll invoice your clients (not get paid) for the next 6 months of your business. To help you estimate this, use information you have on your business from previous months. Additionally, refer to details you have from signed client contracts, new business you plan to win from exiting proposals and what you think you’ll win from trends in your business for example:

- Sales from the same month last year;

- Seasonal sales;

- Sales connected to new product launches you have planned.

Moreover, ensure you are realistic otherwise you’ll undermine the accuracy of your business budget. Using the example of my bookkeeping business, here’s my sales forecast:

Step 2: List Your Fixed Costs

Fixed costs are business expenses that you must-have when you’re self-employed so you can deliver your work/product. That’s things like:

- Subscriptions for essential software;

- Travel costs for clients you need to see on-site;

- Web Hosting;

- Mobile phone.

Step 3: List Your Variable Costs

Variable costs are your non-essential spending. They’re ‘nice to have’ things but aren’t actually essential to your business. This includes aspects such as:

- Premium subscriptions;

- Coffees;

- Unnecessary lunches;

- Taxis, rather than public transport.

Here’s how my fixed and variable costs look for my example bookkeeping business:

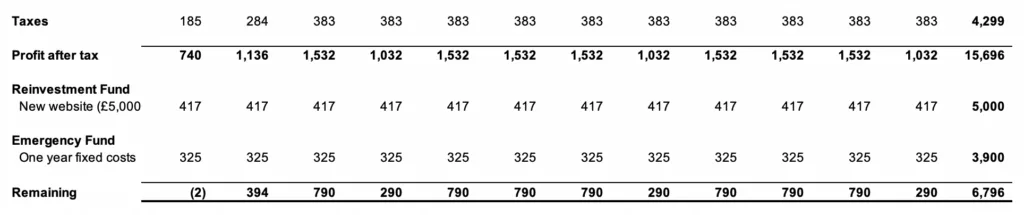

Step 4: Estimate Your Tax

When you’re self-employed, everything you are paid is untaxed. Therefore, setting aside an amount for tax is essential to helping you plan for your tax bill and stopping you from spending money that doesn’t belong to you. The simplest way to do this is to multiply your turnover or profit by the highest rate of income tax you pay.

Step 5: Add Your Business Reinvestment Funds

Growing your business and evolving often takes money. By setting aside an amount each month you can build up a pot of money to reinvest in your business. In my example, I’ve planned for a new website at an estimated cost of £5,000, saving up for this over the year. Whatever you have planned, estimate how much it is going to cost you and try to set aside an amount each month to nurture your business.

Step 6: Add Your Emergency Fund

Just like in your personal life, in business things happen. So, setting aside money for unexpected costs or times when your income is lower should be an essential part of your business budget. Businesses like to hold anything for 3 to 12 months running costs so that their business can continue should sales dry up or you can’t work for some reason.

Step 7: Check What’s Left

After all your expenses, deductions and funds, check what’s left. This is what you have available to pay yourself. In my example, turnover for 12 months is £42,915, but there is only £6,796 left to pay myself – that’s not much of a salary for 12 months work!

Step 8: Set Your Goals

Once you have your numbers, have a think about your financial goals, the types of income you want to be earning and where you see your business going.

Step 9: Amend Your Income & Expenses

Start to amend your income and expenses. Fro example, if you aren’t earning enough, perhaps you need to sell more. Alternatively, are you spending too much on your business expenses? Can you make cutbacks or find cheaper alternatives?

Step 10: Track Your Actual Income & Expenses Against Your Business Budget

Preparing a business budget is the first part of controlling your finances. You need to track your actual results against your projections and use them to help you make financial decisions that are in line with what you intended.

How to Make Business Budgeting Easier

- Open a separate business bank account

When you’re self-employed, you have to work out a lot of new aspects of organising your business. This is especially true when you’re first starting out. However, one of the most important things you can do is to create a business budget. Therefore, put in the time and figure it out so your business stands a great chance of success.

Related: