What is Emergency Tax?

You’re employer will put you on emergency tax when they don’t have sufficient information to put you on a standard tax code and are waiting for HMRC to not

ify them of the right tax code for you.

Employers normally use tax codes so they know how much personal allowance to give to someone and which income tax rates they should be paying.

An emergency tax code is used by an employer when they don’t know whether they should give you any personal allowance** on your payslip or whether your basic rate tax band (20%) is being used elsewhere.

Emergency tax codes are used to try to avoid a situation where an individual receives too much personal allowance or pays too little income tax and ends up owing HMRC tax back.

But in some cases, it means individuals can end up paying too much emergency tax because they don’t benefit from their free pay and lower tax rates, so they are owed a tax refund.

** the personal allowance for 2023-24 is £12,570

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

What are the Emergency Tax Codes?

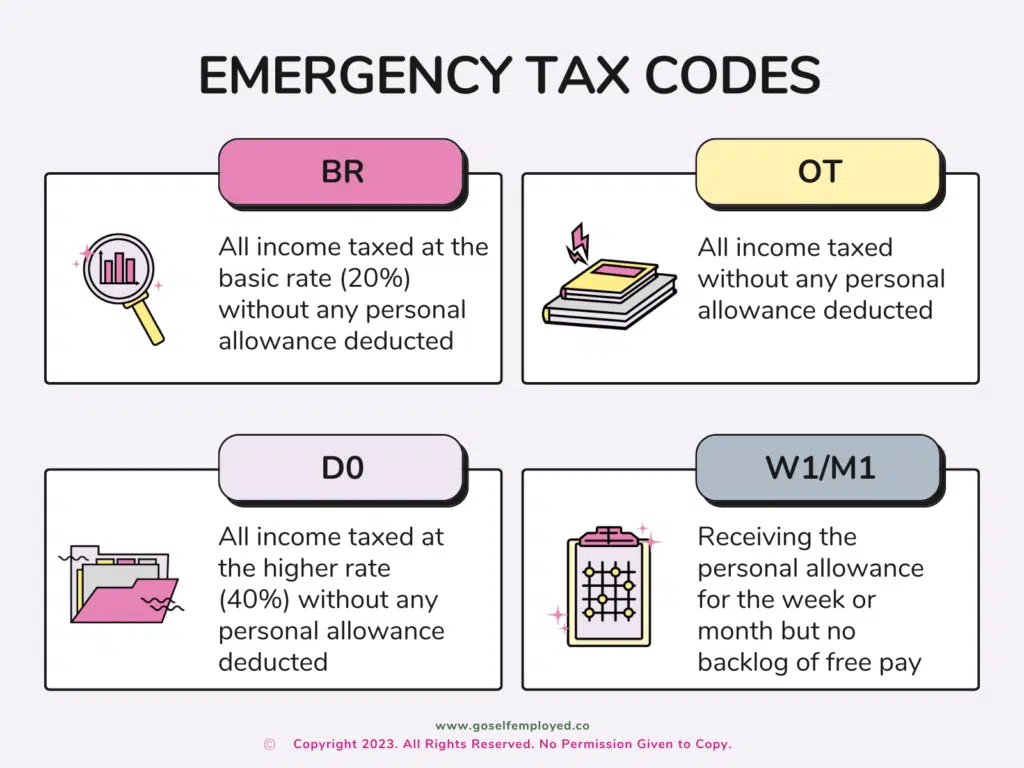

There are 4 main types of emergency tax codes and each one means the personal allowance you’re given and income tax you pay is being worked out slightly differently:

- Basic Rate (BR): All income taxed at the basic rate (20%) without any personal allowance deducted

- 0T: All income taxed without any personal allowance deducted

- D0: All income taxed at the higher rate (40%) without any personal allowance deducted

- W1/M1 or X: Receiving the personal allowance for the week or month but no backlog of personal allowance given

You’ll find your tax code on your payslip and if you see one of the above codes, you’ll be paying emergency tax.

How Much is Emergency Tax?

The amount of emergency tax someone pays depends on their personal situation and the code they’ve been given.

Here’s an example:

You have been placed on emergency tax code BR in a new job during the tax year 2023-24. Your gross pay is £2,000 per month. You will pay emergency tax of £400 when you are paid instead of £190.50 because you are not receiving any personal allowance.

If you were on the standard tax code, you’d receive a deduction for your personal allowance of £1,047.50 (12,570 ÷ 12) before you start paying tax. That means you will pay income tax of £190.40

By being on an emergency tax code, you’ve paid emergency tax of £209.50

| Emergency Tax BR | Standard Tax 1257L | |

|---|---|---|

| Gross Pay | £2,000.00 | £2,000.00 |

| Personal Allowance | £0.00 | (£1,047.50) |

| Taxable pay | £2,000.00 | £952.50 |

| Income Tax (20%) | £400.00 | £190.50 |

What does a W1/M1 tax code mean?

If you are on the W1/M1 (week 1 month 1) tax code then you are receiving the personal allowance for the week or month that you work for your current employer, but you won’t receive any backlog of personal allowance you may be owed for example because you have not worked anywhere else during the current tax year.

Here’s an example:

You have been placed on emergency tax code 1257W1/M1 when you start a new job in May 2023. You had no earnings in April 2023. Your gross pay is £2,500 per month.

Since you are on the W1/M1 tax code you won’t receive your unused April 2023 personal allowance of £1,047.50 in your May 2023 payslip. If you were on a standard tax code your new employer would give you your usued personal allowance for April 2023 before taxing you in May 2023.

You have paid emergency tax of £209.50.

| 1257 W1/M1 | Standard Tax 1257L | |

|---|---|---|

| Gross Pay | £2,500.00 | £2,500.00 |

| Personal Allowance – April 2023 | £0.00 | (£1,047.50) |

| Personal Allowance – May 2023 | (£1,047.50) | (£1,047.50) |

| Taxable pay | £1,452.50 | £405.00 |

| Income Tax (20%) | £290.50 | £81.00 |

You will pay emergency tax of £400 when you are paid instead of £190.50 because you are not receiving any personal allowance.

If you were on the standard tax code, you’d receive a deduction for your personal allowance of £1,047.50 (12,570 ÷ 12) before you start paying tax. That means you will pay income tax of £190.40

By being on an emergency tax code, you’ve paid emergency tax of £209.50

How to Get Off Emergency Tax

If you’re being emergency taxed, you should speak to your employer to check they have all the correct information they need. Once they have all this, they should be able to amend your tax code on your behalf in your next payslip.

Unfortunately, your employer may not be able to help you in certain circumstances because they can only act on the information sent to them in the HMRC coding notice.

In these cases, you should contact HMRC on 0300 200 3300 (have your national insurance number ready to get through security). Alternatively, you can use the HMRC online checker, by logging into your personal tax account.

How to Get an Emergency Tax Refund

You will get an emergency tax refund once your tax code has been changed, where possible through your payslip. Your employer will update the wrong tax code they have used for all your pay and recalculate it for you, refunding you the difference by reducing the tax you have to pay in the month they make the correction.

If your employer isn’t able to help with your emergency tax refund, following the end of the tax year HMRC will calculate your earnings and tax paid. If they find you have under or overpaid, they will issue a P800 letter with details of how much you are owed.

However, if HMRC discovers, for whatever reason, that you have underpaid your tax during the year, they will recalculate your tax and issue you with a P800 if you owe less than £3,000 or a simple assessment if you owe more than £3,000.

How To Avoid Emergency Tax?

You can avoid emergency tax by giving your new employer your P45 as soon as possible. If you have lost your P45, then you should contact HMRC to straighten out your affairs and ask them to send your new employer the right tax code for your payslip.

If you do not have a P45, then make sure your employer gives you a starter checklist to fill in instead and you return it to them in time for them to prepare your payslip.

Why Are You On An Emergency Tax Code?

Individuals end up paying emergency tax because they:

- start a new job and have not provided a P45

- begin working for an employer after they’ve stopped self-employment

- have a second job

- receive company benefits, like a company car

- receive the State Pension

Related: