Find out how a .GOV P800 refund works, what a P800 letter is and what to do if you disagree with HMRC about your P800 tax calculation.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

What is a P800 Tax Refund?

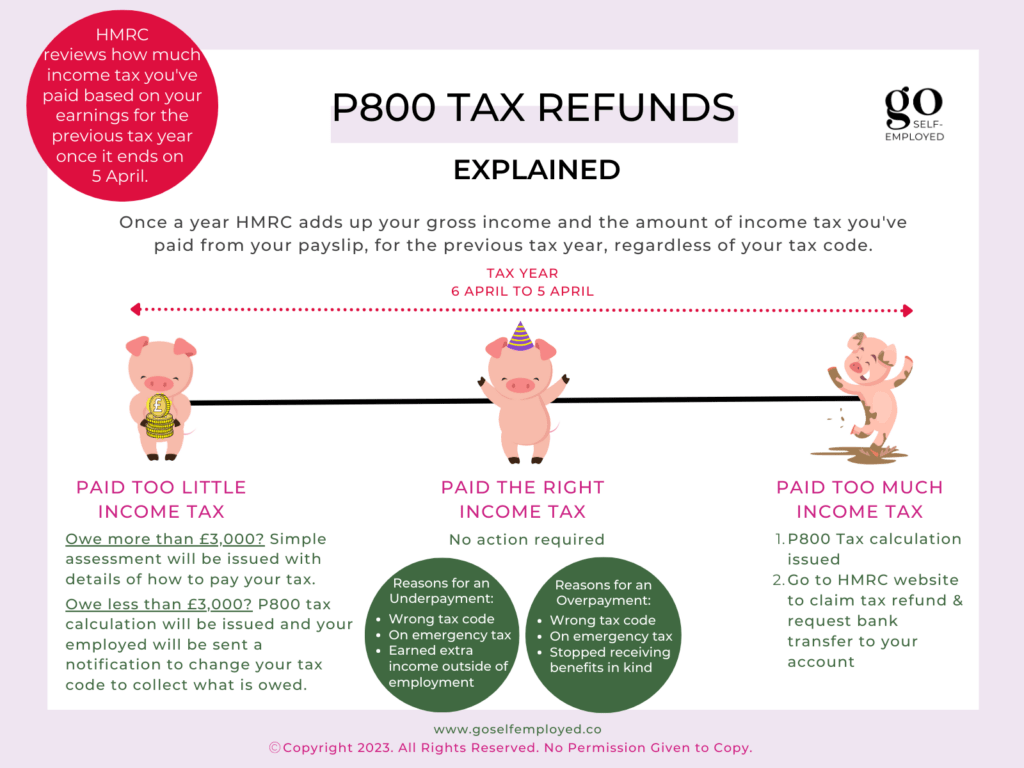

A .GOV P800 tax refund arises when HMRC check the tax records they hold on you on file to make sure that you have paid the right amount of income tax during the previous complete tax year.

The tax year runs from 6 April to 5 April each year. Once the tax year finishes, HMRC adds up the gross income you’ve been paid from records your employer sends to them (from things like payslips, a P60 or P45), works out how much tax you should have paid on this income and then checks enough income tax has been deducted by your employer on your payslip.

If you have paid too much tax you’ll be entitled to a tax rebate. But if you have paid too little, HMRC will ask you to pay what is owed either through your tax code or by making a one-off payment (depending on how much you owe). They normally notify individuals about underpayments or overpayments, usually, between July and November by sending them a P800 tax calculation letter with information on what to do next.

P800 refunds only affect those who are employed by someone and receive a payslip or have a pension. If you are self-employed you need to claim a tax refund by completing your tax return.

What is a P800 Letter?

A P800 letter is sent to individuals who are owed a tax rebate or need to make a tax payment of up to £3,000**. The letter includes a P800 tax calculation so HMRC can explain how they have worked out the difference along with details of what to do next. Not everyone gets a P800 form, if you have paid the right amount of tax HMRC won’t contact you or if you have agreed on changes in advance with HMRC, like the marriage allowance.

** A simple assessment letter is issued to those who owe tax of more than £3,000

Why are P800 Letters Sent?

There are many reasons P800 letters are sent to individuals who have paid the wrong amount of tax. The most common reason is that they are on the wrong tax code during the previous tax year meaning they don’t receive enough personal allowance or got too much allowance through their payslip. This may happen because they:

- started a new job and did not provide a P45;

- began working for an employer after they’ve stopped self-employment;

- have paid emergency tax;

- stopped or started receiving benefits in kind, like a company car;

- receive the state pension;

- owe less than £3,000 in underpaid tax;

The personal allowance entitles UK individuals to earn an amount tax-free every tax year. For 2022-23 it is £12,570. You may be entitled to more tax-free earnings if you are eligible to claim the marriage allowance or blind person’s allowance for example.

Example HMRC P800 Tax Calculation

You earn a gross monthly salary of £2,500 per month and did not provide a P45 to your employer so were put on the BR tax code (a type of emergency tax code) during the 2022-23 tax year.

The BR tax code means that you didn’t receive any personal allowance in your payslip so you have missed out on tax-free pay of £12,570 or £1,047.50 per month. You’ve paid an extra £290.50 income tax. You are now owed a tax rebate due to being on the wrong tax code.

How to Claim Your Tax Rebate

Your P800 letter will contain instructions on how to claim your tax refund. You may need to go to the .GOV website (https://www.gov.uk/claim-tax-refund) to claim your tax refund by logging into your personal tax account using your HMRC user ID and password.

In most cases, HMRC will transfer the money straight back into your bank account once you’ve made your claim for your tax refund or they will post you a cheque.

How to Pay an Underpayment

If your .GOV P800 tax calculation shows that you owe tax of £3,000 or less they will attempt to change your tax code to collect what you owe through your payslip. HMRC will write to your employer with your new tax code but will not tell your employer why they are making the change to keep things confidential, they’ll simply send them a P6 coding notice with the new code to use moving forward.

HMRC will only request a change to your tax code if you earn sufficient income to pay what you owe. If you do not earn enough HMRC will contact you separately to make arrangements about how to pay your tax bill.

What to Do if You Disagree with HMRC About Your P800 Tax Calculation

Mistakes happen. If you don’t agree with the calculation in your .GOV P800 letter you can contact HMRC on 0300 200 3300 to discuss things further. You’ll need to have your national insurance number ready to get through security.

Related: