What Does the BR Tax Code Mean?

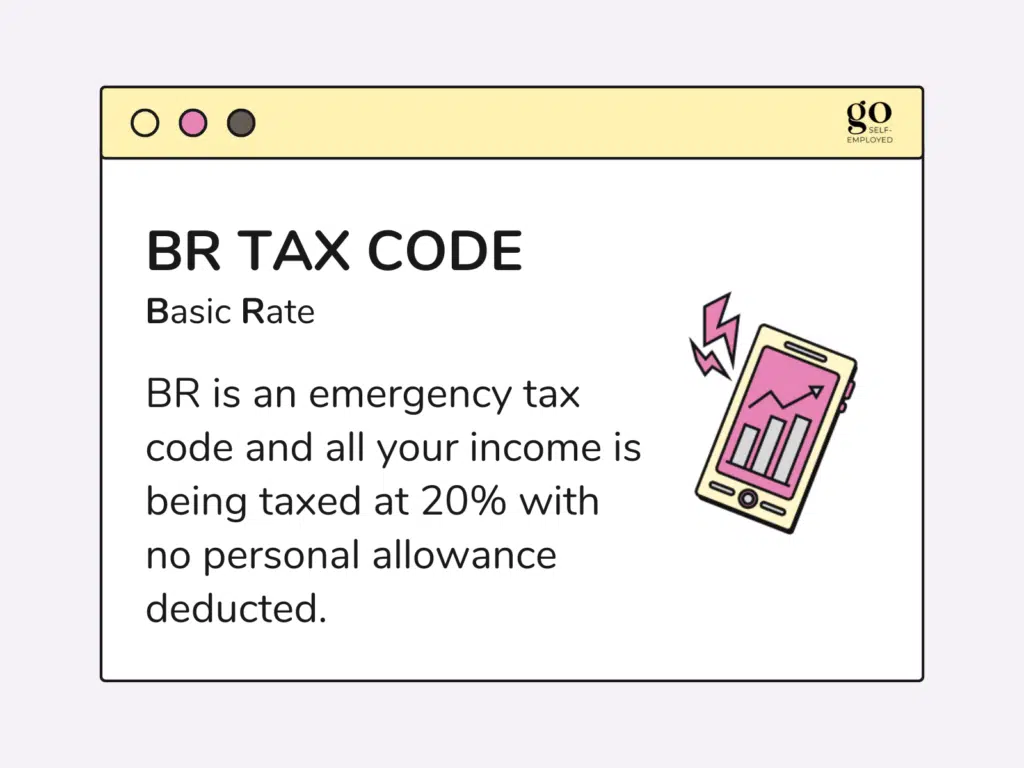

The UK tax code BR means Basic Rate.

BR is an emergency tax code in the UK and means all your income is being taxed at the basic rate tax band (20%) without any personal allowance** being deducted.

** the personal allowance is £12,570 for the 2023-24 tax year

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

How Does the UK BR Tax Code Work?

Everyone in the UK is entitled to earn an amount tax-free every tax year (known as personal allowance). For the 2022-23 tax year, this is £12,570. If you are paid monthly, for example, that means the first £1,047.50 of income you earn is tax-free and you’ll be taxed on everything above that.

Those on a standard tax code will be receiving a portion of their personal allowance every time they are paid. But those who are on an emergency tax code, like BR, won’t be receiving any personal allowance and will find all their salary being taxed at the basic rate of 20%.

How Much is BR Tax?

You earn a gross monthly salary of £2,500. If you were on the standard tax code 1257L (previously 1250L) you’ll receive a deduction of £1,047.50 before you start paying tax. That means you will pay income tax of £290.50 ((£2,500 – £1,047.50) x 20%).

If instead, you were on the BR tax code, you wouldn’t receive any free pay meaning you will be taxed on your full gross salary at 20%. That means you’ll pay income tax of £500. You have paid BR tax of £209.50.

Why Is Your HMRC Tax Code BR?

Unless your employer is totally sure they should be giving you the personal allowance, they will put you on BR emergency tax code.

The reason they do this is to stop you from claiming the tax-free personal allowance twice, paying too little tax and then getting hit with a big tax bill at a later date.

Although the tax code BR is usually temporary, there are a few reasons you may have one;

- The first reason is that your employer does not have details about your previous employment, which would normally be on a P45 or starter checklist (previously known as a P46).

- The next possible reason is that you have a second job or a pension, meaning you are using your personal allowance is being used up somewhere else

- The final reason is that you are going from self-employed to PAYE employment so you are claiming your personal allowance on your tax return or through your salary from your Limited Company, if you have one.

What to Do If You Don’t Think You Should Be on the Tax Code BR

If you think you have been given the wrong BR tax code, then first speak to your employer and check they have all the right paperwork they need from you. If they have, then check with them that your tax code will be changed on your next payslip and you’ll be getting a tax rebate.

If not, and there is a problem with your tax code, then contact HMRC by phone on 0300 200 3300. Alternatively, you can use their income tax service online by logging into (or setting up) your personal tax account to notify them that you believe you are on the wrong tax code.

Why Do I Have a BR Tax Code When I Only Have One Job?

The most likely reason you’ll be on the BR tax code is that you haven’t provided your P45 or filled out a new starter checklist (previously known as a P46).

Speak to your employer if you have provided this information or obtain it as soon as you can from HMRC. You’ll receive a tax rebate on your next payslip.

What Does BR W1/M1 Mean?

If you are on the W1/M1 tax code you won’t receive any backlog of personal allowance you may be owed for example because you have not worked anywhere else during the current tax year – it is a non-cumulative tax code.

What Does the BR X Tax Code Mean?

The X suffix on a tax code means Week 1 or Month 1. BR X means your employer will only calculate your tax on how much they are paying you in the current pay run and not take into account of any tax or personal allowance in the prior tax year.

What Happens if You Haven’t Paid Enough Tax

Once the tax year ends on 5 April, HMRC will check that you have paid the right amount of tax for the year. They will send you a P800 letter & tax calculation if you are owed a tax refund or haven’t paid enough tax. If you owe tax of more than £3,000 you’ll get a simple assessment instead.

What is the Difference Between 0T and BR Tax Codes?

The OT and BR tax codes both give you no personal allowance. But the OT tax code taxes you at the basic (20%), higher (40%) and additional tax rates (45%) as income increases. Whereas the BR tax code only taxes your salary at the basic rate.

If you only pay tax at the basic rate, there is no difference between the BR and 0T tax codes.

Related: