If your payslip shows the 1257l tax code or S1257l, then you’re on one of the most commonly used tax codes for the 2023-24 tax year. But what does it mean?

Your tax code is an essential part of working out how much income tax you pay and, ultimately, what ends up in your bank account. And if you want to learn about the 1257l tax code then keep reading. In this guide, you’ll learn:

- What the 1257l and S1257l tax code means

- How it affects how much you receive in your payslip

- How to check if it’s the right tax code for you

** the UK tax year runs from 6 April to 5 April each year

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

Tax Code S1257L

If your tax code is S1257L, the letter S indicates that you are a Scottish taxpayer and subject to different income tax bands. However, the personal allowance is the same in England, Wales and Scotland so the information in this guide still applies if you pay Scottish tax.

What Does Tax Code 1257l Mean?

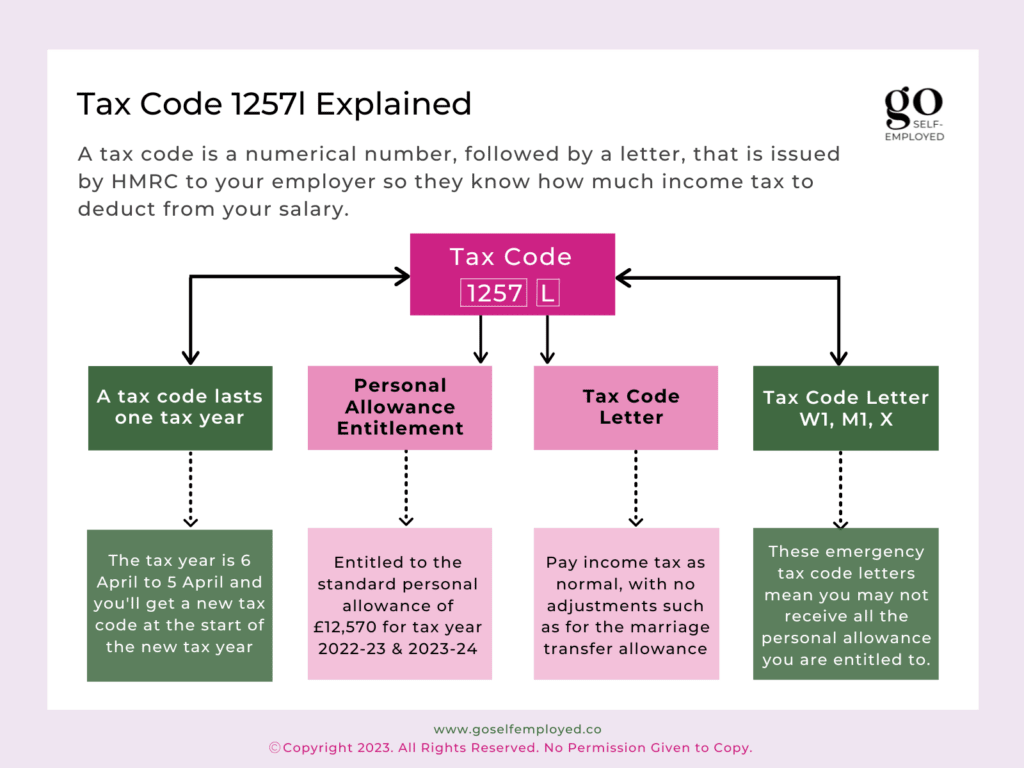

A tax code is a numerical number, followed by a letter, that is issued by HMRC for your employer to use on your payslip. It tells your employer how to calculate how much income tax they need to deduct from your salary under PAYE, depending on which tax bracket you fall into.

The 1257L means that you are entitled to the standard UK personal allowance of £12,570 and the letter L means you pay income tax as normal with no adjustments made needed for things like the marriage allowance.

1257l is a Cumulative Tax Code

The tax code 1257l is a cumulative code. That means you’ll receive a portion of your annual personal allowance every time you get paid.

So if you are paid monthly, you’ll receive £1,047.50 (£12,570 ÷ 12) tax-free each month you get paid. That way by the end of the tax year, you’ll have received your personal allowance in full.

Here’s an example:

You are paid a gross monthly salary of £5,500 and have the 1257l tax code. Every time you are paid you’ll receive £1,047.50 of your pay tax-free and be taxed on everything over that amount. Your total tax bill is £1,152.66 which is worked out like this:

- The first £1,047.50 is covered by the personal allowance = £0

- The next £3,141.67 at 20% basic rate = £628.33

- The remaining £1,310.83 at 40% higher rate = £524.33

If you took a few months of work and have no other job during the tax year, you’ll receive all the personal allowance you are owed in your first payslip if you start a new job. Your employer will know what code to use when you give them your P45.

Read this guide to learn more about how income tax brackets work and how your tax is worked out.

Emergency Tax Codes 1257 W1 M1, 1257 M1, 1257 X

If you have the tax code 1257W1 M1, 1257M1 or 1257X then you’re on emergency tax. This normally happens if you:

- start a new job and not provided a P45

- begin working for an employer after you’ve stopped self-employment

- receive company benefits, like a company car

- receiving the State Pension

Although emergency tax codes are usually temporary while the necessary information is put together, it does mean you’ll pay tax on all your income above the personal allowance and not receive any backlog of personal allowance you may be entitled to but haven’t used.

If you end the tax year on an emergency tax code, HMRC will add up how much tax you have paid and work out whether you owe anything at the end of the tax year. They will then send you an HMRC tax code notification letter called a P800 detailing what you are owed and how you’ll be repaid.

If you are registered as self-employed, any money you are owed will be credited to your tax account.

How to Check If Your Tax Code Is Correct

If you think that you are wrongly on the 1257L tax code or your tax code has changed, then you can contact HMRC on 0300 200 3300. Alternatively, you can use the HMRC online checker, by logging into your Personal Tax Account.

Unfortunately, your employer may not be able to help you because they can only act on the information sent to them in the HMRC coding notice.

DID YOU KNOW

HMRC are responsible for issuing tax codes, not your employer. That’s because HMRC has all the information on your personal income and deductions. It means information on any other income you have or deductions being made, for example, will be kept confidential from your employer.

Why Did Your Tax Code Change from 1250L to 1257L?

The personal allowance in the tax year 2020-21 was £12.500 and it has since changed to £12,570. It means you are entitled to more tax-free pay and the change in your tax code from 1250L to 1257L ensures your employer passes your tax-free pay onto you.

Your tax code lasts for one tax year so both you and your employer will most likely receive a coding notice before the start of a new tax year.

You and your employer may also receive a letter from HMRC to change your tax code if your circumstances change. For example, if:

- you are claiming the marriage allowance tax rebate

- need to pay the £50,000 high-income tax charge

- are self-employed and want to pay any tax you owe through your PAYE tax code

Related: