Did HMRC notify you about a change in your tax code? Wondering why a tax code change has been put through without your agreement? Then read on to find out the most common reasons tax code changes happen, how to find out why yours has changed and what to do if you think HMRC has made a mistake.

Table of contents

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

1. Why Has HMRC Changed Your Tax Code?

A tax code is a numerical number, followed by a letter, that is issued by HMRC to your employer so they know how much income tax to deduct from your gross pay. It’s issued by HMRC because they are the only people that have all the information on your total income, earnings or outstanding debts that can be deducted from your payslip. That means you can keep certain information about yourself confidential from your employer.

Because HMRC has information on your income they can change your tax code when they feel it is appropriate to ensure you pay the right amount of income tax. HMRC can change your tax code so that you pay more or less tax through your payslip.

Confused about how tax codes work? Read this guide to help you Understand Your Tax Code.

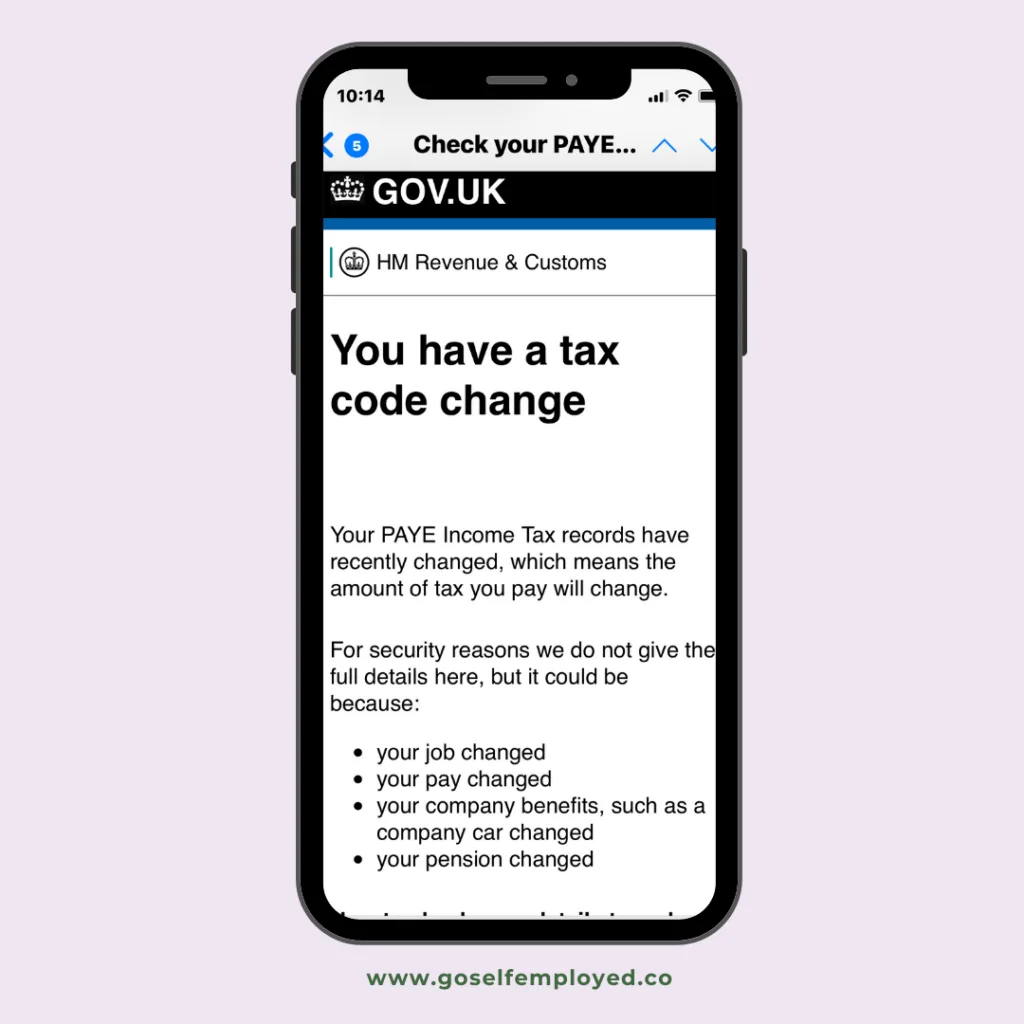

HMRC will notify you about changes to your tax code by email if you have a .GOV personal tax account set up so you can log in with your User ID to find out why a change has taken place. Alternatively, they will write to you explaining changes to your tax code and a calculation of how they reached your new code.

Your employer will not receive an explanation for the reason for the change in your tax code. Instead, they will simply be told of the new tax code to use via a P6 notification.

2. Reasons for Changing a Tax Code

Everyone’s circumstances are different, so there could be many reasons why you have a tax code change. Common reasons include:

- Unpaid self-employment tax;

- A couple sharing personal allowance using the marriage allowance;

- Under or over paid tax from previous tax years;

- Taxable company benefits from a previous tax year P11d such as private medical insurance or company van;

- Unpaid child maintenance or council tax.

HMRC can base their reasons for changing a tax code on information from a previous tax year. This isn’t always correct because they make their decision on historic information. For that reason, it’s always important to check your tax code and any changes.

To check why yours has changed, you’ll need to log into your personal tax account if you have one, read the letter sent to you from HMRC or call them to get more information.

3. What to Do If You Think You Have the Wrong Tax Code

If you think that your you have been given the wrong tax code, then you can contact HMRC on 0300 200 3300 (you’ll need your national insurance number to get through security). Alternatively, you can use the HMRC online checker, by logging into your Personal Tax Account.

Unfortunately, your employer may not be able to help you because they can only act on the information sent to them in the HMRC P6 coding notice.

Related: