If you’re trying to understand your HMRC tax code or aren’t sure how your tax code is worked out, then keep reading. In this guide, you’ll find out all about HMRC tax codes including how they’re worked out, a list of tax code letters and what they mean plus how coding notices work

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

What is a Tax Code?

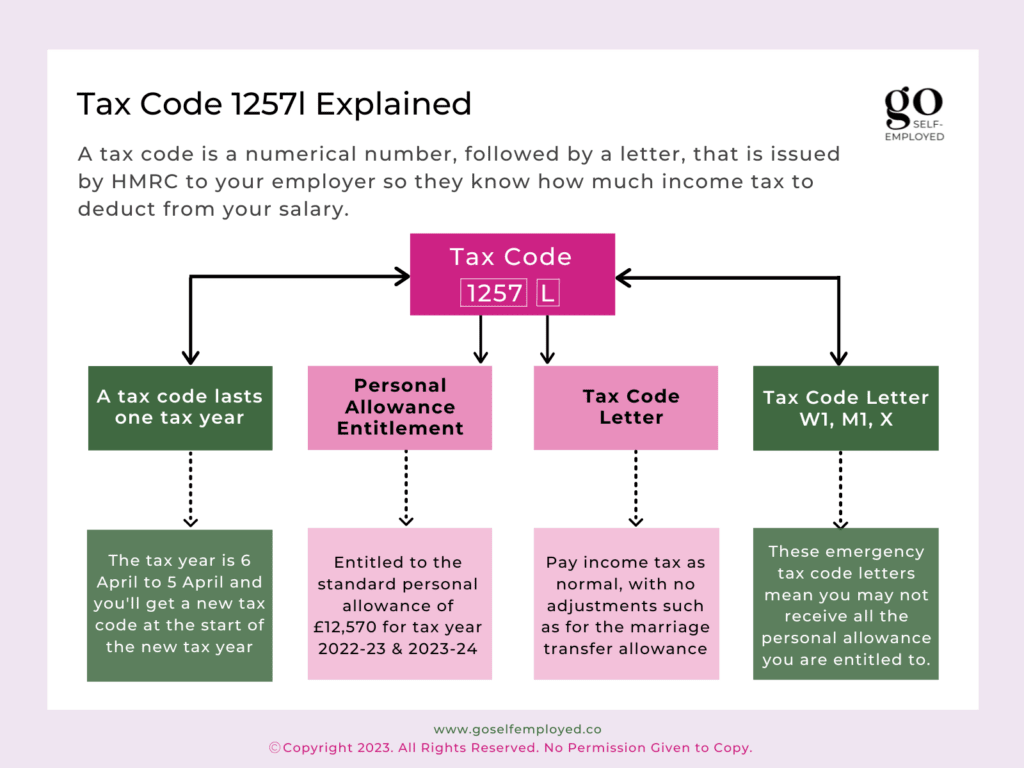

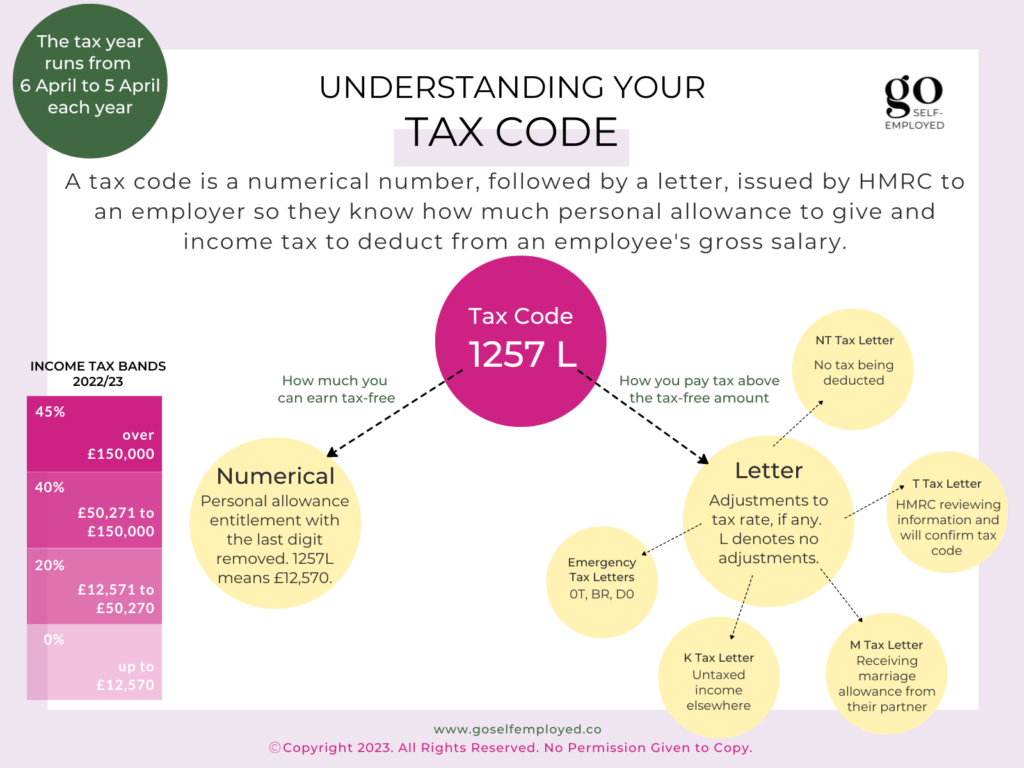

A tax code is a numerical number, followed by a letter, that is issued by HMRC to an employer so they know how much income tax to deduct from an employee’s gross salary. The numerical part denotes how much personal allowance (tax-free pay) an individual is entitled to. The letter denotes any adjustments being made to how their salary is taxed above the tax-free amount.

Employers know which tax code to use from coding notices sent to them from HMRC or P45 when a new employee starts work.

Tax codes are issued by HMRC because they have all the information on an employee’s total income, earnings or outstanding debts that need to be deducted from gross pay. It also means an employee can keep things about their deductions confidential from their employers but in the event a tax code is wrong, an employer may only have a limited ability to help their employee.

The rules in this guide apply if you are a Director Only Company and are registered as an employer to pay yourself through payroll in your Limited Company to take advantage of incorporation to pay yourself tax efficiently.

What a Tax Code Means

Tax codes mean that employers know how much personal allowance to give to an employee and how much income tax to deduct from their income above the tax-free amount.

There are three different income tax rates above the personal allowance – the basic rate (20%), higher rate (40%) and additional rate (45%).

How Does HMRC Work Out a Tax Code?

HMRC uses the information it has on its records about an individual to decide which tax code they should be on. They take three steps to work this out:

- HMRC works out how much personal allowance an individual is entitled to, adding adjustments for marriage allowance and blind person allowance;

- HMRC then deducts income received (that they know about), for which no tax has been paid, for example, bank interest or benefits in kind like medical insurance;

- Once deducted, the last digit in the tax-free amount is removed and replaced with a letter.

HMRC Tax Code Letters

Tax code letters give more information about how an individual is being taxed above their personal allowance. It may mean that an individual pays 40% tax on all their income or doesn’t receive any personal allowance.

Here is a list of tax codes and what they mean:

| Code | Type of Code | How Income is Taxed | Example of When the Tax Code is Used |

|---|---|---|---|

| 0T | Emergency tax code | All income is taxed with no personal allowance deducted | An employee has a second job, has used up their personal tax elsewhere or hasn’t provided a P45 |

| BR | Emergency tax code | All income is taxed at the basic rate (20%) | An employee has a second job or receives a pension |

| C | Welsh tax code | Income taxed as normal, with full personal allowance entitlement | Employee lives in Wales |

| D0 | All income taxed at the higher rate (40%) | An employee has a second job, is self-employed or receives a pension | |

| D1 | All income taxed at the additional rate (45%) | An employee has a second job, is self-employed or receives a pension | |

| K | Untaxed income is added to gross pay | An employee who owes tax from previous a tax year, receives untaxed income such as a pension or company benefits | |

| L | Income taxed as normal, at the basic rate, higher rate and additional rate, depending on how much they earn. | An employee who is entitled to the standard personal allowance | |

| M | Income taxed as normal, at the basic rate, higher rate and additional rate, depending on how much they earn but the employee has additional personal allowance entitlement due to marriage allowance scheme | An employee who has received an additional amount of personal allowance from their partner (up to 10%) | |

| N | Income taxed as normal, at the basic rate, higher rate and additional rate, depending on how much they earn but the employee has less personal allowance entitlement due to marriage allowance scheme | An employee who has transferred an additional amount of personal allowance to their partner (up to 10%) | |

| NT | No tax deducted | Where an individual is on the payroll but is self-employed and responsible for their own tax | |

| S | Scottish tax codes | Income taxed in accordance with Scottish laws | Employee lives in Scotland |

| T | Income taxed as normal, at the basic rate, higher rate and additional rate, depending on how much they earn but HMRC needs to review some items with the employee | HMRC needs to review items with the employee to confirm their tax code |

Example of a Tax Code

Eddie earns a gross salary of £70,000 during the tax year 2022-23 and his tax code is 1100L. Eddie’s first £11,000 of income is tax-free and he will pay income tax of £15,746 on the remaining £59,000 gross pay as follows:

- Basic rate 20% £7,854

- Higher rate 40% £7,892

Eddie is not receiving the full amount of tax-free personal allowance, so he may want to check his tax code with HMRC.

How to Check Your HMRC Tax Code

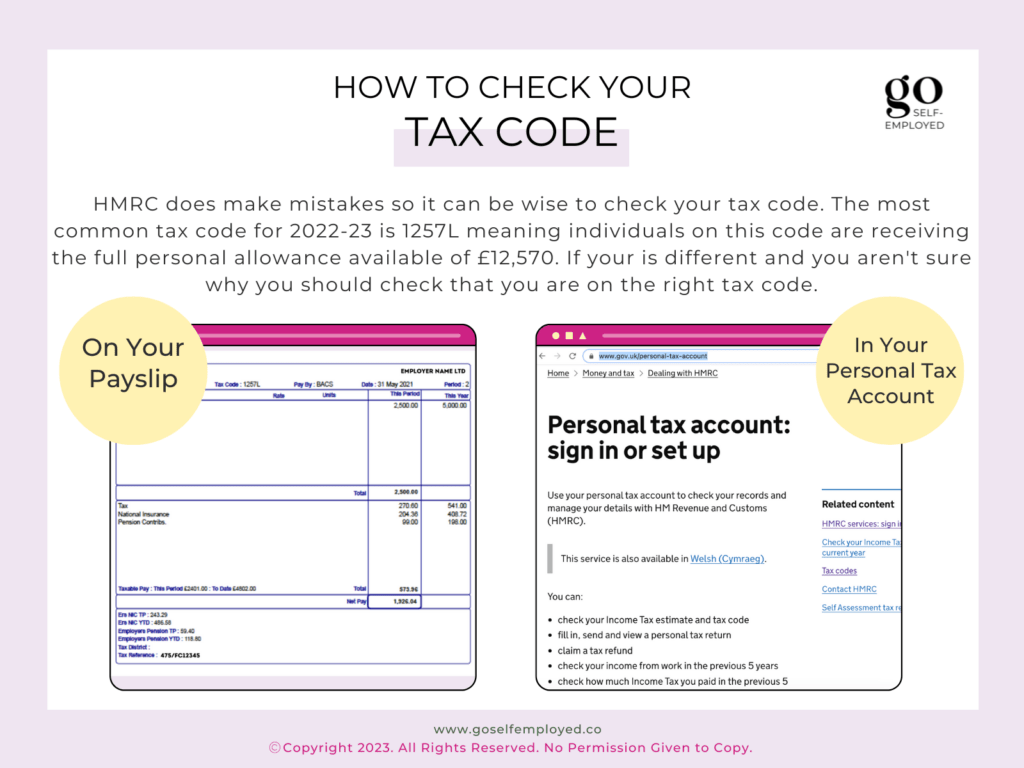

HMRC does make mistakes so it can be wise to check your tax code. You can do this by:

- checking your payslip

- logging into your personal tax account

- looking your P60 which will show the tax code used for previous tax years

- checking your P45 which will show the tax code used by your previous employer

The most common tax code for 2022-23 is 1257L meaning individuals on this code are receiving the full personal allowance available of £12,570. If your is different and you aren’t sure why you should check that you are on the right tax code.

Tax Codes and the Self Employed

If you work for yourself, you’ll have a self-employed UTR number which is a numerical number used by HMRC for managing your self-assessment information.

If you are employed and self-employed, then you may have the 1257l tax code, as well as a UTR number. It means, your employer is giving you your personal allowance and that most likely all the profit you earn from your business will be taxed at your highest rate of tax or push you into a higher tax bracket.

When you fill in your tax return online, you’ll have to declare all your income in the employment and self-employment sections of your tax return. But, you’ll get credit for any tax you’ve paid in your employment when HMRC calculates your tax bill.

Related: