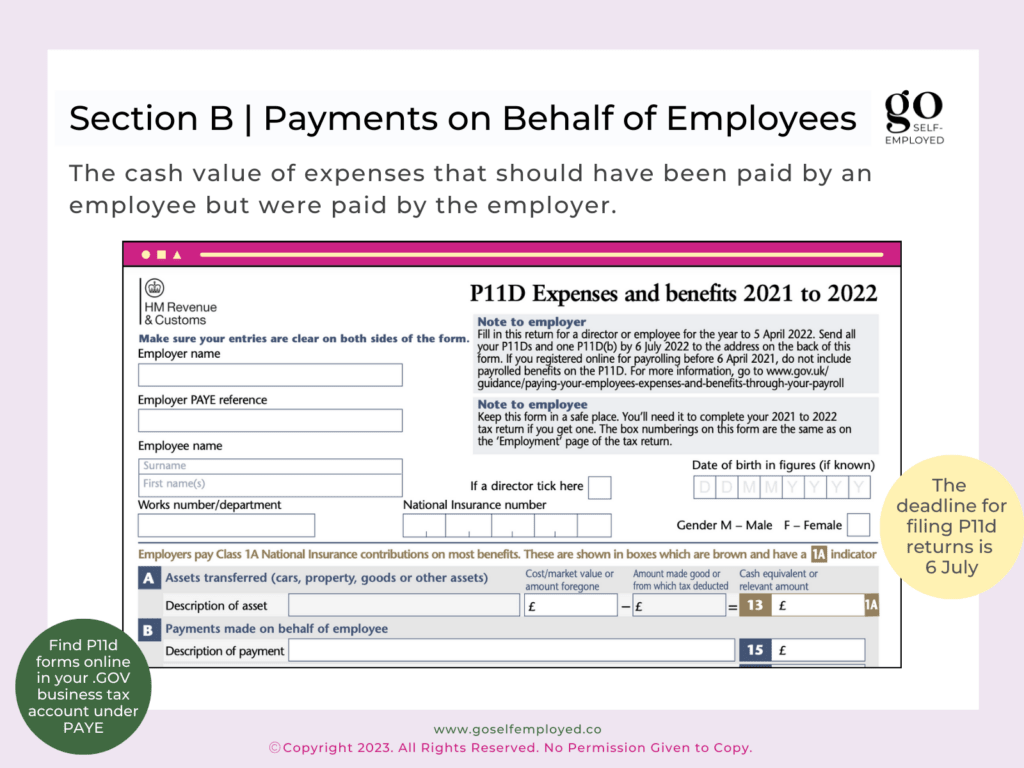

Section B of the P11d form relates to the cash value of expenses that should have been paid by an employee but were paid by the employer instead.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

What’s Included in Section B: Payments Made on Behalf of the Employee

This section covers expenses and invoices that were paid on behalf of an employee by their employer like internet or mobile phone.

For an expense to be tax allowable, the cost needs to be invoiced to the business using its name and address. Where an employee has a personal bill refunded by a business, the amount needs to be declared in section B of the P11d form.

Income tax is then payable by the employee, although no additional tax is payable by the employer.

How to Calculate the Cash Value Payments Made on Behalf of the Employee

The value of any payments made on behalf of an employee to be recorded on the P11d form will be the actual costs paid. Any documentation supporting the value of any payments being recorded should be kept and stored to produce in the event of an HMRC inspection.

Tax on Notional Payments

Taxable benefits can arise on ‘readily convertible assets’. For example a cash voucher or a voucher that can be easily converted to cash. If such vouchers or convertible assets have been provided to employees or Directors, but have not been repaid within 90 days of the end of the tax year being reported on the P11d, then this value must be included within this section.

Related: