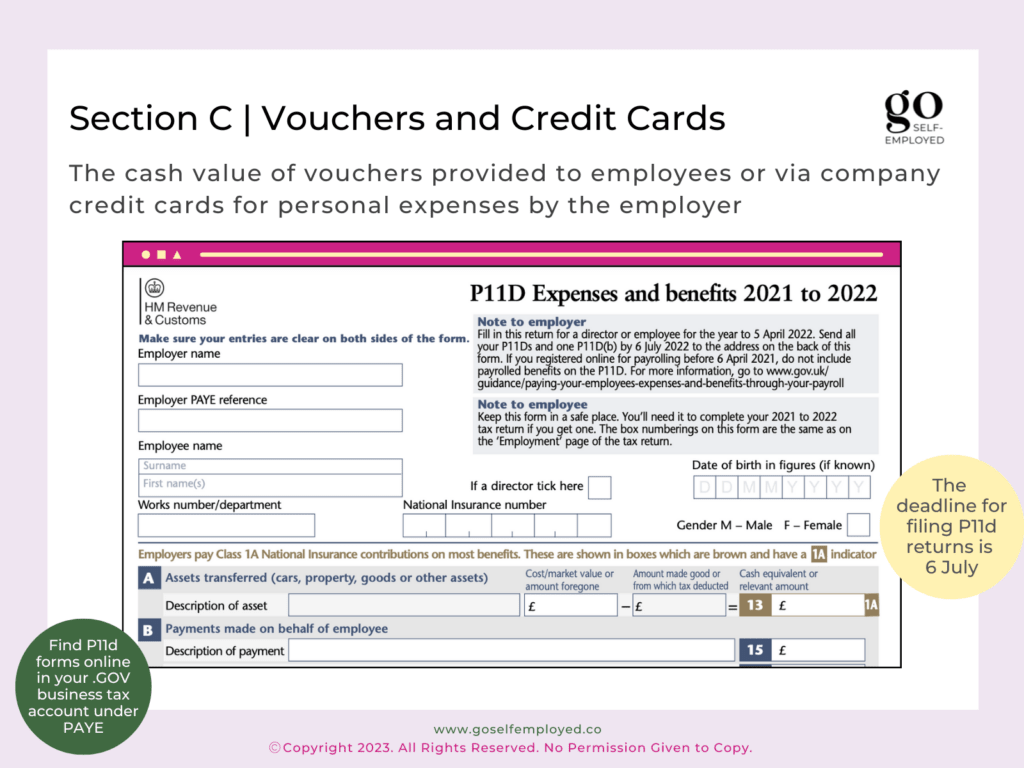

Section C of the P11d form covers the cash value of payments made to employees in the form of vouchers or via company credit cards for personal expenses by the employer.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

Examples of Vouchers Included in Section C

Example of taxable vouchers that would need to be include, at their cash value in section C of the P11d include:

- Season tickets

- Christmas gift vouchers

- Luncheon vouchers

You mustn’t include non-taxable items such as childcare vouchers or payments that need to be included in other sections such as company car fuel.

Income tax is then payable by the employee, although no additional tax is payable by the employer.

How to Calculate the Cash Value Vouchers and Credit Cards

The value to include for any vouchers and credit card payments made is the actual amount paid, including VAT (regardless of whether VAT is recoverable or not).

Related: