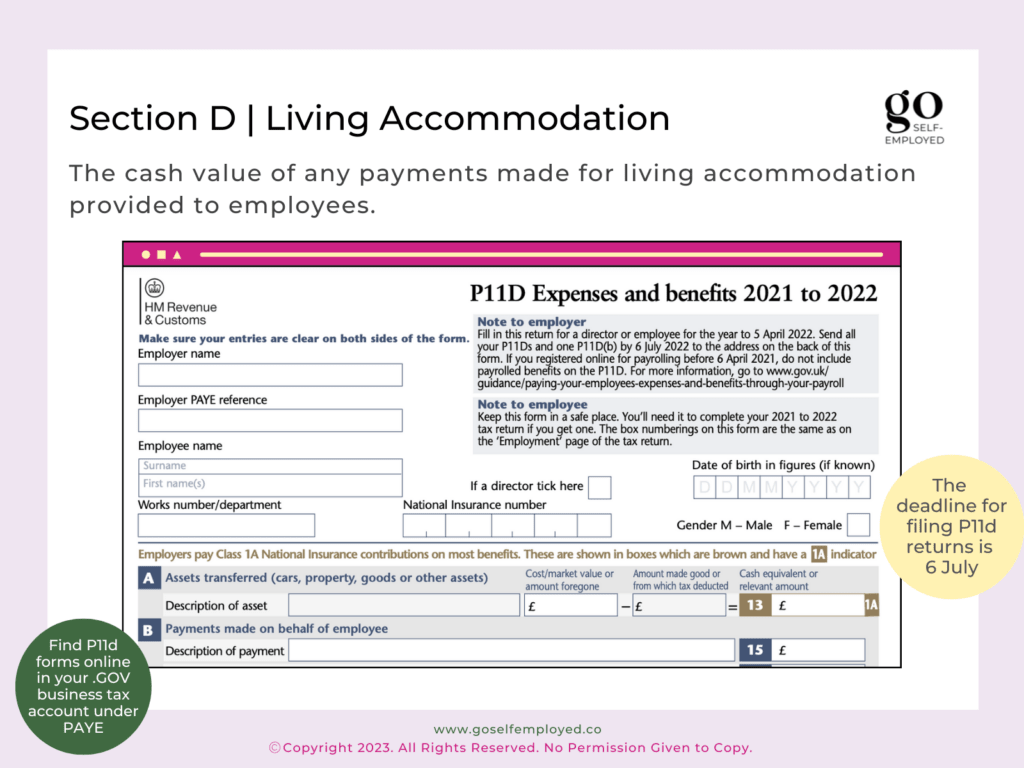

P11d Living Accommodation Section D relates to the cash equivalent of any payments made for living accommodation provided to employees.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

A benefit in kind arises when an employer provides an employee with living accommodation and the cash value needs to be included on the P11d form section D. There is no benefit in kind for living accommodation where:

- The employee pays fair market rent for the living accommodation;

- Employees can’t do their work properly without accommodation being provided, for example, agricultural workers living on farms;

- The Employer is usually expected to provide accommodation for people doing that type of work, for example, a manager living above a pub, or a vicar looking after a parish;

- It’s needed for the security of the employee.

Income tax is then payable by the employee and Class 1a National Insurance by the Employer on the cash value declared on the P11d(b) form.

How to Calculate the Cash Value of Living Accommodation

There are two types of charges in place to work out the taxable value of living accommodation that needs to be included on a P11d form:

- A Basic Charge;

- An Additional Charge for properties over £75,000.

The Basic Charge

The P11d taxable value is worked out as the greater of gross rating value or actual rent paid for the accommodation provided.

How to Find the Gross Rating Value

The gross rating value of living accommodation for P11d purposes is set out from rates set by the Valuation Office Agency (VOA) back in 1973. At this point, the VOA set out what they considered to be the market value of rent on all properties built, if they were rented. Since then although the rates have not been reset, the Gross Rating Values they set have continued to be used for things like P11d benefits and water rates.

To find out the Gross Rating Value of an employees living accommodation you can:

- Contact the local council where the property is located;

- Contact the VOA;

- Look at a water rates bill for the property;

- Contact your water board.

New build properties from 1990 onwards generally won’t be on the list set out by the VOA, so if you need to establish the Gross Rating Value for a newer build then you could use the figure used for Council Tax purposes. If you are unsure of the Gross Rating Value then you should seek professional advice or contact HMRC.

Repairs, Maintenance and Household Bills

Since the Gross Rating Values set out by the VOA reflect market rent, then any payments for repairs and maintenance should not be included as part of working out the gross rating value. Any costs of this type would need to be included separately in Section M: Other Items.

Example

An employer provides living accommodation for an employee throughout the tax year 2022-2023 with a gross rating value of £5,000. The monthly rent is £750 per month. The P11d taxable value is £9,000 since this is greater than the gross rating value:

| Total Rent Paid (£750 x 12 months) | £9,000 |

| Gross Rating Value | £5,000 |

Calculating Living Accommodation Taxable Value with Employee Contribution

Where the employee makes a contribution towards the cost of the accommodation provided, the P11d value can be adjusted for:

- Any contribution made by the employee towards rent from the greater of gross rating value or actual rent paid for the accommodation provided;

- The number of months the accommodation was provided for during the tax year;

- Divided by the number of employees in the accommodation, if the property is shared.

Example

As above, an employer provides living accommodation for an employee throughout the tax year 2022-2023 with a gross rating value of £5,000. The monthly rent is £750 per month and the employee makes a contribution towards the property £350 per month. The P11d taxable value is £4,800 calculated as follows:

| Total Rent Paid (£750 x 12 months) | £9,000 |

| Total Employee Contribution (£350 x 12 months) | £4,200 |

| P11d Taxable Value (£9,000 – £4,200) | £4,800 |

The Additional Charge for Section D Living Accommodation

An additional charge needs to be added where a property has a cost of over £75,000. When working out whether the cost of a property is over £75,000 you need to include:

- the cost of acquiring the accommodation

- the cost of improvements made to the accommodation, in the tax year the property was bought and the following tax year;

- minus any payments made by the employee towards these costs or for the grant of a tenancy.

To calculate the additional charge you need to deduct £75,000 from the cost of the property and multiply this figure by the beneficial rate of interest as set out by HMRC, 2% for 2022-2023.

If the employee has made a contribution towards the property, then this money goes towards reducing the basic charge with anything leftover being set off against the additional charge.

Example

An employer buys a property for £175,000 which has a gross rating value of £5,000. The employee pays rent of £500 per month.

The Basic Charge is £0 because the rent paid by the employee of £6,000 by the employee is more than the gross rating value. The employee has contributed £1,000 above the gross rating value so this can be set off against the additional charge.

The Additional Charge is worked out as:

£175,000 – £75,000 = £100,000

£100,000 x 2% = £2,000

£2,000 – £1,000 (left over rent from the basic charge) = £1,000

Total cash value to report in Section D is £1,000 (Basic charges £0 + additional charge £1,000)

Related: