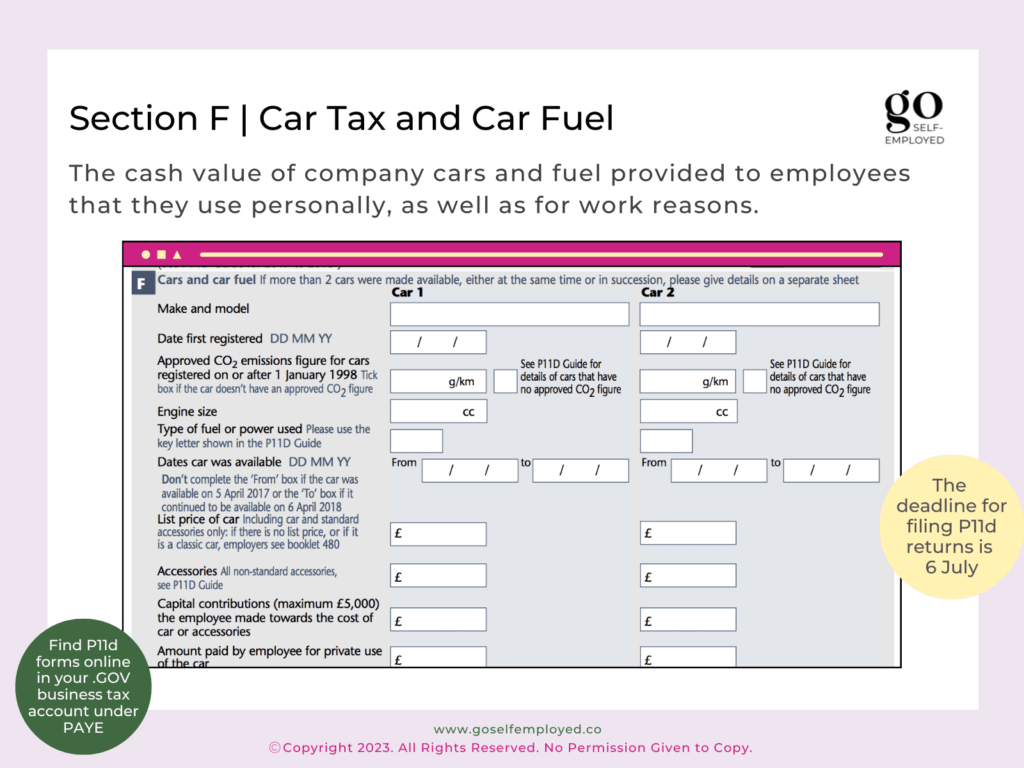

Section F of the P11d form covers the cash value of company cars and fuel provided to employees that they use personally, as well as for work reasons.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

P46 (Car) Form

The P46 (Car) form is used to notify HMRC about a new car being provided or withdrawn from an employee. Although the information can be found in section F of the P11d form, notifying HMRC about changes sooner rather than later so that the employees tax code can be updated quickly and they can begin to pay income tax on the new benefit in kind so it a tax debt doesn’t build up while waiting for annual P11d forms to be completed.

P46 (Car) forms are a legal requirement in addition to the P11d.

How to Calculate the P11d Car Benefit Value

The cash value of a company car is based on list price of the car provided plus accessories, less any contributions made by the employee. To calculate the car benefit you’ll need certain information on the car:

- Make and Model

- Date First Registered

- Approved CO2 emissions

- Engine Size

- Type of fuel (D – Diesel A – All other vehicles)

- List Price

- Accessories

- Capital contributions

- Amounts paid by the employee for private use

To start by working out the P11d Car Benefit in Section F you need to take the following steps:

- Find the list price of the car including VAT, delivery, tax and number plates before any discounts on the original invoice or market value if the invoice is missing.

- Add the price of factory-fitted accessories including VAT, fitting and delivery charges as well as anything subsequently fitted over the value of £100.

- Deduct capital contributions made by the employee to the cost of the car, capped at £5,000 for P11d purposes.

- Find the appropriate percentage** for the car from HMRC to work out the portion of 1-3 that is a taxable benefit.

- Multiply the price from steps 1 – 3 by the percentage.

- Deduct for periods that the vehicle was unavailable, shared or payments made towards private use

**Appropriate Percentages from HMRC

These percentages are set out by HMRC and for 2017/2018 are as follows:

Note: Column 2 relates to diesel engines, column 1 is for all other cars

Example of Calculating Car Benefit

A car with a list price (including standard accessories, VAT, number plates and delivery) of £18,000 is made available to an employee, with optional metallic paint costing £245 and CO2 emissions of 123g/km.

Before being made available to the employee it’s also fitted with an electrically-operated radio aerial from an independent manufacturer costing £95 (including fitting).

List Price of the Car for P11d

Car £18,000

Metallic Paint £245

Total List Price £18,245

The radio aerial is excluded as its total cost including fitting is less than £100.

Appropriate Percentage 23% (always round down when identifying the appropriate percentage)

P11d Benefit in Kind Value £4,196.35 (£18,245 x 23%)

Cars Adapted for an Employee with a Disability

Special rules apply when calculating the P11d value of a car adapted for an employee with a disability if the car is made available for private use. It means that cars may be exempt for P11d purposes if it is provided:

- for only journeys between home and work;

- the car is adapted in accordance with the employees needs;

- travel to work-related training;

- there is no private use of the car.

Classic Cars

Establishing the P11d value of a classic car can be tricky, so HMRC sets out guidance to follow in these situations.

HMRC Definition of a Classic Car

A classic car is one which

- is at least 15 years old on 5 April 2018;

- has a market value of at least £15,000;

- has a market value which is higher than the original list or notional price (including accessories).

P11d List Price of a Classic Car

If the car meets the definition above then the list price of the car becomes the price that the car might reasonably fetch if you sold it on the open market on 5 April 2018, taking into account all accessories on the car. If the classic car was unavailable to the employee on 5 April 2018 then use the last day in the tax year 2017 to 2018 that it was available to the employee.

Calculating P11d Car Fuel Benefit

Car fuel benefit needs to be calculated where fuel is provided to an employee which covers business and personal miles. No declaration needs to be made on the P11d form if:

- fuel provided was used for business purposes only;

- the Director or employee reimburses the Business for personal fuel used (use the Advisory Fuel Rates when working out the amount to refund);

- the business uses mileage allowance payments.

Car fuel benefit is calculated by multiplying the appropriate percentage (found in step 4 above) by an amount set by HMRC – this is £23,400 for 2018/2019.

Example of Calculating Car Fuel Benefit

The car in our example above has CO2 emissions of 123g/km. The employee is provided with a fuel card to pay for both business and personal fuel during the tax year 2018/2019. Therefore the taxable benefit that needs to be included on the P11d form of the employee is £5,382 (£23,400 x 23%).

Tips for Completing the P11d Form Section F Cars and Car Fuel

When it comes to completing the P11d form for a car and car fuel, certain information about the car needs to be included on the form so HMRC can see how the P11d benefit value was reached. This information is:

- Make and Model

- Date First Registered

- Approved CO2 emissions

- Engine Size

- Type of fuel (D – Diesel A – All other vehicles)

- List Price

- Accessories

- Capital contributions by employee

You can enter up to two vehicles on the main P11d form so this covers the event that an employees car is sold and replaced in the tax year.

It’s worth noting that you can only reduce the car and car fuel charges if a car is unavailable for a consecutive period of 30 days.

Related: