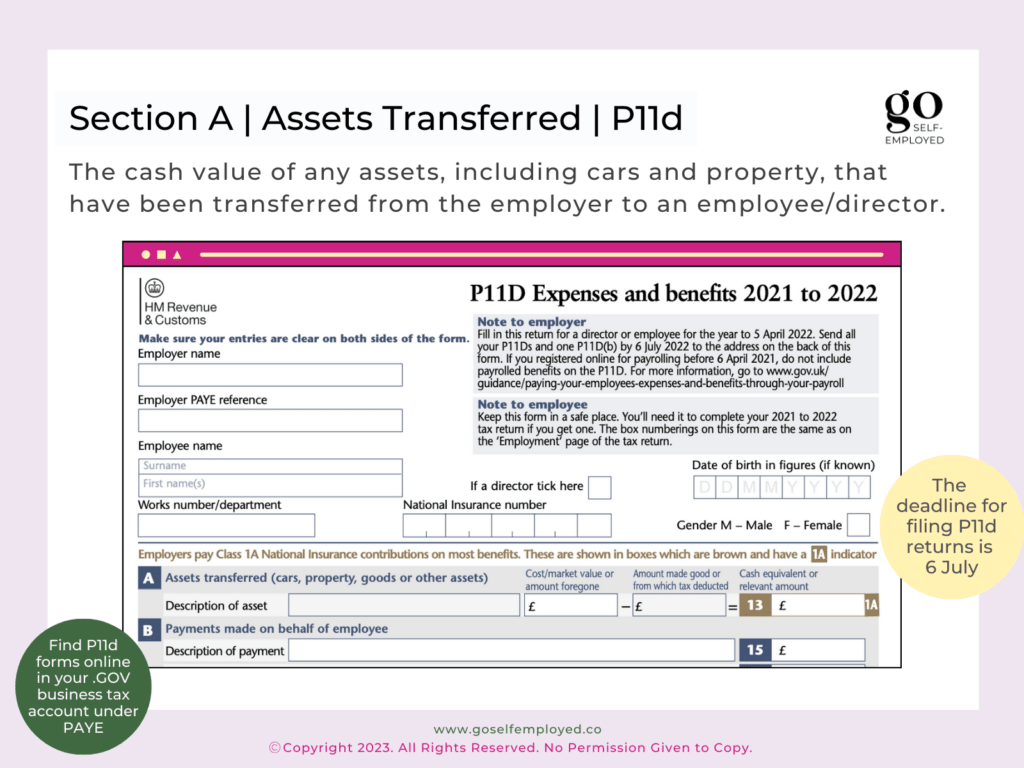

Section A of the P11d form covers ‘Assets Transferred to Employees’. This would cover the value of any assets, including cars and property, that have been transferred from the employer to an employee/director.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

What to Include Section A Assets Transferred

The transfer of assets such as company cars or laptops needs to be included in this section of the P11d.

How to Calculate the Cash Value of Assets Transferred

The section A value of an asset being transferred should be either:

- The market value of the asset at the date of transfer** (less any cash contribution made on transfer);

- A figure based on the cost to the employer.

Market value is the amount that the asset would be worth on the general market, although this can vary depending on where you look.

You must make a reasonable estimate and keep records supporting the value recorded on the P11d form in case HMRC asks.

**If the asset was loaned to the employee or director prior to the date of transfer, then the date of transfer will become the date the asset was first loaned.

Related: