Find out how to claim the cost of a new laptop as a business expense and other computer equipment as a tax deduction in the UK.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

What Expenses Can you Claim When You’re Self-Employed

When you’re self-employed most of your expenses will be tax allowable because without them you wouldn’t be in business.

While most things you pay for being self-employed are can be claimed as a business expense, there are some things you may pay for that you cannot deduct against your taxes even if you feel they were paid for as part of your business. This includes things like:

- Fines and penalties eg: parking fines

- HMRC interest and penalties

- Training and courses for new skills

- Food, except in certain circumstances

- Clothing, except in certain circumstances

- Personal expenses

There may also be some expenses you pay for that you use both personally and for work, like your laptop. In these cases, where you can make a clear apportionment of your usage, you can only claim a portion as a business expense. So, say you use your mobile phone for 60% work and 40% personal, then can claim 60% of the total bills to put against your taxes.

Where you cannot make a clear apportionment, the expense will most likely be disallowable.

How to Claim Your Laptop as a Business Expense

If you use your laptop for business reasons, then you can claim it as a business expense. If you use your laptop for personal reasons as well, then you’ll need to restrict how much you claim against your self employed taxes.

Say for example you use your laptop for 50% business and 50% personal, you will only be able to claim 50% of the laptop cost on your tax return.

What Records Do You Need to Keep?

Just like any other business expense, you need to keep the receipt or invoice for the purchase of your laptop as part of your normal business records.

How to Claim Computer Equipment as a Tax Deduction UK

If you use cash accounting for your tax return, you can claim computer equipment as a tax deduction in the tax year you bought it in the self-employment section.

If your business turnover is less than £85,000 for 2022/23, you’ll have the option to fill in the simplified version of this part of the tax return. This means you can enter the total figure for all your business expenses, including laptops and computer equipment.

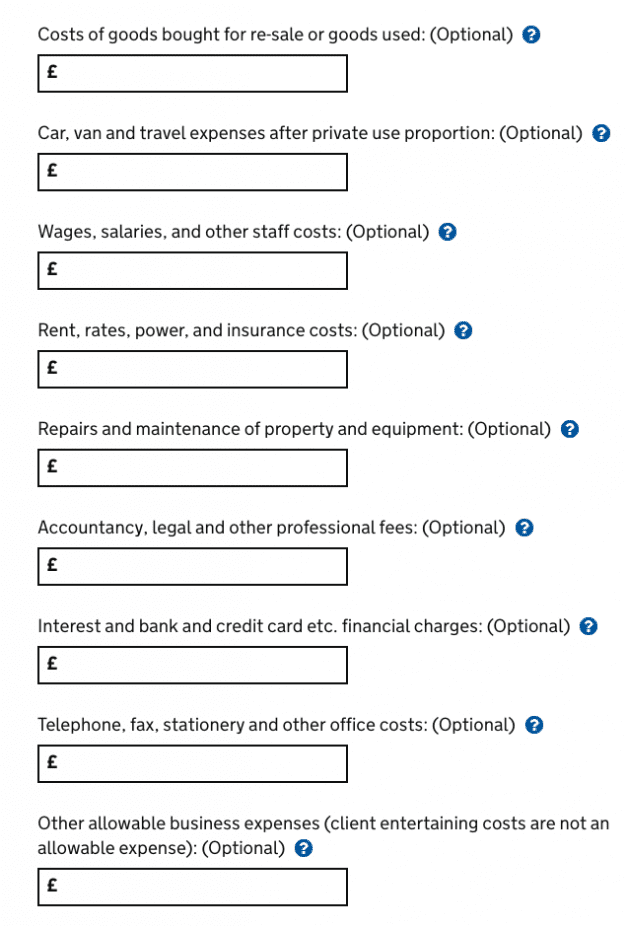

If your business turnover is more than £85,000, you’ll need to enter a breakdown of your expenses and show computer equipment in other allowable business expenses.

Whatever your business turnover, you should keep a note of what you are claiming for and how you worked it out as part of your business records in case of a tax investigation.

Using Capital Allowances to Claim Computer Equipment as a Tax Deduction UK

If you use traditional accounting for your taxes, you’ll need to claim tax relief for your new laptop and computer using the annual investment allowance (AIA).

The AIA is a type of capital allowance that lets you deduct the full business-related cost of computer equipment and laptops in the year you buy them.

Read this guide to Self Employed Expenses to find out more about what you can claim on your tax return and get a list of allowable and disallowable expenses to keep for tax time.

Related: