Find out how to claim self-employed expenses on your tax return, which ones you can and can’t claim (with examples) and download my self-employed expenses list to keep for tax time.

This advice in this guide is for the self-employed. Different rules may apply if you have a Limited Company.

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

What Can You Claim as Self-Employed Expenses?

Claiming self-employed expenses is the best legitimate way to reduce your tax bill. HMRC sets out rules to follow about expenses you can claim known as allowable business expenses and those you can’t, called disallowable business expenses.

In a nutshell, any expenses you claim on your tax return must be wholly and necessarily incurred for business purposes only. So if you pay for something that is essential for doing business, like a work email address, then most likely that expense will be tax allowable.

Unfortunately, there are some trickier costs such as travel and things you use personally, where special rules apply (read on to find out more about these ones).

What are Allowable Business Expenses?

Allowable expenses are costs that you can claim against your tax bill. Generally speaking, most of the things you pay for in your business will be an allowable expense. That’s because if it wasn’t for you working for yourself or being in business, you wouldn’t be paying for them.

What are Disallowable Expenses?

There are certain self-employed expenses, that even though you may pay for as a result of working for yourself, you cannot claim against your taxes. This includes things like:

- Personal expenses

- Certain types of clothing

- HMRC fines and penalties

- Entertaining

- Travel from home to office

- Drawings or the salary you pay yourself as a sole trader.

Read this guide to find out more about disallowable expenses.

Claiming for Expenses You Use in Business and Personal Life

There may also be some expenses you pay for that you use both personally and for work, like a laptop, car or pair of glasses. In these cases, where you can make a clear apportionment of your usage, you can only claim a portion as a business expense. So, say you use your laptop for 60% work and 40% personal, then can claim 60% of the total cost on your taxes.

Where you cannot make a clear apportionment, the expense will most likely be disallowable under the rules of duality of purpose. This is a term HMRC uses for expenses that are used both in business and personally. Where an expense is used for both business and personal reasons and it is difficult to distinguish a clear split of usage, like a Spotify subscription that you use while you work, the whole expense is deemed disallowable.

Is there a ‘Right Amount’ of Self Employed Expenses to Claim?

There is a misconception by some self-employed individuals that they should be claiming a set amount of expenses on their tax returns. There is no ‘right amount’ because no two small businesses are the same, even within the same industry.

One sole trader made decide to use an accountant or another may have to buy more equipment to do their job.

The ‘right amount to claim’ are all the allowable expenses that you have paid for that are wholly and necessarily incurred for your work and that you have receipts or evidence to support.

HMRC will no doubt use some common sense checks when they review your tax return, checking:

- whether the type of expenses you are claiming suit the nature of your business;

- if it is in line with previous tax returns you have submitted;

- receipts upon request only.

Read this guide to find out more about what can trigger an HMRC tax inspection.

Self Employed Allowable Expenses List

Here’s a list of self-employed expenses that you should look out for and make sure you are claiming for:

- Stock and Raw Materials

- Wages, Sub-contractors and Freelancers

- Business Travel

- Business Mileage

- Car

- Home Office

- Clothing

- Food

- Office Rent

- Website

- Marketing and Advertising

- Telephone and Internet

- Insurance

- Trade or Professional Journals

- Training and courses

- Business Subscriptions

- Professional Fees

- Payment Processing Fees

- Bank charges for a business bank account

- Bank interest for a business bank account (capped at £500 if you use the cash basis)

Business Travel

In general, you can claim travel away from your base of work to a temporary workplace:

- Visiting clients for new or existing business;

- Seeing suppliers;

- Overnight stays (for business);

- Training courses;

- Parking charges are allowable but parking fines are not.

Read this guide to find out more about claiming business travel.

Business Mileage

If you choose to use your personal car for business travel, you can claim mileage at the HMRC set rates, known as simplified expenses, to cover the cost of using your car.

The current HMRC’s set rates for most cars are 45p for the first 10,000 business miles and 25p per mile after that. The set rate covers the cost of fuel, servicing, tax, MOT and depreciation of a vehicle. You’ll need to keep a log of your business mileage as evidence for HMRC. Take a look at my business mileage tracker spreadsheet.

Car

If you buy a car through your business as a sole trader then, depending on how you bought the car, you can claim for a business portion of the cost of the car, lease or hire purchase payments. This is particularly beneficial if you are dependent on your car to earn money, for example as an Uber driver or work for Amazon Flex.

Home Office

Many of us self-employed folks choose to work from home. If this applies to you, then you can claim an amount against your taxes to reflect the use of space and increased household bills.

The easiest way to claim your expense is to use a simplified flat-rate amount depending on the number of hours you work at home. Alternatively, you can claim an actual portion of your household bills.

For help calculating your claim, read this guide to claiming for your home office.

Clothing

You can claim the costs of branded uniforms that you have for your business. However, you cannot claim non-branded uniforms unless they are for safety reasons. Dual-use clothing, like business suits, is not an allowable expense.

Food

There are certain circumstances when you are allowed to claim food against your taxes. Again this is a complex area and I have written a separate guide. You can generally claim for food and drink when you are away from your base of work seeing clients but you cannot claim for client entertainment (such as lunch with a client).

Claiming Expenses that You Use for Business and Personal Reasons

There may be some expenses you pay for that you use personally and for work, such as your mobile phone or laptop.

In these cases, you can only claim a portion as an expense where you can clearly apportion the split between business and personal. So, say you use your mobile phone for 60% work and 40% personal, then you can claim 60% of the total bills to put against your taxes.

Where it is difficult to distinguish a split of usage, the whole expense would most likely be deemed disallowable.

Keeping Receipts

You are legally required to keep copies of receipts and invoices to back up the self-employed expenses that you are claiming for 6 years. It’s proof that you really bought something and that it was for business reasons and you’ve paid the right amount of self-employed tax.

Read this guide to find out more about keeping business records when you’re self-employed and tips on organising your receipts.

How to Claim Allowable Business Expenses

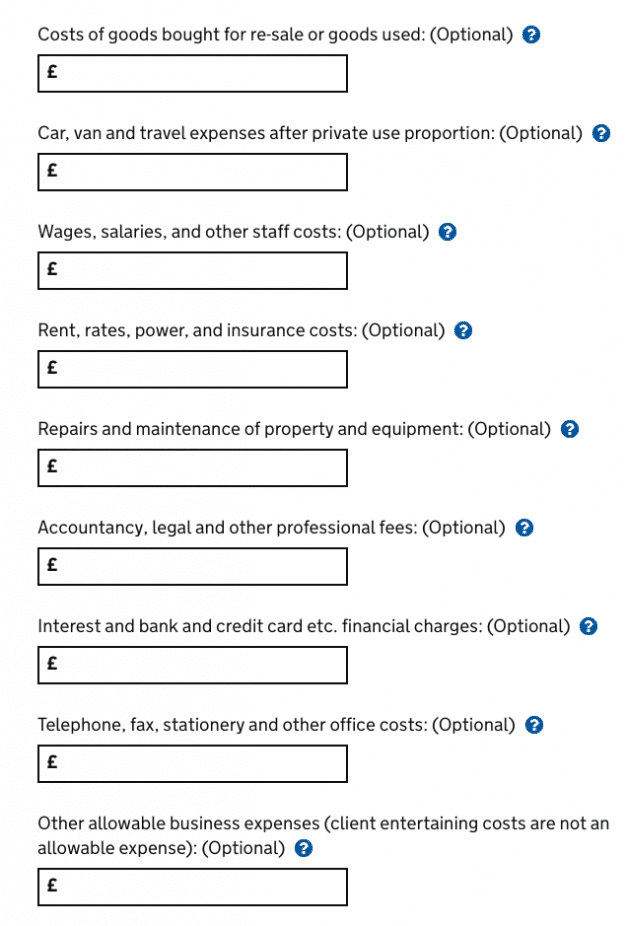

You need to claim allowable expenses in the self-employment section of your tax return. If your business turnover is less than £85,000 for 2022/2023, you’ll have the option to fill in the simplified version of this part of the tax return. Therefore, you only need to enter one figure for your total self-employed expenses for the tax year.

If your business turnover is more than £85,000, you need to enter a breakdown of your expenses in the boxes set out by HMRC.

Whatever your business turnover, you should keep a note of what you are claiming for and how you worked it out as part of your business records. You can do this by using an accounting software or a bookkeeping spreadsheet.

Related: