Claiming pre-trading expenses as a sole trader is a handy way to reduce your tax bill. In most cases, many of the expenses you’ve paid for while you set up your business will qualify for tax relief. This is even if it was before you registered as self-employed.

In this guide, you’ll find out what pre-trading expenses you can claim as a sole trader. In addition, I’ll outline how to record them and enter them on your tax return.

1. What Counts as Pre-Trading Expenditure?

Pre-trade expenses are defined as costs incurred in setting up your business, so you can ‘open the doors’ and start trading. Here are some examples:

- Equipment;

- Insurance;

- Stock;

- Rent;

- Laptop;

- Travel;

- Business cards;

- Legal and accountants fees;

- Website setup.

Pre-trade expenditure must still meet the criteria of being an allowable business expense. These are costs that HMRC permits you to claim against your tax bill.

2. How to Claim Pre-Trade Expenses on Your Tax Return (Sole Traders)

As a sole trader, you can claim for pre-trading expenses going back 7 years. This is only as long as you have receipts and paperwork to support the claim, just like your other business records. Your pre-trade expenses will be deemed to have been purchased in the tax year you are claiming them in. The way you claim for your expenses depends on whether or not you are using the cash basis for recording the numbers on your tax return.

2.1 Claiming Pre-Trade Expenses Using the Cash Basis

If you are using the cash basis, you’ll need to claim the cost of allowable pre-trading expenses in the self-employment section of your tax return. If your business turnover is less than £85,000 for 2021/2022, you’ll have the option to fill in the simplified version of this part of the tax return. Therefore, you only need to enter your total expenses. You’ll also need to include your pre-trade expense claim in the figure you enter alongside your other allowable business expenses.

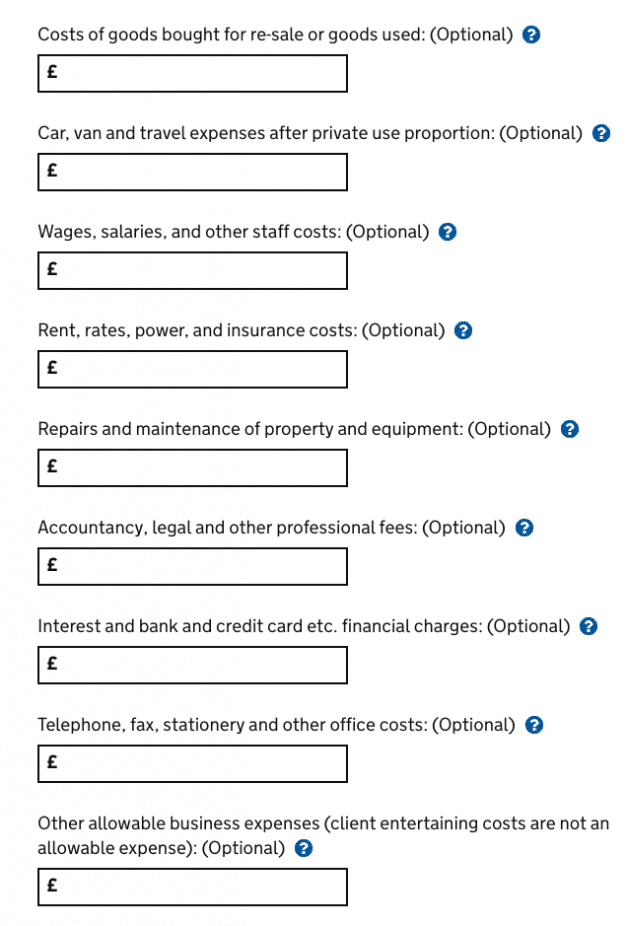

If your business turnover is more than £85,000, you’ll need to enter a breakdown of your expenses in the boxes set out by HMRC. In addition, you’ll need to include your pre-trade expenses within the most appropriate box of your return

The only exception to this rule is if you have bought a car as a sole trader. In this instance, you would need to use capital allowances.

2.2 Claiming Pre-Trade Expenses Using Traditional Accounting

When you use traditional accounting, depending on what you paid for, you may need to claim tax relief using capital allowances or annual investment allowance (AIA) if your pre-trade expenses are capital assets in nature.

You’ll need to claim your capital allowances or AIA in boxes 50 to 59 in the self-employment section of your tax return. You can choose to show depreciation. However, this will be flagged as a disallowable expense and added back when calculating your business profits.

Whatever your business turnover or method you choose for filling in your tax return, you should keep a note of what you are claiming for and how you worked it out as part of your business records. This is in case of an HMRC investigation and they ask for evidence of what you are claiming for to check you’ve paid the right amount of self-employed tax.

3. How to Claim Pre-Trading Expenses for a Limited Company

If you have a Limited Company, you can claim for pre-trading expenses going back 7 years. However, this is only as long as you have receipts and paperwork to support the claim. Your pre-trade expenditure will be deemed as being paid for during the financial year you put them through your business, regardless of when you actually paid for them. You’ll then get corporation tax relief in the tax return submitted with those financial accounts.

You’ll need to follow the rules of capital allowances or annual investment allowance, depending on what you have bought are capital assets in nature. You can repay yourself for the pre-trading expenses you’ve paid for, just like you would for any other expense claim. Alternatively, you can log them in your directors loan account and repay yourself when the time is right for your business.

Company formation costs are not tax allowable, even though they are pre-trading expenses. However, you can claim the money back as a business expense.

4. Claiming VAT on Pre-Trade Expenditure

If you are registered for VAT, then you might be able to claim back the VAT you have paid on your pre-trade expenditure. HMRC lets you claim back VAT on expenses from your registration date:

- 4 years for goods you still have. Or, that were used to make other goods you still have;

- 6 months for services.

When it comes to claiming expenses, always use your judgement when it comes to deciding what you deduct against your taxes. Incorrect claims can result in penalties. And, as always, if you aren’t sure, seeks the advice of a professional.

Related: