If you’re self-employed, completing your self-assessment tax return can be very daunting. However, it’s vital not to make mistakes on your tax return and get it right. This step-by-step guide to completing your tax return online will help you beat the 31 January self-assessment deadline with ease. There’s no jargon, but there is quite a lot of information. Therefore, you may want to bookmark this page so you can come back to it as you work through each step of filing your tax return online. And here’s how!

Friendly Disclaimer: Whilst I am an accountant, I’m not your accountant. The information in this article is legally correct but it is for guidance and information purposes only. Everyone’s situation is different and unique so you’ll need to use your own best judgement when applying the advice that I give to your situation. If you are unsure or have a question be sure to contact a qualified professional because mistakes can result in penalties.

When Do You Need to Complete Your Tax Return?

The UK tax return deadline is 31 January. By this date, you need to submit your tax return online for the previous tax year**. So, you should complete your tax return for the tax year 2021-22 by 31 January 2023.

**the tax year runs from 6 April to 5 April each year.

You can choose to do a paper tax return instead but the deadline for sending this to HMRC is earlier on 31 October 2022.

If you’re employed and self-employed, you can choose to complete your tax return online by 30th December. This is instead of 31 January so you can pay any tax you owed through your payslip. Once you’ve submitted your return, HMRC will send your employer a notification to change your tax code so they can collect any tax you owe through PAYE.

Not sure if you need to fill in a self assessment tax return? Read this guide to find out who needs to complete a UK tax return.

What Happens if You Miss the Self Assessment Filing Deadline?

If you miss the HMRC self-assessment tax return deadline, HMRC will issue automatic penalties. This starts at £100, rising the longer you leave submitting your return. You may be able to appeal to get any penalties and interest issued reduced or removed if you have a reasonable excuse.

Can I File My Tax Return Early?

HMRC makes tax returns available once the tax year ends. And even though the deadline for filling in your tax return is 31 January, you can choose to do it early. This can be useful if you are owed a tax refund or just want to get it out of the way.

Even if you decide to file your tax return early, you won’t need to pay any tax you owe until 31 January.

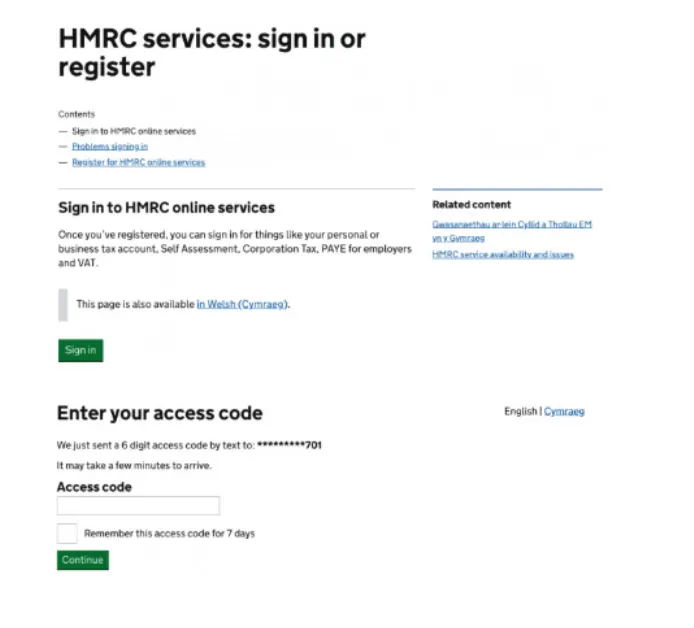

Where to Find Your Tax Return Online

You’ll find your tax return in your .GOV account. You’ll need to login with user ID and password you set up when you registered for self assessment. It might help to tick the box “remember this access code for 7 days”. This will make logging in a bit quicker if you’re in the 7-day window.

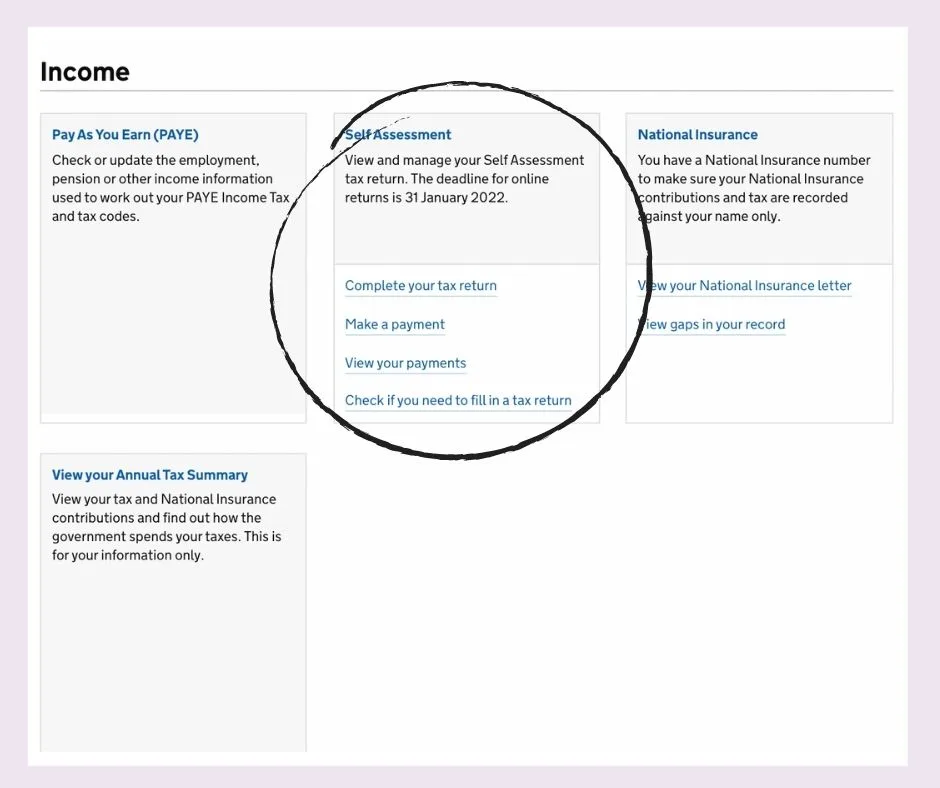

Once logged in, you’ll be able to manage your personal details and see options to manage your tax credits or National Insurance record. You’ll also find the option for self-assessment, when you’ll find your online tax return.

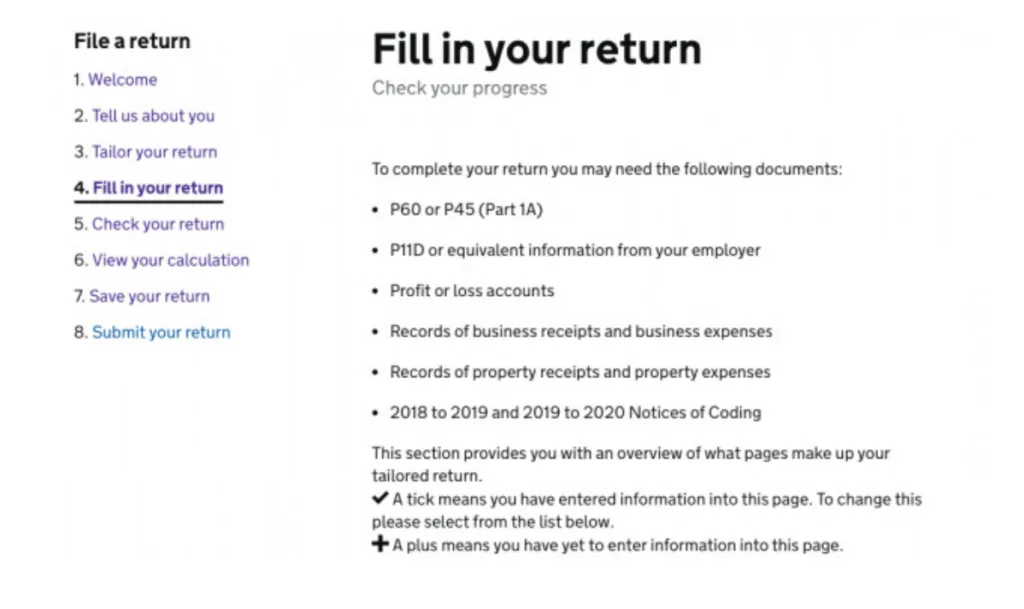

What Information Do You Need to Complete Your Tax Return?

Getting all the documents you need ready in advance will make completing your HMRC tax return quicker and easier. Depending on your circumstances, you’ll need things like your UTR number, pension statements and details about your self-employment income and expenses.

This guide contains a list of information you may need for your self-assessment tax return.

How to Complete Your Tax Return Online

Your online tax return has various sections. The main section must be completed by all individuals registered for self-assessment.

In the ‘tailor your return’ section, you’ll be able to let HMRC know which supplementary sections you need to fill in. These pages are specifically designed for different forms of income and they are:

- Employees or company directors SA102

- Self-employment SA103S or SA103F

- Business partnerships SA104S or SA104F

- UK property income SA105

- Foreign income or gains SA106

- Capital gains SA108

- Non-UK residents or dual residents SA109

The “Tell Us About You” Section

You’ll need to start completing your return by filling in the “Tell Us About You” section. This is your chance to check HMRC has the right personal information about you and for you to make any corrections necessary. For example, a change of address or name. It will be pre-populated if HMRC has any of the information about you on their system already, but it still pays to check that everything is correct.

Some boxes like a phone number and email address are optional. Consequently, it is up to you whether you want to provide them. But it can be useful to add them in case HMRC need to contact you.

What You Need to Do:

- Check all your personal details;

- Ensure you tick the box to confirm you are UK Resident;

- Tick the box if you are entitled to blind person’s allowance;

- Enter information if you are making student loan repayments, the type of plan you are on and whether you are employed or self-employed.

The “Tailor Your Return” Section

This section of your tax return lets you tell HMRC what types of income you have received. It also includes the types of income tax reliefs you want to claim that help to reduce your tax bill. There are three pages:

- Sources of income you have received like self-employment, employment or rental income;

- Interest and dividends;

- Income tax reliefs and allowances you plan to claim like the marriage allowance.

You won’t enter any numbers at this stage. It’s just to generate the right supplementary sections for you to enter numbers into later on in the return.

If You Were An Employee

You’ll need to choose “yes” if you were employed. This is whether you were full-time or part-time during the tax year. You’ll then have to enter the name(s) of your employer which you’ll find on a payslip, P45 or P60.

If you are the Director of your own Limited Company and pay yourself a PAYE salary, you’ll need to enter the name of your LTD.

You’ll need to enter details of your employment(s) even if you paid all your taxes through your payslip.

What You Need to Do:

- If you were employed during the tax year, enter how many employments you had and the name of your Employer(s);

- You were not employed by anyone, choose “no”.

If You Were Self-Employed

You’ll need to let HMRC know about your business(es), along with your business name(s).

You’ll have the option to claim the HMRC £1,000 trading allowance if your business turnover (not profit) was less than £1,000. That means you don’t need to declare your income but you also can’t:

- Create an allowable tax loss that they can use against future profits;

- Pay voluntary Class 2 National Insurance contributions to protect their full entitlement to state benefits like Pensions;

- Get a tax refund if you are a subcontractor under the Construction Industry Scheme (CIS);

- Claim maternity allowance or tax-free childcare because your earnings aren’t officially documented.

What You Need to Do:

- If your business turnover is more than £1,000 choose “yes”, enter the number of businesses your run and their names;

- If your business turnover is less than £1,000 and you want to use the trading allowance, choose “no”.

Page 2 contains a list of questions to tell HMRC about all the other types of income you received during the tax year including:

- Interest for example from UK banks, building societies or unit trusts;

- Dividends for example from UK companies or open-ended investment companies;

- UK pensions, annuities or state benefits;

- Child benefit and whether you earned more than £50,000 because you may need to pay the high-income tax charge;

- Lump sums, share schemes and life insurance gains.

If you made income tax losses during the tax year then you can let HMRC know about them here. This is because you may be able to offset these against your other forms of income. For example, investors who make a loss on an EIS company may be able to offset it against their capital gains or income tax.

If you made contributions towards a personal pension or retirement annuity, then you’ll be able to get tax relief on a certain amount of the contributions you make. This is currently up to £40,000. You’ll receive tax relief at the highest rate of tax you pay as long as you have:

- contributed to a registered pension scheme;

- received taxable UK earnings, such as employment income or profits from self-employment, or

- are a resident in the UK for some time during the tax year or sometime in the 5 preceding years and when you joined the pension scheme.

Finally, you’ll also be able to claim any other tax reliefs on things like:

- community investment tax relief;

- venture capital trust shares;

- maintenance/alimony payments relief.

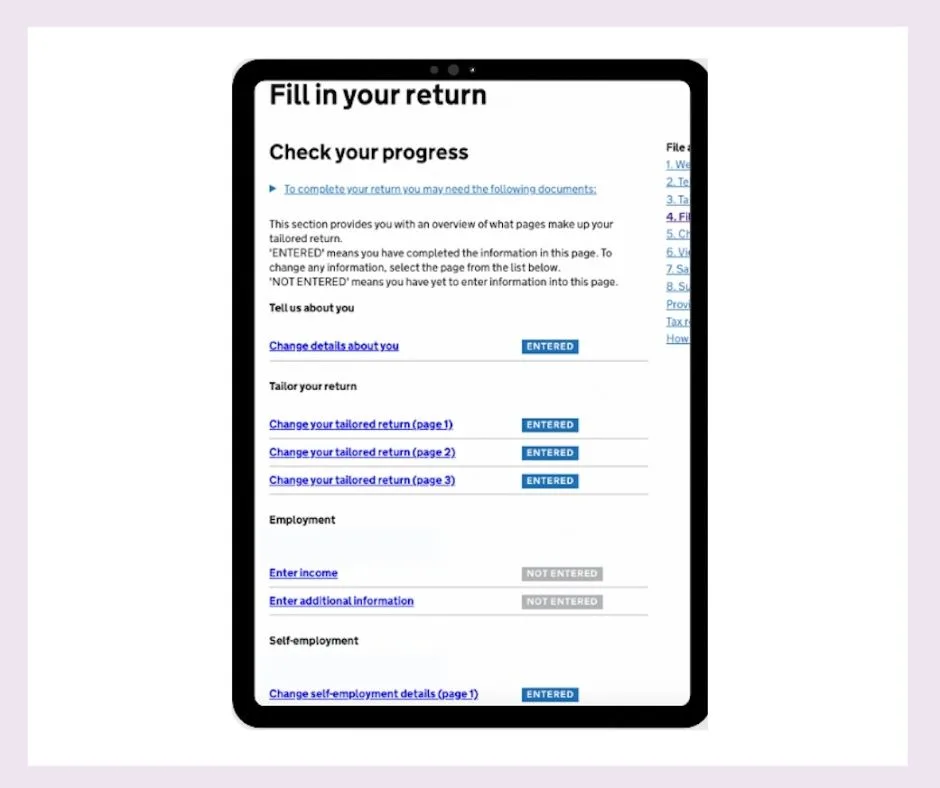

Once you have tailored your tax return online to your personal circumstances, it’s time to start inputting the numbers. You’ll see all the sections you need to complete and be able to check your progress:

Employment Section

If you were employed by someone, you’ll need to enter your income from your P45 or P60. You should also comple more than one employment section if you had more than one employer during the tax year. You can claim tax relief on expenses that you paid for, but were not reimbursed by your employer. For example, if you had to work from home. If you own a Limited Company and have added yourself on the payroll, then you’ll also need to include details of this employment here too.

You’ll find a separate guide here to help you to complete the employment section of your tax return.

Self-Employment Section

You’ll be presented with the self-employment section if you have become self-employed, are a sub-contractor under the CIS scheme or are a registered foster carer. The first thing you’ll need to do is calculate your business turnover (excluding any SEISS grant you received. You can find out how to show your grant here). If it is less than £85,000, then you’ll be able to complete the short-form self-employment section which requires less information. Next, you’ll need to have your business expenses ready and then decide what tax reliefs like capital allowances and tax loss reliefs you want to claim.

You’ll find a separate guide here to help you to complete the self-employment section of your tax return.

Self-Assessment for the High-Income Child Benefit Charge

If you or your partner earn between £50,000 and £60,000, including through self-employment, then you’ll need to pay back any child benefit you have received in the form of an income tax payment. You can choose to do this by electing to stop receiving child benefit payments or paying the high-income tax charge by filling out an HMRC tax return. This charge claws back child benefits paid at a rate of 1% for every £100 you earn over £50,000. That means once your income reaches £60,000, you will not receive any child benefit.

You’ll find a separate guide here to help you to fill in your tax return for the high-income child benefit charge.

Paying Your Tax Bill

You can pay your self-assessment tax bill online in a variety of ways, including by direct debit, bank transfer and debit card. If you want to pay by bank transfer, then you’ll find the bank details on the HMRC website. This is unless you want to pay your self-assessment bill through your PAYE code.

HMRC takes non-payment of tax seriously and has the power to make you bankrupt and add penalties that escalate. That said, they will work with you if you are struggling to pay your tax bill. First of all, you must file your tax return in January. If you don’t you’ll face penalties until you do which only increase your debt. Once you know how much tax you owe, contact HMRC ASAP to discuss the situation with them. You can do this online or by phone and it means you can agree on a suitable repayment plan. By sorting out a repayment plan, it means you’ll freeze penalties and interest thereby stopping the amount you owe HMRC from escalating.

If you are due a repayment after filing your tax return, then be aware that there are significant delays with HMRC making tax refunds due to additional security checks taking place as a result of the increase in fraud as part of the Coronavirus pandemic. They are increasingly sending out SURF 1 and SURF 2 Tax Letters as part of their checks to request additional information as well as completed R38 forms.

Filling in an HMRC Paper Tax Return

HMRC paper tax returns are due for filing by 31 October and you can get one by:

Getting a Tax Refund After Filing Your Self Assessment Tax Return Online

If you are due a tax refund, you’ll need to let HMRC know that you want a repayment and enter your bank details. Once you have completed this, it can take up to 4 weeks for HMRC to process your refund and send it back to you.

How to Contact HMRC for Help Filling In Your Tax Return Online

If you have a question for HMRC about registering or the self-assessment then contact HMRC on 0300 200 3310.

Related: